Robo-advisors manage your investments for you by using a combination of investing algorithms and artificial intelligence. As a result, they give you the option to spend little to no time poring over your investments.

Because who has time to spend hours managing a stock portfolio?

But there is an increasing number of robo-advisors available these days. As a result, you have plenty of options if active trading isn’t your thing. And in this article, we’ll take a look at the best robo-advisors available in 2021.

After all, one of the main reasons to use a robo-advisor is to save time. You probably don’t want to spend untold amounts of time researching which ones are best. That’s why we did the hard work for you.

So, let’s get to it and take a look at the top robo-advisors for 2021.

Best Robo-Advisors for 2021: Overview

| Robo-Advisor | Best For |

| Betterment | Best overall |

| M1 Finance | Customizable portfolios |

| Blooom | Retirement accounts |

| SoFi Automated Investing | Low-cost investing |

| Acorns | Everyday saving |

| Vanguard Digital Advisor | Low-cost investing |

| Wealthfront | Financial planning |

| Ellevest | Investing for women |

| Schwab Intelligent Portfolios | Risk-averse investors |

| SigFig | No fees first $10,000 |

| Axos Invest | Customized portfolios |

Betterment

Betterment

Betterment’s standout features are its automatic tax-loss harvesting (TLH+) and automatic rebalancing. It also invests your money in a diversified portfolio of 13 different asset classes. These strong features make it our favorite robo-advisor overall.

Plus, it has goal setting to help you reach your financial goals. Betterment will help you do that with your brokerage account, IRA, Roth IRA, and other account types.

It does all this with a management fee of 0.25% (Digital) or 0.40% (Premium). The Premium plan has a $100,000 minimum, so most investors will start with Digital.

For an additional fee, you can gain access to certified financial planners (CFPs).

- Fees: 0.25% (Betterment Digital); 0.40% (Betterment Premium).

- Account Minimum: $0.

- Best for: Investors who want a hands-off investing experience.

Open an account | Read our review

M1 Finance

M1 Finance combines elements of a robo-advisor with DIY investing tools to give you a custom investing experience that you can fully automate.

That makes it great for investors who have experience with brokerage accounts. You can buy individual stocks, exchange-traded funds (ETFs), bonds, or even one of M1’s expert pies.

On that note, M1’s standout feature is its pie-based investing. This feature allows you to assign percentages to each one of your investments. Then, each time you deposit, the system distributes your money according to each investment’s target allocation.

It also has fractional shares, which helps it meet your targets. All of this makes M1 Finance our top choice for taxable accounts.

It doesn’t have tax-loss harvesting, but it does allow you to rebalance your portfolio with one click. A basic investment account has no membership fees, giving you the option to use the app for free.

- Fees: $0 or $125/year (M1 Plus).

- Account Minimum: $100 initial deposit; $0 after that.

- Best for: Investors who want a portfolio they can easily customize but also fully automate.

Open an account | Read our review

Blooom

Blooom is a different kind of robo-advisor. In fact, it’s the only robo-advisor currently able to manage 401(k) accounts and

In particular, it works with IRAs held at Fidelity and Vanguard.

Blooom has three subscription tiers: Essentials ($45/year), Standard ($120/year), and Unlimited ($250/year). A tiered approach means each tier adds on additional features.

Annual fees are reasonable, but you can pay only for what you need.

As a robo-advisor, Blooom will analyze your retirement portfolio and then invest it in low-cost exchange-traded funds (ETFs) if you’re on the Standard or Unlimited tier. Its other paid features include advisor access and auto-optimization.

- Fees: $45, $120, or $250/year.

- Account Minimum: $0.

- Best for: Investors who want help managing their retirement accounts.

Open an account | Read our review

SoFi Automated Investing

SoFi Automated Investing makes a compelling case for the best robo-advisor in an increasingly competitive field. It has no management fees

SoFi also has its own ETFs, and some of them have a 0.00% expense ratio. Plus, it has specialized ETFs, such as one that invests in gig economy companies like Uber.

SoFi Automated Investing doesn’t currently offer tax-loss harvesting, and you only have five risk levels to choose from. Still, with its ultra-low fees, it will likely appeal to many investors.

- Fees: No management or membership fees.

- Account Minimum: $1.

- Best for: Cost-conscious investors who don’t need extra bells and whistles.

Open an account | Read our review

Acorns

Acorns has the unique distinction of helping people invest their spare change. It automatically rounds up to the nearest dollar, then invests the

This is great for those who need a little nudge in order to start saving. Acorns has a $1/month fee for its Invest product.

That’s actually more than Betterment’s 0.25% fee for smaller balances, though it’s still quite affordable. Like SoFi, Acorns has five risk levels to choose from.

