M1 Finance Review 2022

| By: Bob Haegele | January 17, 2022 |

In a nutshell: M1 Finance is a low-cost investment app combining automated investing with customizable stock portfolios to give you to best of both worlds.

It achieves this with its pie investing and easy portfolio management. The result? More investment options and more ease of use.

| Fees | Account Minimum | Promotion |

|---|---|---|

| $0 - $125/year | $0 | Invest for Free |

M1 Finance is an online trading platform offering investment pies, one-click rebalancing, and customizable portfolios. It allows you to choose from a set of pre-built portfolios and auto-invest or build your own portfolio from scratch with stocks and ETFs.

M1 Finance is best for:

- Passive investors

- DIY investors

- Socially-responsible investors

- Fee-conscious investors

Pros & Cons

PROS

- No minimum balances

- No monthly or annual fees

- Automatic portfolio rebalancing

- Invest for Free

CONS

- No tax-loss harvesting

- Only supports IRA for retirement accounts

- No futures, options, mutual funds, individual bonds, or cryptocurrencies

Compare to Other Investing Platforms

| |

| Management Fees$0 - $125/year |

| Minimum Investment$0 |

| PromoInvest for free |

| |

| Management Fees0.25% - 0.40% |

| Minimum Investment$0 |

| PromoUp to 1 year free |

| |

| Management Fees$0 |

| Minimum Investment$0 |

| PromoInvest for free |

Full M1 Finance Review

M1 Finance is the perfect robo-advisor for anyone to start investing in the stock market. M1 allows you to create fully custom stock portfolios. And after the initial setup, you can automate your investment strategy. Or just pick from one of the portfolios built by M1’s team of experts.

It doesn’t matter if you have a large amount of cash to invest upfront or you are just starting to save. Either way, this low-cost robo-advisor has something for you with its simple portfolio management.

M1 Finance at a Glance

| Account Minimum |

|

| Management Fees |

|

| Expense Ratios |

|

| Account Fees |

|

| Portfolio Mix |

|

| Account Types |

|

| Tax Strategy |

|

| Automatic Rebalancing |

|

| Savings Account/Cash Management Account |

|

| Customer Support |

|

| Human Advisors |

|

What is M1 Finance?

M1 Finance is a robo-advisor and investment platform that combines features of various other investing services. The company is based in Chicago, IL, and was founded in 2015. Its parent organization is M1 Holdings Inc.

Today, M1’s assets under management exceed $5 billion.

The company’s CEO, Brian Barnes, created M1 because “The financial services industry has lacked any meaningful innovation for far too long, and I decided it was time for change.”

Barnes then did exactly that: he created a unique, innovative product. If you aren’t sure how to buy stocks, M1 is a great way to start.

M1 Finance gives you automated investment management for a hands-off experience. But it also allows you to hand-pick your investments—something most other robo-advisors don’t offer. Plus, there’s no account management fee to worry about.

What is similar to other robo-advisors is that it directs users to a questionnaire that helps assess risk.

Other robo-advisors may use this questionnaire simply to determine your stock/bond asset allocation, but M1 uses it to suggest different portfolios. Once you get set up, portfolio management is easy.

Those with lower risk tolerance will have more bonds; higher risk tolerance means more stocks and exchange-traded funds (ETFs). These are only suggestions, however. You are still able to create your own custom portfolio from the ground up.

M1 Finance is a member of FINRA. Each investment portfolio is covered for up to $500,000 by the Securities Investor Protection Corporation (SIPC). Also, there is no trading commission, much like other popular apps, such as Robinhood.

Still have questions? We’ll try to answer all of them, but you can also check out the company’s About page.

M1 Invest: Building Your Portfolio

The main feature that sets M1 apart from other investing platforms is its investment pies. Pie investing allows you to build an easy-to-maintain, custom portfolio. Plus, you can buy fractional shares, making investing both fun and lucrative.

What Are Investment Pies?

