In our M1 Finance review, we briefly touched upon one of the platform’s most powerful features: M1 Finance pies.

For novice investors, M1 investing can be relatively confusing. There are 60 pre-built pies already on the M1 Finance platform, but you can also build your own pies, which can then form slices of other pies.

Sound confusing? It’s simpler than it might sound.

Unlike other robo-advisors, you are not required to follow M1 stock recommendations. You have full agency over your investments. Let’s talk about how to begin automating your investing portfolio by creating your own pies.

What Are M1 Finance Pies?

M1 pies can consist of different asset classes, or they may consist of different investments within the same asset class. As of now, you have three types of investment to choose from:

- Bonds

- Stocks

- ETFs

The M1 Finance pie approach makes it easier for the average investor to plan, invest, and analyze their portfolios at a glance. M1 pies work just like a pie chart. Every pie at M1 adds up to a weighted total of 100.

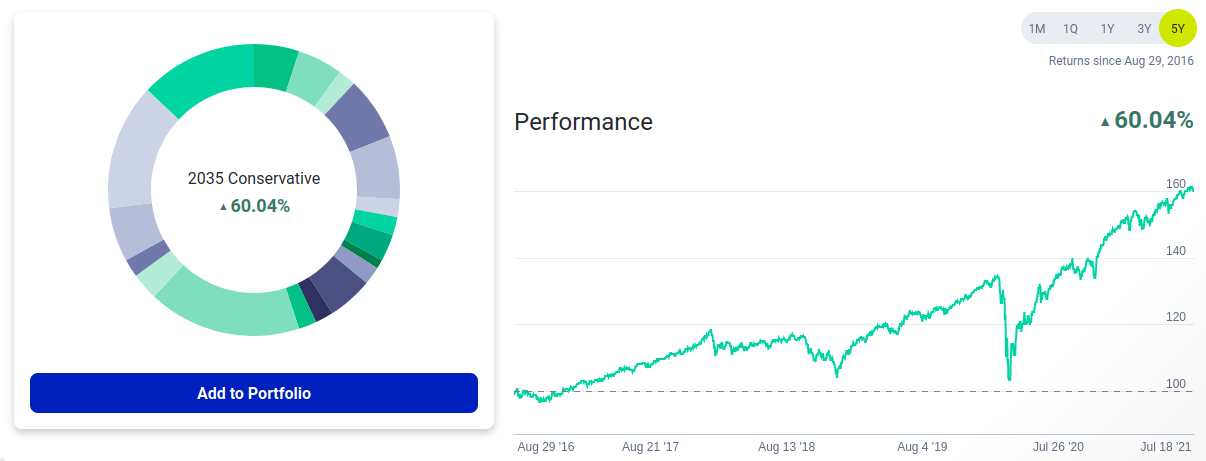

For the beginner, there are expert pies which are created by humans who use quantitative analysis to determine the best investments within each pie. These are entirely pre-built and benefit from automatic rebalancing to allow investors who know nothing to invest intelligently.

We recommend starting with an Expert Pie and tweaking from there. M1 is flexible, so even expert pies can be changed and customized according to your needs.

What Does it Cost to Invest in M1 Finance Pies?

As you likely read in our M1 Finance review, there are no monthly account fees, no minimum balances, no trading fees, and no management fees with a basic investment account. M1 is one of the most affordable ways to invest.

When you do decide to invest, there are minimum investment amounts:

- $100 for the standard retirement account.

- $500 for the retirement investment account.

Truthfully, if you can’t meet these minimums there’s little to gain from investing in the first place, so it’s an excellent deal.

Step-by-Step Guide for Creating Your First Pie

Let’s go through the process of creating a pie from scratch. Take note, a pie is not the same as your M1 Finance portfolio. Each pie fits into your overall portfolio.

At the basic level, your M1 investing account works like this:

Portfolio > Pies > Slices > Individual Stocks/Bonds/ETFs

- Step One – Visit the “My Pies” tab on the main menu and select “Create New Pie”. Since this is your first time, your list should be empty.

- Step Two – Choose from “Stocks,” “Funds,” “Expert Pies,” and “My Pies.” The “My Pies” option is visible because you can add other pies as slices to new pies.

- Step Three – Search for your desired stocks by their market tickers in the search bar. You can add multiple stocks to your pie at once.

- Step Four – Assign a weight to each individual stock. These are expressed as percentages and must add up to 100. You can add as many or as few investments to your pie as you like.

- Step Five – Save your pie, give it a name, and add a description (optional).

- Step Six – Click the “Invest” tab and add it to your portfolio.

It really is that simple. Every time you add more money to your pie, it will be allocated according to the weightings you set when you created it.