You can also set up recurring investments of a set amount of money rather than only investing your spare change.

- Fees: $1, $3, or $5/month.

- Account Minimum: $0 to get started; $5 minimum to invest your money.

- Best for: Everyday day savers who need a little extra help getting started.

Open an account | Read our review

Vanguard Digital Advisor

Long the gold standard for DIY investing, Vanguard has since joined the robo-advisor party. Now, with its Digital Advisor, it offers investment

Vanguard Digital Advisor does have a minimum investment of $3,000, but that matches the minimum for VTSAX. In other words, existing Vanguard investors are used to minimum investments, so they probably won’t mind.

Digital Advisor doesn’t currently have the advanced features of some other robo-advisors, but it has a mailing list specifically to inform you of new features.

- Fees: 0.15% management fee.

- Account Minimum: $3,000.

- Best for: Existing Vanguard investors seeking a low-cost robo-advisor.

Wealthfront

Wealthfront is quite comparable to Betterment; its robo-advisor has a 0.25% management fee as well. It also has a diverse set of ETFs, although its funds have a slightly lower expense ratio on average.

Specifically, the average is about 0.11% for Betterment compared to 0.09% for Wealthfront. Not a noticeable difference by any means. Plus, Wealthfront has great financial planning tools, which a plus.

And like Betterment, Wealthfront has a cash account with a similar APY. It also has many risk levels to choose from and tax-loss harvesting.

Unlike Betterment, Wealthfront does have a $500 minimum investment.

- Fees: 0.25% management fee.

- Account Minimum: $500.

- Best for: Cost-conscious investors who want a hands-off investing experience.

Ellevest

Ellevest has a goal of putting more money into the hands of women. However, as Ellevest’s website says, “we welcome clients of all gender identities and expressions.”

Ellevest has superb goal setting and offers a broad set of ETFs. In addition, it offers three membership tiers for investing, and all three have automatic rebalancing.

To top things off, this investing platform offers impact investing if you want to invest in a portfolio that aligns with your values.

The membership costs are $1, $5, and $9 per month. The Plus plan offers retirement advice, and the Premium Plan offers multi-goal investing.

All three tiers offer coaching access for a per-session fee.

- Fees: $1, $5, or $9 per month.

- Account Minimum: $0.

- Best for: Women and other goal-oriented investors.

Charles Schwab Intelligent Portfolios

Charles Schwab Intelligent Portfolios has no advisory fee, but that comes with a caveat: it holds a significant chunk of your portfolio in cash.

Specifically, that could range anyway from 6% to close to 30% of your balance. The cash balance does earn interest, but it’s in line with other savings accounts.

That said, expense ratios are low, and Schwab gives you a diverse set of ETFs. It does however have a $5,000 minimum, and no tax-loss harvesting below $50,000 invested.

- Fees: No management or membership fees (requires cash balance).

- Account Minimum: $5,000.

- Best for: Risk-averse investors who don’t mind having a large cash balance.

SigFig

SigFig has no management fees for the first $10,000 invested. Of course, some robo-advisors on this list, such as SoFi, have no management fees

Still, if you like the other things SigFig has to offer, it could be an attractive proposition. As an increasing number of robo-advisors are doing, SigFig offers free access to financial

Beyond the first $10,000 invested, this robo-advisor has a 0.25% management fee, like others on this list. Also notable is that it actually manages investments with TD Ameritrade rather than holding investments itself.

SigFig has a $2,000 minimum investment.

- Fees: No management fees for the first $10,000; 0.25% after that.

- Account Minimum: $2,000.

- Best for: Cost-conscious investors who want the strong investment performance.

Axos Invest

Formerly known as WiseBanyan, Axos Invest charges a 0.24% fee for features like tax-loss harvesting and selective trading.

Previously, the account minimum was only $1. It is $500 now, but it includes all of the featured that were previously relegated to Premium.

| Robo-Advisor | Best For | Mnt | Fees | Benefits |

| Betterment | Hands-off investing | $0 | 0.25% or 0.40% | Tax-loss harvesting, dynamic rbalancing |

| M1 Finance | Customizable portfolios | $100 | $0 or $125/yr. | Pie-based investing |

| Bloom | Retirement accounts | $0 | $45, $120, or $250/yr. | No minimums and advisor access |

| SoFi Automated Investing | Low-cost investing | $1 | 0.00% | No management fees |

| Acorns | Everyday saving | $5 | $1, $3, or $5/mo. | Invest your change |

| Vanguard Digital Advisor | Low-cost investing | $3,000 | 0.15% | Low management fees |

| Wealthfront | Financial planning | $500 | 0.25% | Low management fees |

| Ellevest | Investing for women | $0 | $1, $5, or $9/mo. | Financial coaching, impact investing |

| Schwab Intelligent Portfolios | Risk-averse investors | $5,000 | 0.00% | No management fees |

| SigFig | High-ROI investing | $2,000 | 0.00% first $10,000, then 0.25% | Strong portfolio performance |

| Axos Invest | Low minimum for premium features | $500 | 0.24% | Selective portfolios: remove ETFs you don’t want |

Selective trading is a nice feature: this gives you some customizability if there are certain investments you want to avoid.