Investment pies allow investors to create “pies” where each asset is one slice. Those slices can be stocks, bonds, or ETFs. Each time you invest, M1 will automatically balance each slice to match your target allocation. |

These pies are exactly what they sound like: they are made up of individual “slices,” which can be either individual stocks, bonds, or low-cost exchange-traded funds. And they can be tailored to any risk tolerance.

When you first sign up, you’ll be prompted to make three selections from a list of popular stocks, funds, and expert pies. You can also search for your own if you prefer.

Thousands of different bonds, stocks, and ETFs are available on M1 Finance’s platform, so you should have no problem finding the ones you’d like to buy.

Unfortunately, M1 Finance does not offer mutual funds. For more info, have a look at M1’s How it Works page.

Funding Your Account

When you run through the setup process, you won’t be required to make an initial deposit. However, in order to actually start investing on the platform, you must deposit at least $100. A taxable account is the most common choice, but you can also start a retirement fund. Retirement accounts require an initial deposit of $500.

Also note that if you want to enable automatic deposits, there is a minimum of $10 for each deposit.

During the setup process, you will be prompted to add your bank account via Plaid. You’ll see a list of common banks, or you can search for your bank if you don’t see it.

You also have the option to add your bank manually using your routing and account numbers.

Read to create your account? M1 Finance has a sign-up bonus of up to $500 for new members. There is a sliding scale that starts at $1,000; if you deposit that much, you’ll get $30 free just for joining. Or if you use our link, you only have to deposit $100 ($500 if you have a retirement account).

Account Types

Opening a taxable brokerage account is the most likely option for M1 Finance users, but that isn’t the only type of account you’re able to add. An M1 Finance Roth IRA is a great choice as well.

M1 Finance offers the following account types:

- Taxable investment accounts

- Traditional IRA, SEP IRA, & Roth IRA

- Rollover IRA

- Trust accounts and custodial accounts

- Checking account/cash management account (M1 Spend)

Other types of investment accounts, such as a 401k, 403b, or 457b are not currently supported.

Features

M1 has a few key features that make it unique. Where it really shines is with its pie-based investing.

M1 Finance Pies

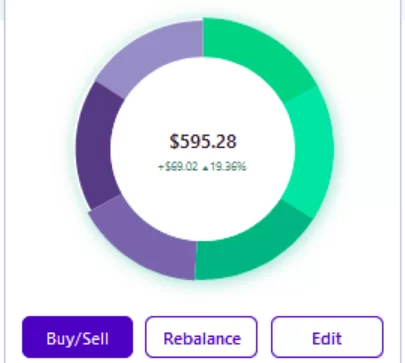

M1 Finance pies allow you to maintain your M1 Finance portfolios in pie form. You simply add slices to your investment pie, allowing for easy portfolio customization.

Plus, you can see a visual representation of your pie, and slices shrink and grow based on whether you are underweight or overweight against your target allocation.

Investment pies let you create “pies” where each asset is one slice. Those slices can be stocks, bonds, or ETFs. Each time you invest, M1 will automatically balance each slice to match the percentages you specify.

You can either build your own pie or use one of M1’s expert pies. Later, we’ll cover what some of those are.

