There is no shortage of information designed to help people become better investors. One of the best ways to learn how to improve investment performance is by listening to the advice of the world’s greatest investors.

Markets are very difficult to predict with any accuracy. Instead of buying and selling stocks frequently, investors should follow the time tested, buy-and-hold strategies employed by Benjamin Graham, Warren Buffett, and Peter Lynch, to name just a few. These investors diligently followed value investing principles, and made billions for themselves and their investors over the long term. Here are five of the best quotes that can help investors learn from the greats.

Learn From The Oracle Of Omaha

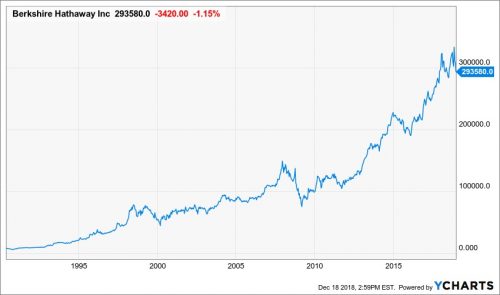

Warren Buffett, Chairman and CEO of Berkshire Hathaway (BRK.B), is commonly referred to as the Oracle of Omaha. This is a deserving nickname, as Buffett is arguably the greatest investor of all time. With Buffett at the helm, Berkshire has produced tremendous returns for its shareholders over the long run.

The first lesson Buffett can teach investors is the value of thinking for the long-term. With financial television shows seemingly obsessed with the stock market’s daily fluctuations, investors can be tricked into thinking they need to act. But that is often a mistake:

”Nobody buys a farm based on whether they think it’s going to rain next year. They buy it because they think it’s a good investment over 10 or 20 years.”

–Warren Buffett

Few investors would associate the stock market with buying a farm, but Buffett’s quote makes a great deal of sense. Just as a farmer would not concern themselves with a forecast for rain, investors should not buy stocks just for short-term gains. Don’t think about buying stocks in terms of days or weeks—instead, think in terms of years. That is what Motley Fool recommendations are all about.

This second Buffett quote is designed to change how we think about stocks:

“I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for ten years.”

– Warren Buffett

It is important to know the difference between investing and speculating. Investing is about buying pieces of high-quality businesses, with strong brands and durable competitive advantages, and holding on for the long term. On the other hand, speculating is simply betting on an outcome. It is no different than wagering on which team will win the Super Bowl. In this case, it is no longer investing—it is simply gambling.

Don’t Overreact To Market Downturns

Another bit of wisdom from the Oracle of Omaha is changing how investors view market downturns. When markets decline, too many investors succumb to fear and sell their stocks, only to miss out on the gains when stock prices go back up. If anything, value investors like Buffett recommend investors buy more when markets are declining:

“Every decade or so, dark clouds will fill the economic skies, and they will briefly rain gold. When downpours of that sort occur, it’s imperative that we rush outdoors carrying washtubs, not teaspoons.”

– Warren Buffett

The economy will expand and contract through the economic cycles, and the stock market typically follows suit. But rather than focus too much on the price of stocks, investors should keep focus on the earnings of the underlying business. As Buffet suggests in the quote above, investors should look to buy stocks when prices are low, and reduce buying when valuations climb to unsustainably high levels.

In this way, investors can change their perception of risk. There is a common fear that when stock markets decline, things are getting riskier. But consider the Great Recession of 2008-2009 as an example. When the S&P 500 declined toward its low of 666.79 on 03/06/2009, many investors presumed that stocks were too risky to buy. But in fact, this served as one of the best buying opportunities investors have ever seen:

“Risk is not inherent in an investment; it is always relative to the price paid. Uncertainty is not the same as risk. Indeed, when great uncertainty – such as in the fall of 2008 – drives securities prices to especially low levels, they often become less risky investments.”

– Seth Klarman

Seth Klarman, Chief Executive and portfolio manager of the Baupost Group, has pointed out in the above quote that while declining stock markets cause so many investors to be gripped by fear, investors should treat market downturns as a buying opportunity.

Keep It Simple

Lastly, another piece of useful advice for investors is to keep it simple. Growth stocks have a tendency to be associated with overly complex business models. Investors might assume that the more complicated a company’s business plan, the greater the potential returns. But some of the highest-returning stocks in history are those with boring business models.

Noted economist Jeremy Siegel calculated in his book, The Future for Investors: Why the Tried and the True Triumph Over the Bold and the New, that the single best stock to own from 1925 to 2003 was none other than Altria Group (MO). During that time, Altria, formerly known as Philip Morris, returned 17% per year on average. Altria has a simple business that virtually everyone can understand. It is a U.S. tobacco company, that manufactures the Marlboro cigarette brand, among others.

This brings us to the following quote from Peter Lynch, former manager of the Magellan Fund at Fidelity Investments between 1977 and 1990:

“Go for a business that any idiot can run – because sooner or later any idiot probably is going to be running it.”

– Peter Lynch

During his tenure as portfolio manager, the Magellan Fund averaged a 29.2% annual return. Lynch’s advice is simply—know what you own. Do not buy a stock if you don’t understand the business model or its future growth plan. By understanding a business inside and out, an investor will be better prepared if and when the business enters a downturn or the stock price declines, and will be less inclined to simply sell the stock out of fear.

Final Thoughts

The stock markets fluctuate, sometimes wildly, which can compel investors into thinking they should trade their stocks with greater frequency. Nothing could be further from the truth. Research has shown that frequent trading reduces the returns generated by investors.

With this in mind, investors can drastically improve their performance by adhering to a few core principles: don’t day-trade, don’t sell stocks simply out of fear, and buy what you know. The five quotes presented above, from some of the world’s greatest investors, help illustrate these valuable points.