M1 Finance vs Vanguard

- No fees or commissions

- No account minimums

- Simple investing with M1 Pies

- Human/robo-advisors available

- Large number of investment options

- Lots of supported account types

M1 Finance and Vanguard are the investment platforms that offer different ways to invest. During the COVID-19 pandemic, retail investments have surged to 25% of all trades throughout the summer of 2020.

If we look at M1 Finance vs. Vanguard, this is a debate between the new and the old. With M1 investing, you have an advanced robo-advisor that helps you to make better investing decisions. Vanguard, on the other hand, is one of the investing stalwarts, with the company credited with creating the first index fund.

So, which option should you choose as your investment platform of choice?

M1 Finance Overview

M1 Finance started back in 2015 under the guidance of CEO Brian Barnes. With its roots in Chicago, Illinois, the firm now holds over $5 billion in investor assets. Their approach to automated portfolios has made them incredibly popular among investors who have little to no experience in the financial markets.

As mentioned in our M1 Finance review, we believe this platform was a game changer. Based on your future goals, you can select one of their automated portfolios. It doesn’t matter whether you’re looking to save money for a house or to plan for your retirement, M1 can do it all.

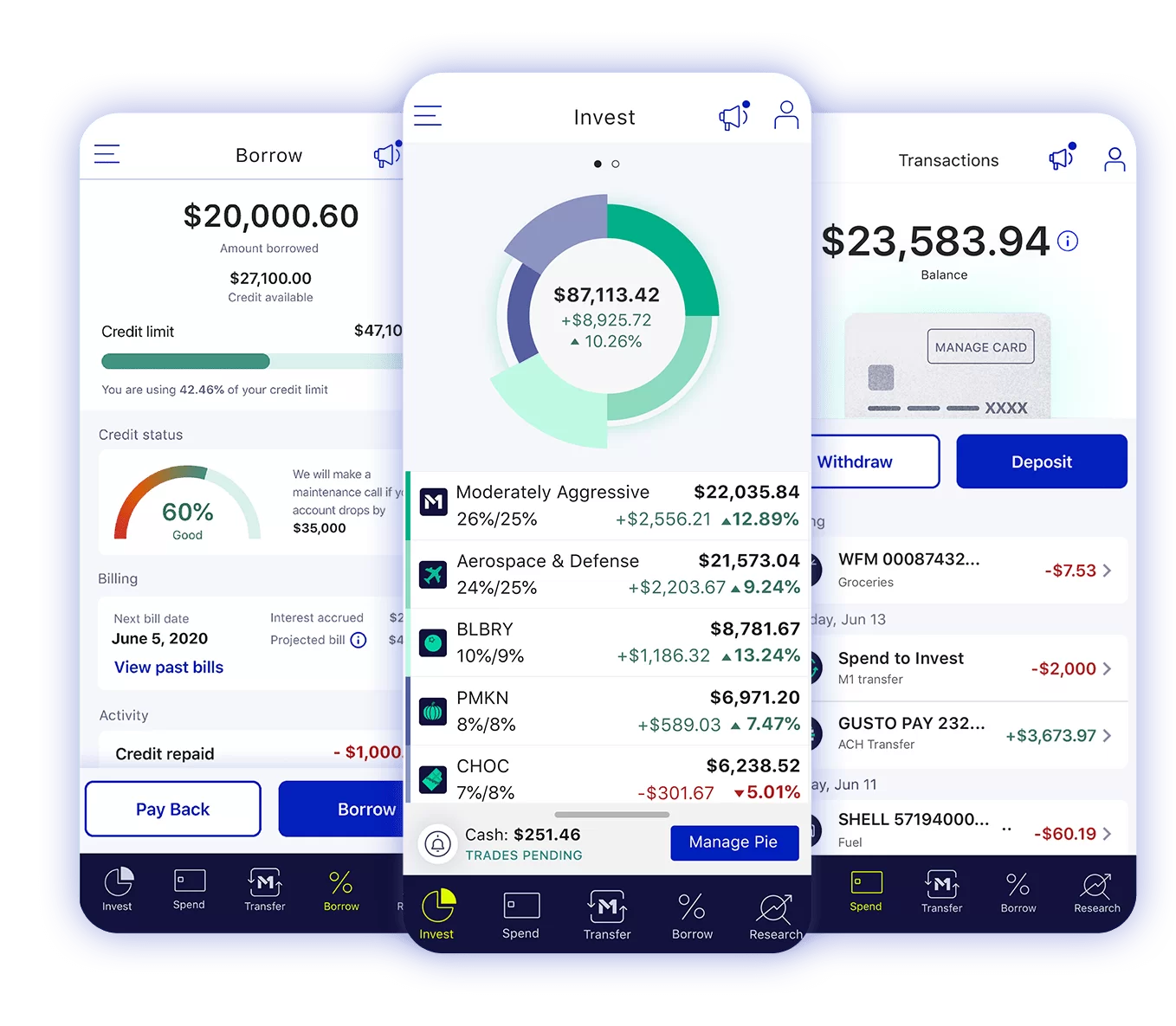

This completely automated service also enables investors to create custom portfolios using the pie investing feature.

Whether you want total control over your investments or whether you want to invest and let it ride, investing with M1 Finance allows you to do that and more.