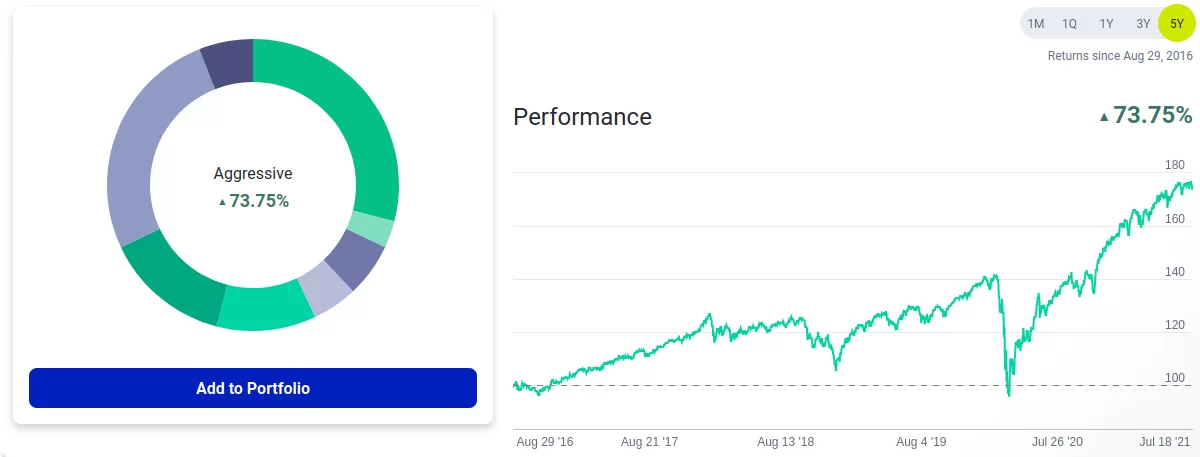

Expert Pies

M1 Finance offers expert pies, which make investing with M1 easy. Expert pies are pre-made investment portfolios built by M1’s team of experts. You can use any of M1’s expert pies as-is, or you can add it to an existing portfolio. They are based on Modern Portfolio Theory (MPT) to help maximize returns.

Some examples of expert pies include:

- General investing pies: general investing strategy based on risk tolerance, such as conservative, aggressive, etc.

- Plan for retirement: target-date funds that become less aggressive over time.

- Responsible investing: investment funds that invest in companies with high scores for ESG principles.

- Income earners: stocks paying regular/high dividends.

- Hedge fund followers: pies that mimic the strategies of popular hedge funds. Popular hedge funds include Berkshire Hathaway and Coatue Management.

- Stocks & bonds: portfolios consisting of different mixes of stocks & bonds, such as 90/10, 80/20, etc.

- Other strategies: other assorted strategies, including value & growth, ARK Invest, and cannabis.

Each expert pie can contain a combination of stocks, ETFs, or bonds. Whether you’re interested in socially responsible investing or just stocks and ETFs in general, M1 offers it.

You can use an expert pie as-is or you can make it a percentage of your custom pie, then add other slices to it. In other words, you can make expert pies part of your own pie, so you can see how easy portfolio customization is in this system.

“Our selection model takes into account the fund’s cost, volume, size, and tracking error (how well the fund tracks the benchmark it seeks to replicate).” |

M1 uses a quantitative analysis on all traded ETFs to determine the best ones for each pie. The result is that each pie leaves you with the best combination of diversity and performance. When you view each expert pie, you can also see a performance chart, letting you know what to expect.

M1 Finance offers different pies suited to different goals, such as socially responsible investing. That is great for investors who want to invest in companies that align with their values.

Smart Transfers

Smart Transfers allow you to move money into your accounts automatically. The feature is reserved for M1 Plus members, but it allows you to automate some actions that would otherwise be manual.

For example, you can set a rule to transfer money into your brokerage accounts automatically when your M1 Spend account value is $1,000 or greater. Or you can use a rule to max out your annual IRA contributions. However you set it up, Smart Transfers allow you to configure things just right so you don’t have to spend a lot of time maintaining your investments.

While this feature is reserved for M1 Plus members, anyone who signs up is automatically eligible for one year free trial of M1 Plus.

What is the Best M1 Finance Pie?

It’s not easy to pick one pie as a blanket recommendation because everyone has such different goals. Your risk tolerance and your values may play a part, among other factors.

The best way to get started is to take a look at one of the M1 Finance expert pies. Once you have a feel for how you want to invest, you can further refine your strategy.

Managing Your M1 Finance Portfolio

Your account with M1 can contain several expert pies, allowing you to customize it exactly the way you want. Any time you add a stock slice to your portfolio, it will be bought during the next trading window when the New York Stock Exchange is open.

For free users, that means 9 a.m. Central time on the New York Stock Exchange each business day. Since there is only one trading window, M1 is not the best for active traders. Nevertheless, it’s a great way to invest in ETFs.

However, note that if you want to create more than one asset allocation, you have to create an entirely new account. To give an example, let’s say you have a diversified portfolio that is 80% stock funds (ETFs) and 20% bond funds.