- Fees: 0.24%.

- Account Minimum: $500.

- Best for: Investors who want a hands-off experience but also want the option to customize their portfolio.

Best Robo-Advisors: Comparison

What is a Robo-Advisor?

A robo-advisor is an algorithm-driven set of investment tools that allow investors to partially or entirely automate their investment portfolio. They invest your money in mutual funds, ETFs, bonds, and index funds.

Most robo-advisors offer investors at least some control over their asset allocation.

Each investor has a different risk tolerance, so it makes sense to give you some level of control. This allows you to tailor your investment strategy to meet your personal financial goals.

However, every robo-advisor is different. Many investment platforms have no minimum, while some, like Vanguard Personal Advisor Services, have a $100,000 minimum.

Robo-advisor fees vary, too, as do the features each one has. Plus, each robo-advisor uses different funds, which have different expense ratios.

Expense ratios are the fees mutual funds and ETFs charge to manage the investments.

However, in general, the biggest advantage of using a robo-advisor is that they give you more financial advice than you would have on your own. And, more importantly, they do so while charging less than a human advisor.

That’s because portfolio management is done by an algorithm rather than a human.

Most robo-advisors have a fully-functional mobile app for both Apple and Android, allowing you to manage your investment options from anywhere.

Notably, some robo-advisors give you the option to work with human advisors. SoFi Automated Investing offers help for no additional charge. Betterment offers it, too, charging $199-$299 by the session.

All robo-advisors have their own unique advantages and disadvantages – hence the need for this list.

Which Robo-Advisor is Best?

There isn’t a single “best” robo-advisor. The one you should choose depends on your financial situation and goals.

For example, if tax-loss harvesting is a must for you, Betterment is our top pick. If you want to be in complete control over your portfolio, M1 Finance is a great choice.

Of course, there are other considerations, such as fees and minimum balances. Betterment and SoFi give you the option to work with human financial advisors if that gives you peace of mind.

In the end, it comes down to which features are most important to you and what you hope to accomplish.

Can Robo-Advisors Make You Money?

Robo-advisors can absolutely make you money. Each robo-advisor uses a slightly different strategy, but the common theme is to invest your money in a diverse set of ETFs.