Existing pies can be edited as much as you like. You can create as many as 100 different pies and have any number of those pies consisting of slices of other pies. This is what makes up your overall portfolio.

Expert Pies on M1 Finance

But what if you don’t know what you want to invest in? For these investors, there are expert pies that were compiled using a data-driven, expert-managed approach.

We recommend using these pre-built expert pies, or at least using them as a template, if you’re new to M1 investing and the markets as a whole.

Here’s a list of the most important pies for beginners:

General Investing – These pies are based on your risk tolerance. They range from ultra-conservative to ultra-aggressive and are defined chiefly by allocations between stocks and bonds.

Enter your target retirement date and you’ll receive a pie tailored towards how long you have until you retire.

Responsible Investing – These M1 Finance pies will eliminate so-called sin stocks. They focus on sustainable investments and socially responsible organizations.

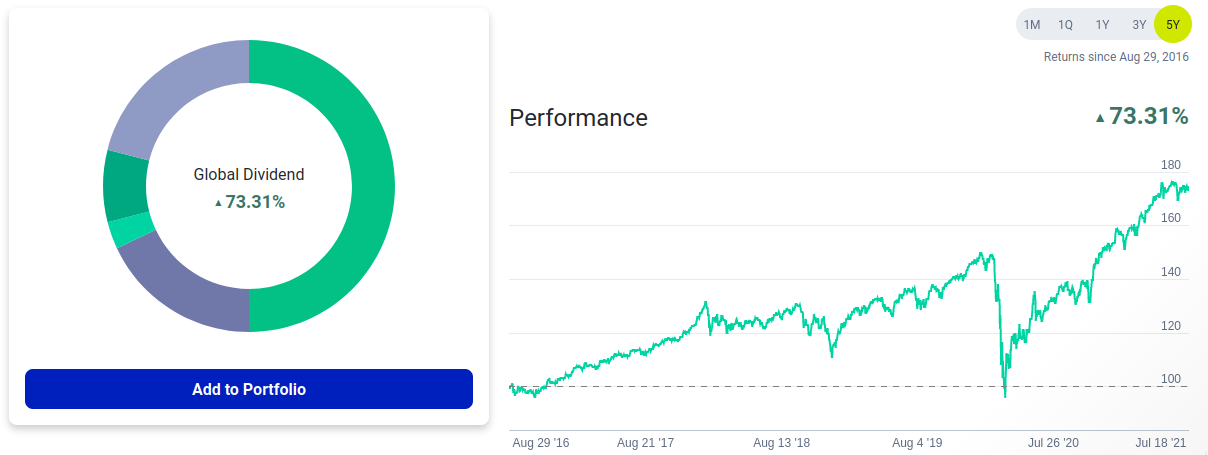

Income Earners – If you’re looking to create a regular income, these pies focus on companies that pay a regular dividend.

Hedge Fund Followers – Do what the big hedge funds do. From Pershing Square to Tiger Global, transplant their investing styles to your portfolio.

Hedge Fund Followers – Do what the big hedge funds do. From Pershing Square to Tiger Global, transplant their investing styles to your portfolio.

Balancing Your Portfolio the Easy Way

The beauty of M1 Finance is how easy its pies make things for you. When you add slices to your pie, you specify how much of your pie each slice should make up. When your portfolio immediately drifts, you can re-balance with one click.

The same happens when you add money to your portfolio. Whether that’s automatically or manually, M1 pies work to keep everything in balance. As money is added, M1 automatically buys more of your underweight slices. And it uses fractional shares for added precision.

Do you have dividend funds in your portfolio? That too is no problem for M1 pies. It allows you to auto-invest as soon as you have at least $25. That includes both cash and any dividends you receive. These too are invested in any underweight slices you have.

Move Money with Smart Transfers and M1 Pies

M1 Smart Transfers are a way to take automation to the next level. Keep in mind that this feature is only available for M1 Plus members with an M1 Spend account.

If you meet those criteria, you can set up custom rules to make money for you. The idea is to specify how your money should be allocated, such as maxing out your IRA or saving for emergencies. Then, when you meet the threshold you set, your money will automatically be moved from M1 Spend to wherever you specify.

And because this is M1, the account your money is moved to can have its own pie. For example, you might have an IRA might consist of a target date expert pie. Or maybe you have an emergency pie that invests in short term bonds. Whatever option you choose, everything can be fully automated with M1 pies.

The Bottom Line

While some investors may be disappointed by the fact mutual funds and options are unavailable at M1 Finance, the average investor planning for the future will be able to accomplish their goals with the asset classes available.

As you can see, the pie approach is an easy way of creating a balanced portfolio, even if you’re no market expert.

Ready to start creating your M1 Finance pies for free? Get started with M1 to set up your very own portfolio.

By: Bob Haegele

By: Bob Haegele