But you’d also like to separately invest in a few stocks just for fun. Maybe you buy some Apple shares, some Tesla shares, and some Microsoft shares. If you want to do this, it’s not possible to add them to your investment portfolio without changing your 80/20 asset allocation.

If you were to change that 80/20 asset allocation, it will affect all of your investments going forward. Changing your allocation to 70/20/10, where 10 is your “fun money” means any time you invest, 10% of it will go to those individual stocks.

You can’t just invest in a few individual stocks here and there.

So if you wanted to create another allocation of a few fun money stocks without affecting your main ETF/bonds portfolio, you have to create a whole new account with M1 Finance.

This isn’t terribly inconvenient, but it seems that technology should enable this all within one account.

Asset Performance

Like most investing platforms, M1 gives you basic performance indicators for each stock/bond.

This includes several key pieces of information, such as the number of holdings, expense ratios, performance, and the share price.

Automatic Rebalancing

Another nice feature of an M1 account is its built-in rebalancing. Because each slice of your pie has a percentage allocated to it, M1 will distribute each deposit you make so that it fits your allocation.

If one of your assets is outperforming all the others and you make a deposit, less will be invested in it so that the others can “catch up.”

What is Automatic Rebalancing?

Automatic rebalancing will rebalance your portfolio as your investments grow. In the case of M1, this is done by allocating money deposited to any assets that are lagging until each one is as close as possible to your target allocation. |

Going back to our 80/20 allocation, if your stocks are performing exceptionally well and your portfolio is now 85% stocks, more of your deposited money goes to bonds until your portfolio is back to 80/20.

Having that built-in rebalancing is nice – especially if your pie has dozens of slices. And when you sell your shares, M1 also does so in a way that helps balance your portfolio.

One-Click Rebalancing

You also have the option to rebalance with a single click. To do so, all you have to do is click “rebalance” under your portfolio pie on the dashboard:

Once you click rebalance, M1 will automatically execute trades for you to match your target allocations. Those trades will start at the next trade window, which is 9:30 a.m. Eastern on business days. M1 Plus members have an additional trade window at 3 p.m. Eastern.

You can also see your portfolio setup by clicking “edit” next to the rebalance button (see snippet above).

Tax-Loss Harvesting

M1 doesn’t have tax-loss harvesting like some other platforms, but it does have features built in to help minimize tax implications when selling shares.

In particular, when you sell your shares, the system will sell them in this order:

- Losses that offset future gains

- Lots that result in long-term gains

- Lots that result in short-term gains

While this is not the same as real tax-loss harvesting, it is better than the system selling shares in totally random order.

Fractional Shares

M1 has fractional shares which let you purchase pieces of stock as small as 1/100,000th of a share. Thus, you’ll never have cash sitting on the sidelines until you can afford another share.

“A fractional share is equity in a security that is less than one full share. M1 splits every share into 1/100,000th of a share so you can trade exact amounts of each based on the targets set in your portfolio.” |

Say you want to buy a share of Facebook (NYSE: FB) stock or Amazon (NYSE: AMZN) stock.

If you only have $100 to invest, you’d have to save up until you have enough to buy a whole share with a traditional brokerage. That’s not the case for fractional shares. As long as what you want to buy isn’t smaller than 1/100,000th of a share, you’re good to go.

Cash tends to lose purchasing power over time due to inflation, even when put in high-yield savings accounts. Therefore, being able to invest all of the cash you set aside for that purpose is a big win.

If you combine this with an M1 Spend cash management account, you’ll be able to fully leverage your cash at all times. M1 Spend is an online checking account and money is moved from M1 Spend to your taxable account/IRA the next business day. It takes two-three business days when using an external bank.

Dividend Reinvestment

Dividends are displayed in the activity tab as well as the performance for individual securities. When you receive a dividend, it will be added to your cash balance. You can either spend that money with your debit account or reinvest it.

If you turn on auto-invest, your dividends (plus any other cash you deposit) will be automatically invested. Thus, M1 Finance has DRIP style reinvesting.

In order to auto-invest, your cash balance must reach at least $25. You also have the option to set a minimum balance which will result in a set amount of cash not being automatically invested.

