M1 Finance vs Webull

- Investing simplified with M1 pies

- No commissions

- No minimum to open an account

- Commission-free trading

- Features for active traders

- Access to cryptocurrency

M1 Finance and Webull are two popular investing apps that have a lot in common. Both offer features like commission-free trading and the ability to trade in stocks and exchange-traded funds (ETFs).

When considering M1 Finance vs. Webull, deciding which is better is less about the competence of each platform and more about which one is best for the beginner to start investing.

M1 Finance is the undisputed financial app for beginners. Webull also offers some cool features, but its array of functions makes it complex to manage if you don’t know what you’re doing.

For the investor who wants to plan for the future, which platform is right for you?

M1 Finance Overview

M1 Finance was launched in 2015 by current CEO Brian Barnes. Based in Chicago, Illinois, the platform now boasts more than $5 billion in investor assets. And this number is only expected to grow exponentially in the coming years.

Thanks to its automated portfolios, the platform has widened access to financial markets. No longer do investors need to pay for expensive fund managers or spend months learning about individual stocks and ETFs.

Read our M1 Finance review to find out why we believe this platform has changed the way people invest forever. To get started, all you need to do is define your investing goals and M1 investing will recommend an automated portfolio just for you.

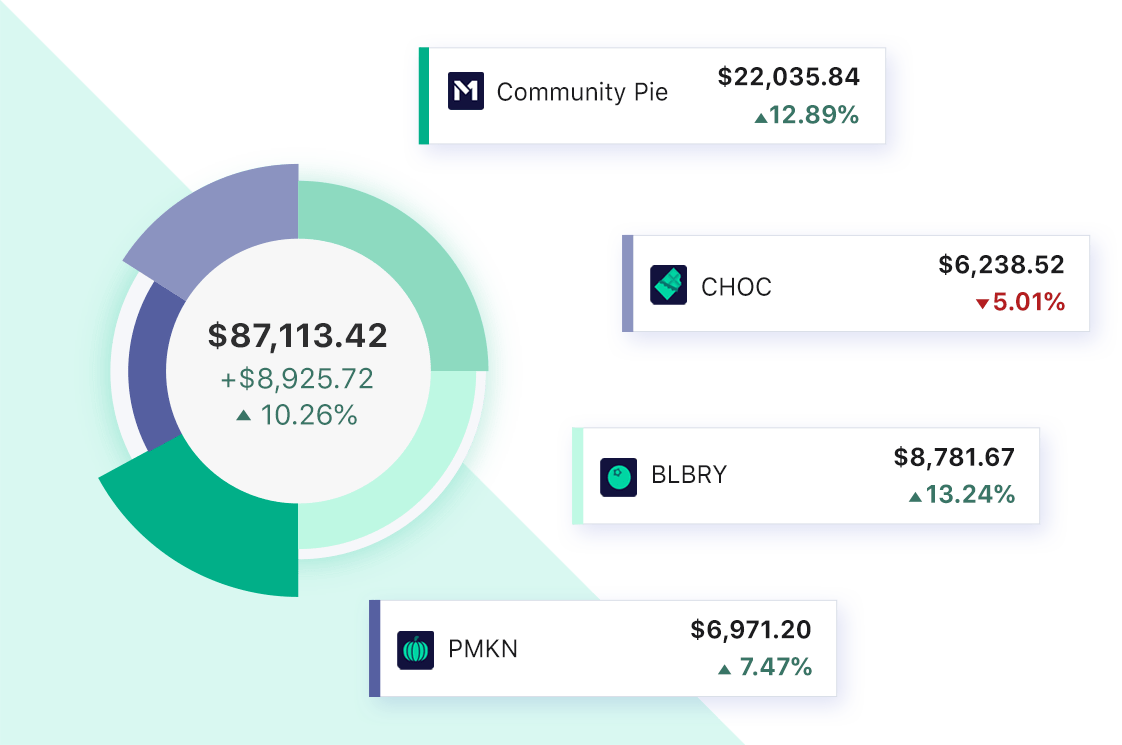

Even if you want to take direct control of your investments, you can with the M1 pie investing feature. Create your custom portfolios and invest your money however you want. Investing with M1 Finance is simple and affordable.

M1 Finance Details

| Account Minimum | $0 |

|---|---|

| Management Fees | $0-$125 per year |

| Account Types | Individual and joint brokerage accounts, Roth IRA, SEP IRA, and Traditional IRA, trust accounts, and custodial accounts |

| Investment Type | Stocks and Exchange-Traded Funds (ETFs) |

How do you get started with M1 Finance?

Create your account and make your first deposit. There are no account minimums to get started and no fees for trading or maintaining your assets on the platform. It’s at the forefront of the drive toward low-cost investing. We love M1 simply because even if you only have a few hundred dollars to invest, you’re welcome on this platform.

M1 also offers an array of supported account types, including IRAs and custodial accounts. Although there are platforms with similarities to M1, most of them don’t support more than the most basic of account types.

Check out this robo-advisor’s M1 Expert Pies if you want to let the experts control your portfolio. Alternatively, make your own pies. There are no limits to how many pies you can hold in your account.

M1 Finance Fees

To put it simply, there are no fees for investing with M1 Finance. Unlike traditional brokerages, you’ll never pay any management fees, trading fees, or commissions. Also, you don’t even need to hold any money in your account. There are no minimums in place on this platform.

