Axos Bank Review 2022: Is This the Future of Banking?

| By: Bob Haegele | April 5, 2021 |

In a nutshell: Axos Bank is an online bank that removes many of the common fees charged by regular banks. It offers features like Rewards Checking and certificates of deposit (CD).

Axos handles customer service remotely, with several 24/7 options available. Our Axos Bank review recommends this bank for avoiding fees and saving with higher-than-average yields.

| Fees | Service Type | Promotion |

|---|---|---|

| $0 | Checking, savings, CDs | $20 referral bonus |

Axos Bank makes banking a no-fee experience for most customers, plus offers 24/7 support. What’s not to like? As an added bonus, it has high yields on savings.

Pros & Cons

PROS

- No monthly fees on checking and savings accounts

- Great rewards checking program

- ATM fee reimbursements within the US

- $20 referral bonus

CONS

- Poor rates on CDs

- Only two physical branches

Compare to Other Banks

| |

| Fees$0 |

| Service TypeChecking, savings, CDs |

| Promo$20 referral bonus |

| |

| Fees$0 |

| Service TypeChecking, savings, CDs |

| PromoNone |

Full Axos Bank Review

Axos Bank internet banking is ideal for customers who want to benefit from high-yield savings accounts. Their online-only customer service is a small price to pay for the lack of fees for most account holders.

Axos Bank is best for:

- Fee-conscious consumers

- Frequent travelers

- Those who do all their banking online

Formerly known as Bank of Internet USA, Axos Bank offers a low-cost alternative to traditional banking.

With more than $10 billion in assets, this is a solid full-service bank. For customers who regularly pay in cash, their unlimited ATM fee reimbursements is an incredible perk.

Read on to find out more in our review on Axos Bank.

What is Axos Bank?

| Product Name |

|

| Services |

|

| Membership Fee |

|

| Customer Support |

|

| Promotions |

Axos Bank was founded in 1999 by Jerry Englert as the Bank of Internet USA. It was also previously known as Bofl Federal Bank, until it was re-branded as Axos Bank in 2018. Today, it’s a full-service bank with more than $10 billion in assets and 800 full-time employees.

The Axos Bank high-yield savings accounts and Axos checking accounts have been praised for their lack of monthly fees and minimum account balances. For Americans looking to not pay fees, this is one of the best online banking options available today.

Axos Banking Options

Our review on Axos Bank believes that Axos has several distinct advantages over traditional downtown banks. As well as no fees, they offer a strong checking rewards program and even offer mortgages at competitive rates.

Axos Bank High Yield Savings Account

The Axos High Yield Savings account is one of their most popular accounts. There are no monthly fees for savers and there are no minimum balance requirements.

Customers are free to withdraw their money without penalty.

Currently, the interest rate on the Axos Bank High Yield Savings account is 0.61%, which sounds small but is one of the highest rates currently available.

Applicants need a minimum of $250 to open an account.

Axos Bank Rewards Checking

In the view of this Axos Bank review, the Rewards Checking account is one of the best banking options for Americans. Like other accounts, there are no monthly fees and no minimum account balances.

All domestic ATM fees incurred will be automatically reimbursed, so you no longer need to worry about paying to access your money.

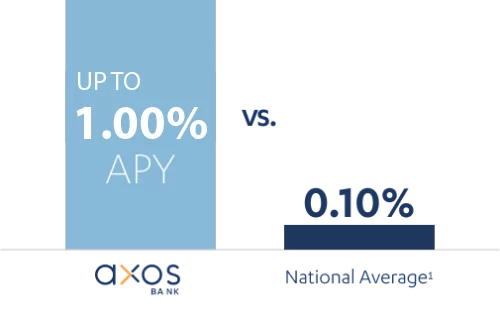

The annual percentage yield is high at up to 1.00%, but there are caveats to get this rate. Customers must receive at least $1,000 per month in direct deposits. They also have to make a minimum of 15 debit card transactions a month.

If you think you can meet these requirements, this is an excellent account to have.

Axos Bank CD

One area where Axos Bank fails to deliver is its CD accounts. Axos CDs offer terms ranging from three months to five years. Although the APYs on CDs exceed the rates offered by most major banks, there are far better options for yields with other online banks.

If you want to invest money in CDs, we recommend looking elsewhere. However, if you do decide to invest in CDs with Axos, you’ll need to deposit a minimum of $1,000. This is in line with traditional banks.

Axos Bank Overdraft Fees

How does Axos Bank work with overdrafts?

Most checking accounts don’t charge any overdraft or non-sufficient funds fees. If a charge is more than the remaining balance, transactions will be simply declined. You don’t get an overdraft automatically.

The only exception is the CashBack account, which will charge $25 as a non-sufficient fund fee. This is limited to three charges per 24-hour period.

Axos Bank FAQ

Now, let’s get to some of your most common questions about Axos Bank.

Is Axos Bank Legit?

Yes, it’s a real bank. It’s also covered by the FDIC, which guarantees your first $250,000.

How Do I Contact Axos Customer Service?

There are several remote customer service options to choose from. Many are available 24/7. You can call, email, speak via live chat, or get in touch with them on social media.

How Do I Make Cash Deposits with Axos?

Axos has more than 91,000 ATMs within its network nationwide. It has also partnered with Green Dot, so customers can make cash deposits with retailers like CVS and 7-Eleven. This service costs $4.95 per deposit.

Is Axos Bank Right for You?

Most Axos Bank reviews are full of praise for this online bank. We agree with their assessment. Their no fees, no minimum balance approach is a breath of fresh air for a banking sector that has shortchanged its customers for years.

Although their CD yields and terms are poor, the majority of retail customers will be delighted with the service offered by Axos Bank.

Check out Axos Bank and open your account today.