As is always the case with M1, that money will be evenly distributed based on the allocation set in your investment pie.

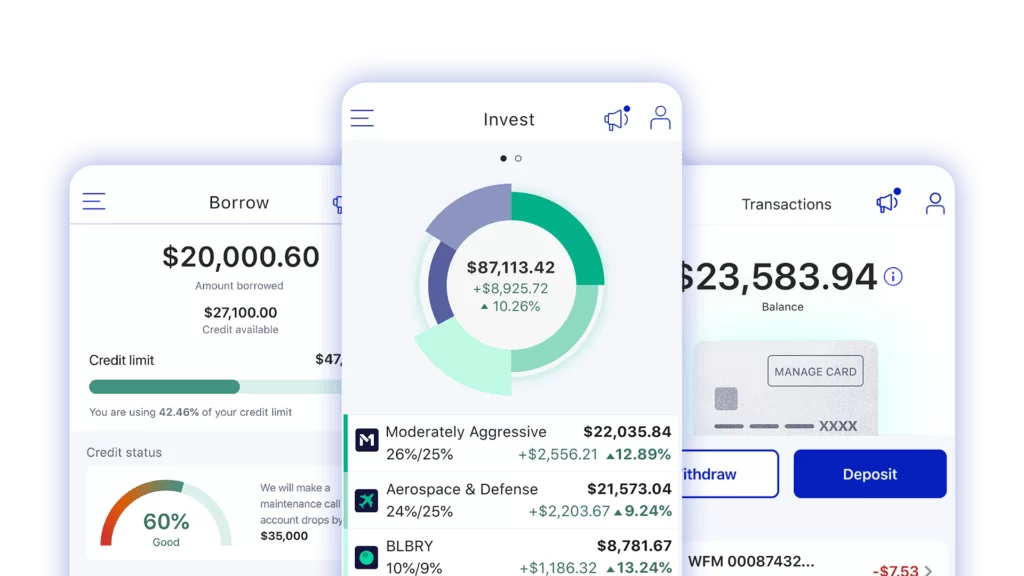

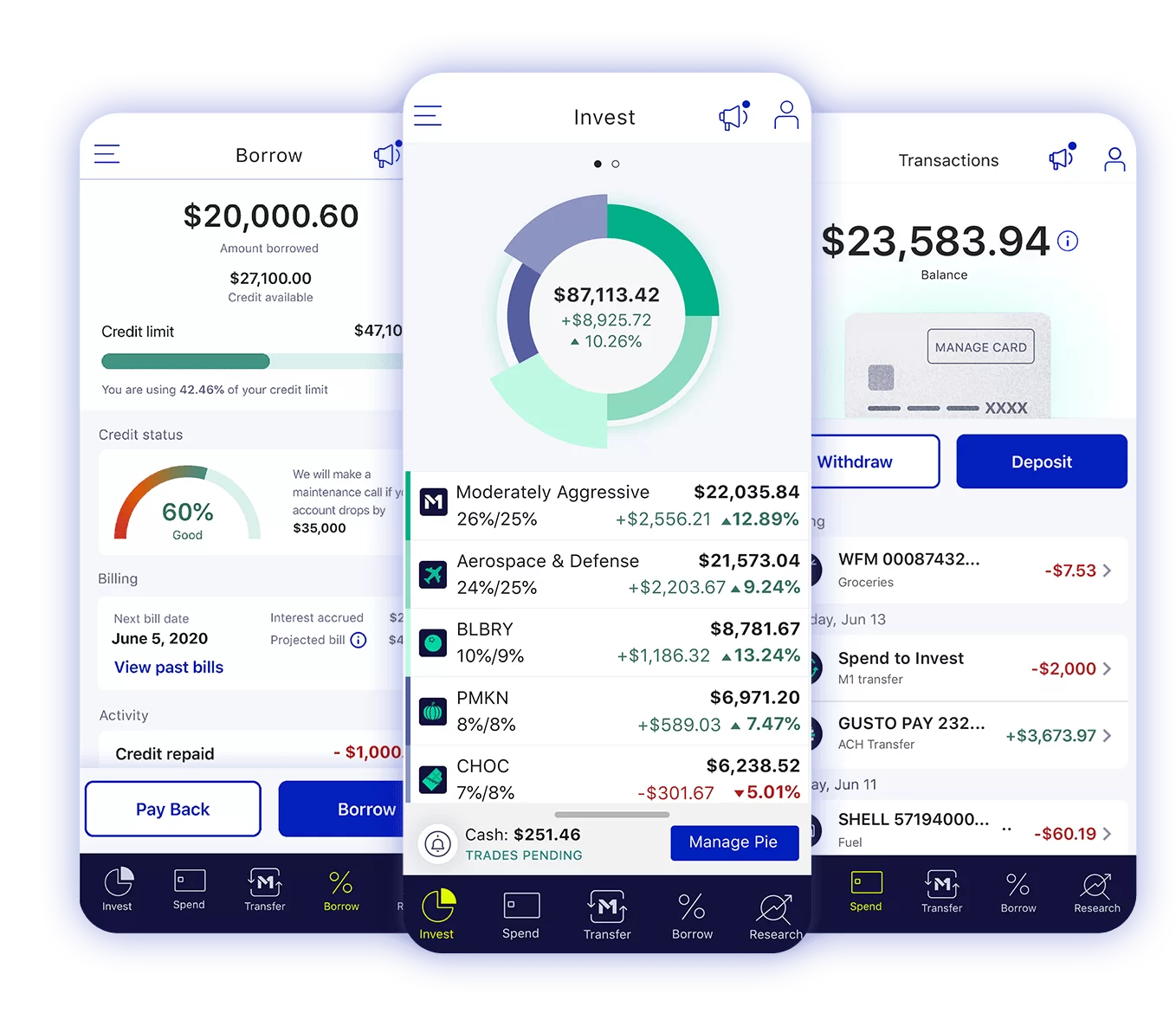

Mobile App

One of M1’s strong points is the excellent M1 Finance app. That’s because it doesn’t sacrifice much. In truth, the experience when moving between the desktop site and the mobile app is seamless.

The app is available on both Android and iPhone. Indeed, just about all the functionality of the desktop site is available on this little mobile app.

M1’s mobile app lets you purchase new investments, access M1 Spend and M1 Borrow, transfer money, and see investment research.

The app supports biometric (fingerprint) login, and the system has military-grade 4096-bit encryption, keeping your investments safe.

You can also optionally enable two-factor authentication for added security.

M1 Finance Fees

A basic M1 Invest account is completely free. There are no monthly fees or management fees, no minimum balance, and no trading fees. If you have a taxable account or retirement account, M1 is an excellent low-cost investment platform.

Of course, M1 still wants to make money. It does so through fees on its other services, M1 Spend and margin loans through M1 Borrow. Fees on the portfolio line of credit through M1 Borrow are somewhat high at 3.5% for basic members, but quite low at 2% for M1 Plus members.

M1 Spend

M1 Spend is M1’s free checking account and can serve as a place to hold cash that you’d like to set aside but aren’t quite ready to invest. M1 Spend is a bank account that earns 1% cash back on debit card purchases for M1 Plus members. If you prefer digital banking, it’s the perfect setup.

M1 Spend members now also have access to the Owner’s Rewards Card, an exclusive card for M1 Plus members that lets you earn up to 10% cash back from certain retailers. It does have a $95 annual fee, but it could be worth it if you regularly earn 10% back. Sign up for M1 Finance to take advantage of the offer.

You will receive a debit card in the mail if you opt in for the M1 Spend checking account. If you incur ATM fees when using your debit card, M1 will issue one ATM fee reimbursement per month (or up to four reimbursements with M1 Plus).

M1 Spend balances are held by M1’s partner, Lincoln savings bank. In addition, up to $250,000 cash in the M1 Spend cash management account is covered by the FDIC.

M1 Borrow

M1 Borrow is a portfolio line of credit that allows you to borrow up to 35% of your portfolio’s value. The base interest rate for these loans is 3.5% or 2% for M1 Plus members. 2% is a great rate for margin loans and beats out many competitors.