If there are no fees, how does M1 Finance make money? Through its M1 Borrow and M1 Spend products, this is where the company generates its income streams.

M1 does offer the M1 Plus program, which costs $125 per year and upgrades your investing account. Subscribers gain access to features like higher daily ACH limits.

Truthfully, most investors have everything they need with the standard M1 account.

Is M1 Finance Safe?

M1 Finance is very affordable, but this is not to be confused with a lack of security. Every M1 Finance Review appreciates how the firm protects accounts through both encryption and two-factor authorization.

All data transmissions on M1 Finance are ensured with military-grade encryption, and two-factor authorization means that users can choose to approve of any login attempts via cellphone as an extra layer of account protection.

Is M1 Finance Worth It?

M1 Finance is largely considered a great option for investors of all experience and activity levels. M1 Finance Reddit reviews praise the firm’s automation for inexperienced investors who want to take a “set it and forget it” approach to their investments. For more experienced investors or those who adopt a hands-on approach, M1 also allows the customization of each portfolio, making the robo-investor beneficial for subscribers of every type.

M1 Finance Pros

- Investing simplified with M1 pies

- No account minimums

- No minimum to open an account

M1 Finance Cons

- No access to mutual funds

- No financial advisors

- No tax-loss harvesting

We believe M1 Finance is the perfect platform for beginners. Browse our in-depth review on M1 Finance to learn more about the platform.

Webull Overview

Webull Financial LLC, the parent company behind the Webull app, was formed by Wang Anquan. Anquan boasts a lot of experience after spending many years with the Alibaba Group. However, it wasn’t until May 2020 that it received SEC approval to launch its new roboadvisor. This lack of a track record may make some investors nervous.

Webull allows you to trade in stocks, ETFs, options, and crypto. Like M1 Finance, there are no commissions and they do offer you two free stocks upon opening an account. The latter is a nice bonus, but it shouldn’t be instrumental in your financial decision.

The platform has positioned itself as a choice for regular traders, as it also includes access to free margin trading. Leverage can be dangerous and should not be used by inexperienced investors. If you’re a short-term trader, this is the platform for you.

Webull Details

| Account Minimum | $0 |

|---|---|

| Management Fees | $0 |

| Account Types | Individual accounts, Traditional, Rollover, and Roth IRAs |

| Investment Type | Stocks, options, ETFs, and crypto |

In the debate between M1 Finance vs. Webull, there are so many similarities between the platforms. The platform has adopted M1 Finance’s revolutionary stance on not charging any fees for trading or operating any account minimums,

The platform offers up to 22 different technical indicators and a wealth of the latest market news. Investors who are concerned with short-term trading will benefit from being able to use the various charting options.

On the other hand, the interface can be incredibly intimidating for beginners. There’s a huge learning curve to navigate. Another issue with Webull is that there’s no automatic portfolio rebalancing.

Unlike M1, if a major market change occurs, your desired portfolio allocation could be shifted out of position without your knowledge. For this reason, Webull requires a lot of active management on the part of investors.

Only if you have experience in the market should you opt for Webull over M1 investing.

Webull Fees

Webull’s fee structure is almost identical to that of M1’s. There are no trading fees, commissions, or management fees. It’s truly a free investing app. This even extends to their new crypto trading option.

Webull primarily makes money off the back end, such as charging short selling fees, handling order flow, and making money off the spread.

However, this isn’t something that will impact the average retail investor.

Is Webull Worth it?

Webull is a great choice for intermediate to advanced traders who don’t want to pay exorbitant fees. The firm offers a myriad of analytical tools for experienced subscribers but might not be the best choice for new investors.

Webull Reddit forums typically mention the lack of educational content typically found in platforms that advertise to retail investors. Brand new subscribers who still need some basic education on market dynamics will have to seek additional resources if they choose a Webull subscription.

Webull Pros

- Commission-free trading

- Features for active traders

- Access to cryptocurrency

Webull Cons

- High interest rates for margin trading

- Difficult for beginners to get used to

- No automatic portfolio rebalancing

M1 Finance vs Webull: Comparison

| Feature | M1 Finance | Webull |

|---|---|---|

| Management Fees | $0 | $0 |

| Min. Investment | $0 | $0 |

| Avg. ETF Expense Ratio | $0 (Charged by certain providers) | 0.09% |

| Account Types | Individual and joint brokerage accounts, Roth IRA, SEP IRA, and Traditional IRA, Trust accounts, and Custodial accounts | Individual accounts, Traditional, Rollover, and Roth IRAs |

| Tax-Loss Harvesting | None | None |

| Financial Advisor Fee | No financial advisors available | No financial advisors available |

| Best For | Beginners | Active traders |

M1 Finance vs. Webull: Which One is Right for You?

Most retail investors are advised to take a conservative stance aligned with their financial goals. The vast majority of active traders will lose money. One study reveals that 70% of traders lose money every single financial quarter.

Total beginners looking to get into the market for free are advised to choose M1 Finance over Webull.

M1 makes investing for the first time simple. You can manage your investments on mobile and it takes only a few minutes to buy your first asset.

Webull, on the other hand, has some cool features, but the interface is simply too complex for beginners. It’s a product aimed at active investors who are looking to make some short trades (possibly on margin).

Although the two platforms do offer similar fee structures, M1 still wins out because of the way the platform works. The two free stocks promo on Webull is a nice bonus, but it doesn’t cover up the steep beginner learning curve.

Create Your M1 Investing account and start your portfolio with M1 Finance now.