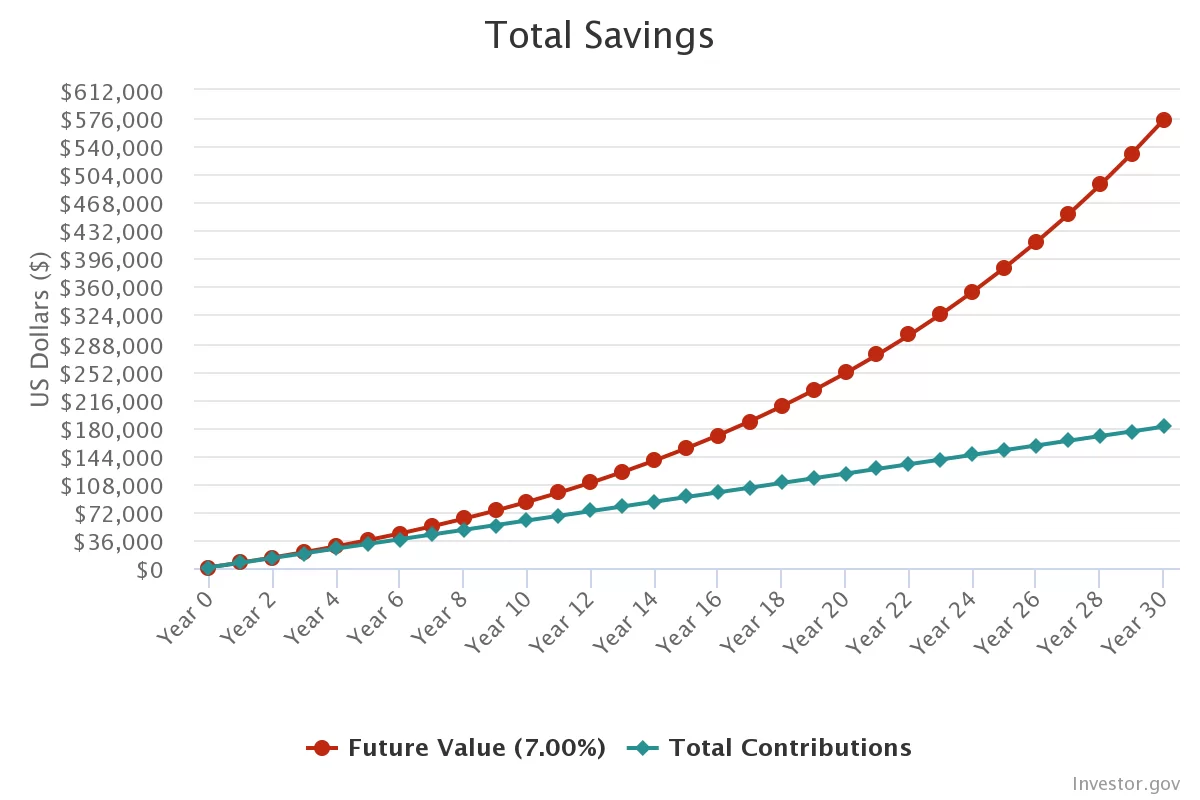

Let’s imagine you have an initial investment of $1,000. You then add $6,000 to that fund, per year, for 30 years.

We can’t know exactly how much the market will return in a given year, but a reasonable estimate is 6-7%. A typical robo-advisor with a diversified portfolio will likely have a return in this range, on average.

After 30 years, your investment would have grown to just over $500,000 with a 6% return. Only around $180,000 of that is your contributions.Kick that return up to 7%, and you have nearly $600,000 with the same contributions.

Growth of $6,000 annual investment over 30 years, 7% return

Of course, there are fees. But this is where robo-advisors easily beat human advisors.

With a 6% return, your robo-advisor fees (0.25%) are about $23,000 after 30 years. With a 7% return, $28,000.

Now imagine you’re paying a human advisor 1.5% to manage your investments. Those figures become $122,000 and $150,000.

Indeed, robo-advisors can make you money – especially when compared to a human advisor.

| Type | 7% Return (less fees) | Total Fees |

| Robo-advisor (0.25% fee) | $585,574.55 | $28,475.95 |

| Human advisor (1.5% fee) | $463,500.53 | $150,549.97 |

Are Robo-Advisors Worth It?

These investment platforms can be worth it, but the true answer to this question will vary. As we see above, robo-advisors can certainly be expected to make money.

And while the fees are a fraction of what you would pay to a human advisor, they are still noticeable.

Therefore, the way to answer this question is to consider the features each robo-advisor offers.

In our list above, we see several valuable features, such as tax-loss harvesting, automatic rebalancing, and even access to financial advisors.

In the case of SoFi Automatic Investing, financial advisor access doesn’t even cost extra.

If you decide to manage your portfolio on your own, you’ll have to do all of that yourself. It typically isn’t necessary to rebalance more than once per quarter. However, if you decide to do your own tax-loss harvesting, that will take up more time.

Then there is the simple fact of having to decide how to invest. Which funds should you select? Which percentage of your portfolio should be bonds?

How to decide: If you need help choosing a robo-advisor, check out our guide.

The people behind these robo-advisors are the experts and already know the answers to these questions. On that note, if your financial situation is complicated, you may well need the help of a financial advisor.

Thus, to determine whether a robo-advisor is worth it, take a look at the fees. Then try plugging those fees into an investment fee calculator.

Then, consider everything that will go into investing on your own. Is that amount of extra work worth saving that much in fees?

When you answer that question, you’ll know whether it’s worth it for you.

Robo-Advisor Pros & Cons

Again, every robo-advisor is different, which means not all of these pros and cons will apply to every robo-advisor. See above to check whether these apply to the one you’re considering.

However, in general, here are the pros and cons for most robo-advisors:

Pros

- Easier to use and less research required compared to DIY investing

- Cheaper than human financial advisors

- Low account minimums

Cons

- Less investment flexibility than DIY investing/human advisors

- Most come with a management or membership fee

- Most don’t offer advice from a human financial advisor

Ready to Get Started? Our Top Picks for 2022:

| |

| 4.9/5 | 4.9/5 |

| Read Review | Read Review |

| Get Started | Get Started |

| Fees $0 or $125/year (M1 Plus) Minimum Investment $0 Promo Invest for Free Tax-Loss Harvesting No Dynamic Rebalancing Yes | Fees 0.25% (Digital), 0.40 (Premium) Minimum Investment $0 Promo Up to 1 Year Free Tax-Loss Harvesting Yes Dynamic Rebalancing Yes |