This could make them an attractive borrowing option for anyone making a large purchase. Or you could use it to refinance student loans, pay off credit cards, etc. In order to borrow against that balance, you must have a brokerage account with a balance of at least $5,000.

On the plus side, there is no payment schedule, and interest accrued may be tax-deductible if you itemize your tax deductions.

M1 Plus

M1 Plus works as an upgrade to what you get with a free account. For the $125/year annual fee, it either adds new features or upgrades existing ones.

M1 Plus does provide benefits that may appeal to some, such as 1% cash back on debit card purchases, custodial accounts, and high APY for checking accounts. In addition, four ATM fees are reimbursed instead of one. That said, these benefits can be had elsewhere without an annual fee.

If you’re an active trader, the higher daily ACH limit may seem appealing. M1 Plus also adds a second afternoon trading window at 3 p.m. Eastern. In addition, the 2% base rate on margin loans through M1 Borrow could prove useful for some. With its margin accounts, M1 lets you borrow up to 35% of your portfolio’s value once it is above $5,000.

All in all, your spending/borrowing/investing habits will determine if the $125 annual fee is worth paying. But if you aren’t sure if you want to take the plunge just yet, you can get a free trial of M1 Plus just for joining M1 Finance.

M1 Finance Customer Service

Whether you need investment advice or help with your account, M1 can answer customer support questions via email and phone. Their phone support is available from 9 a.m. to 4 p.m. eastern. There is also an AI-driven chat box at the bottom of the website.

You can also find several FAQ pages to answer some of your common questions. Plus, there are detailed blog posts and webinars with more information on the customer support page.

Unlike some other investment apps and services, M1 does not offer investment advice or access to financial advisors. However, most charge a fee to meet with human advisors, with the exception of SoFi Invest. Betterment and Blooom offer access to financial advisors and financial planning for an added fee.

M1 Finance vs. Betterment

When looking at M1 Finance vs. Betterment, what you should know is that each is an excellent investing platform, albeit for different reasons. Both offer an FDIC-insured checking account, allowing you to bring all your finances under one roof. Still, they have their differences.

M1 Finance is great for its pie-based investing, which makes it easy to create custom portfolios. You have the option to use M1 completely for free unless you opt for M1 Plus for some additional features.

Unlike Betterment, M1 doesn’t have tax-loss harvesting. It does, however, allow you to rebalance with one click, making portfolio management a breeze.

Betterment, on the other hand, has excellent diversification, but it doesn’t allow you to customize your portfolio (beyond stocks vs. bond allocation).

As Betterment is strictly a robo-advisor, it doesn’t have a free option. Still, the fee isn’t too bad for those who want a truly hands-off experience.

Neither service lets you deal with mutual funds. Betterment lets you meet with financial advisors for a per-session fee, but M1 doesn’t offer investment advice from humans.

M1 Finance vs. Robinhood

When considering M1 Finance vs. Robinhood, we can see that both are great platforms depending on how you use them. However, there are significant differences.

M1 Finance is ideal for long-term investors who want an easy-to-manage portfolio of stocks, ETFs, and bonds. The M1 app makes it easy to trade on the go. Plus, M1’s expert pies make it easy for anyone to create a portfolio in a matter of minutes.

Robinhood, on the other hand, is great if you find the M1 Finance trading window to be an issue. Indeed, if you want to be a day trader, Robinhood is a better bet. That’s because it lets you trade whenever you want. M1 only lets you trade once per day (or twice per day for M1 Plus).

Robinhood is also known for letting its users trade on leverage, which became controversial during the COVID-19 pandemic. However, if you want to be a pattern day trader on Robinhood, you’ll need to maintain at least $25,000 in equity. And even after Robinhood reduced the rate for its margin loans to 2.5%, M1 Plus still beats that at 2%.

Both apps are nice for buying individual stocks. M1 Finance fees and Robinhood fees are both $0 for trades. Both have excellent mobile apps and, overall, make trading a breeze.