M1 Finance Details

| Account Minimum | $0 |

|---|---|

| Management Fees | $0-$125 per year |

| Account Types | Individual and joint brokerage accounts, Roth IRA, SEP IRA, and Traditional IRA, trust accounts, and custodial accounts |

| Investment Type | Stocks and Exchange-Traded Funds (ETFs) |

The M1 platform, whether on desktop on on the M1 Finance app, requires you to meet no account minimums and pay no fees. Although there are some small fees for certain actions, most investors will never pay a cent in fees to M1. There are zero account minimums at any point, so if you only have a small amount to invest you won’t have any problems.

M1 supports a huge number of account types, such as IRAs, individual brokerage accounts, and even custodial accounts. Many investment platforms don’t offer the same variety of supported accounts.

If you’re more confident with investing, you can create ‘pies’. The pie investing system enables you to make your own custom portfolios. Alternatively, let the experts handle your portfolio with the robo-advisor’s M1 expert pies.

These pre-made portfolios contain various stocks and ETFs designed to align with specific goals and levels of risk tolerance.

M1 Finance Fees

M1 Finance has always taken pride in charging no fees to investors. This is why M1 investing is such a game changer as traditional brokerages usually charge commissions, management fees, other trading fees, as well as requiring adherence to various account minimums.

Instead, the platform turns a profit through its separate M1 Spend and M1 Borrow features. These checking accounts and portfolio lines of credit do come with fees, but unless you want to go beyond the standard investing account you’ll never pay any fees.

However, if you’re looking to enhance your investing experience, you do have the option of upgrading to M1 Plus. This is the upgraded M1 investing account and costs $125 per year.

M1 Plus comes with various features, such as a higher ACH limit per day. On balance, the majority of investors will not need the upgraded version of M1.

M1 Finance Pros

- No fees or commissions

- No account minimums

- Simple investing with M1 Pies

M1 Finance Cons

- Lack of investment options

- No human financial advisors

- No tax-loss harvesting

To find out more about how M1 Finance works, check out our in-depth review on M1 Finance.

Vanguard Overview

Vanguard was founded by Jack Bogle back in 1975 in Malvern, Pennsylvania. It quickly grew to become one of the most popular investment advisors in the nation. Bogle, for example, was credited with creating the first-ever index fund. Plus, they were arguably the fathers of low-cost investing.

Before M1 Finance and other robo-advisors began offering 0% fees, Vanguard was offering 0.04% on its ETFs. It’s also worth mentioning that Vanguard is owned by the funds it manages, therefore they are run by its investors on an indirect basis.

Currently, Vanguard is the biggest provider of mutual funds and the second-biggest provider of ETFs in the country.

Vanguard Details

| Account Minimum | $50,000 |

|---|---|

| Management Fees | 0.30% |

| Account Types | Traditional IRA, Roth IRA, SEP IRA, SIMPLE IRA, 403(b), 401(k), and individual and joint taxable accounts. |

| Investment Type | Stocks, ETFs, bonds, mutual funds, and more |

Vanguard Fees

Vanguard does charge fees, where M1 charges none. Vanguard’s 0.30% management fee is a real killer with an account minimum of $50,000. However, they do favor investors with larger portfolios, and so if you happen to have a portfolio value of more than $25 million, your management fee would be just 0.05%.

Its expense ratios are still at a record low of 0.04%, which is extremely similar to M1 investing. In short, if you’re concerned about fees Vanguard may not be the investment brokerage for you.

Vanguard Pros

- Human/robo-advisors available

- Large number of investment options

- Lots of supported account types

Vanguard Cons

- Very high account minimum

- Management fees

- Reliance on Vanguard index funds

M1 Finance vs Vanguard: Comparison

| Feature | M1 Finance | Vanguard |

|---|---|---|

| Management Fees | $0 | 0.30% |

| Min. Investment | $0 | $50,000 |

| Avg. ETF Expense Ratio | $0 (Charged by certain providers) | 0.04% |

| Account Types | Individual and joint brokerage accounts, Roth IRA, SEP IRA, and Traditional IRA, Trust accounts, and Custodial accounts | Traditional IRA, Roth IRA, SEP IRA, SIMPLE IRA, 403(b), 401(k), and individual and joint taxable accounts |

| Tax-Loss Harvesting | None | None |

| Financial Advisor Fee | No financial advisors available | Available |

| Best For | Beginners | High net-worth investors |

Vanguard is the king and M1 Finance is the young pretender. The reality is that both platforms are aimed at different types of investors. Unless you already have a large amount to invest, Vanguard is not an option.

This has long been part of the problem with investing. M1 Finance enables you to get started even if you don’t have a lot of money. You can start with as little as a few dollars and begin crafting your portfolio using the M1 pie system.

Alternatively, you can take advantage of one of their pre-made portfolios.

Vanguard, on the other hand, works directly with you to create the portfolio that’s right for you. There’s an added personal touch that you just don’t find with most conventional robo-advisors, and that’s what high net-worth investors expect to pay for.

Overall, M1 Finance offers a simpler product that works better for the majority of ordinary investors. If you already have a significant amount to invest, you may want to consider using Vanguard’s PAS service.

Whether you want to create an account with M1 Finance or Vanguard, do it with Good Credit Info. Enter the market and begin forging the future you deserve.

Create your M1 Investing account and invest for free with M1 Finance.