M1 Finance vs. Vanguard

In some ways, M1 and Vanguard are similar. In other ways – not so much. Both are great in their own ways, but there are significant differences, too. Let’s find out how

M1 Finance is best for investors with their own strategy, like Vanguard. However, it has a more modern approach to investing and makes things simpler with its investment pies.

It also has no minimum balance with fractional shares. Although a Vanguard brokerage account has no minimum balance, several of its funds do have a minimum.

Plus, Vanguard doesn’t offer fractional shares with its brokerage accounts, unlike M1 Finance.

Vanguard is one of the original DIY investment tools. In fact, Jack Bogle, the company’s founder, created the first index fund.

These days, it doesn’t have quite the ease of use of more modern tools like M1 Finance. That’s because it’s more of a traditional brokerage. Nevertheless, its fees remain quite low.

In addition, it now has a robo-advisor called Vanguard Digital Services. At 0.15%, its management fee is actually lower than other popular robo-advisors such as Betterment.

So, while Vanguard is a bit antiquated in some ways, it has recently introduced some new products that could be attractive to new investors.

» Want to see how M1 compares to its competitors? Check out our list of the best robo-advisors.

M1 Finance FAQ

As M1 is still relatively new compared to names like Fidelity and Vanguard, I’d like to address questions you may have about the platform.

Is M1 Finance Safe?

Have you ever wondered, “Is M1 Finance safe?” Yes, M1 is safe. and legitimate company. M1 is a member of FINRA and cash deposits are FDIC-insured. Plus, investments are SIPC-insured. Thus, M1 Finance is safe and you don’t have to worry that your money isn’t protected.

Despite the fact that M1 is relatively new, there is little reason to have doubts about the company. In addition, M1 is an American company based in downtown Chicago, IL—not some obscure foreign country.

You can learn more about M1 Finance’s About page.

Is M1 Good for Beginners?

M1 can be good for beginners used the right way. M1 offers a variety of ETFs and pre-built expert pies, meaning there’s no need for you to sift through thousands of possible investments. Portfolio management is simple on this platform if you know what you’re doing.

That being said, it’s likely that intermediate to advanced investors will appreciate the platform more. That’s because it allows for almost unlimited flexibility, and you still have to select your own investments.

Beginner investors may prefer a platform like Betterment, which select all your investments for you.

How Does M1 Finance Make Money?

M1 Finance makes money from fees it charges investors for M1 Plus, M1 Borrow, and on interest earned from lending securities. It also makes money from cash management and payment for order flow (PFOF).

M1 Borrow is another source of revenue as the company charges interest on the money you borrow. Rates start at 2% for M1 Plus and 3.5% for free users.

That said, a basic M1 Invest account is completely free. You can easily create a portfolio and never spend anything unless you decide to upgrade to M1 Plus.

Is M1 Finance Right For You?

M1 is an excellent investing platform with very minimal fees. There’s no management fee for a basic account, and it’s one of our favorite robo-advisors. The company has over $5 billion in assets under management (and counting).

It simplifies the investing process and makes it easy for the passive investor to maintain a healthy, balanced portfolio and personal finance through automated investing.

That said, M1 is not great for active traders and day traders because there is only one trading window (9 a.m. Central). M1 Finance allows trades only during that time. And if you want to meet with a financial advisor, there are better choices, such as SoFi Invest.

If you transfer funds into your M1 Finance account after that time (or on the weekends), they won’t be invested until 9 a.m. the next business day. If you pay for M1 Plus, you’ll get two trade windows, including an afternoon trade window. Still, that isn’t enough for an active trader.

If you’re looking for a simple solution that will demystify investing and create a diversified portfolio that helps you grow your investments with minimal intervention, M1 is for you.

In fact, if you enable automatic deposits, your portfolio will require virtually no ongoing maintenance. That is all thanks to M1 Finance’s automated rebalancing.

It’s always good to check it from time to time, but checking it every day – or even every month – might be unnecessary. Regardless of your goals, M1 is a great platform for all kinds of investors, and one worth checking out for anyone who wants to start investing.

Related Investing Product Reviews:

Start Investing with M1 for Free TodayLearn More