Acorns Review 2022: Does It Live up to the Hype?

| By: Bob Haegele | April 3, 2021 |

In a nutshell: Acorns is a savings app that helps you invest your spare change. You can invest as little as $5.

It uses a robo-advisor to invest your money at a low cost and also allows you to invest manually.

| Fees | Account Minimum | Promotion |

|---|---|---|

| $1, $3, or $5/month | $0 | $5 Sign-Up Bonus |

With Acorns, you can round up all of your purchases and invest whatever is left over. The app does the rest. While investing your change won’t be enough on its own, it does allow you to invest outside of round-ups.

Pros & Cons

PROS

- $5 to start investing

- No trading commissions

- Round up your purchases

- $5 sign-up bonus

CONS

- Fees are a bit high for smaller accounts

- Investing your change will only get you so far

Compare to Other Investing Apps

| |

| Fees$1 - $5/month |

| Minimum Investment$0 |

| Promo$5 sign-up bonus |

| |

| Fees$1 - $9/month |

| Minimum Investment$0 |

| Promo$5 sign-up bonus |

| |

| Fees$0 |

| Minimum Investment$0 |

| PromoInvest for free |

Full Acorns Review

Acorns is a simple investing app that lets you round up all of your purchases and invest whatever is left over. The app does the rest. While investing your change won’t be enough on its own, it does allow you to invest outside of round-ups.

Acorns is best for:

- Beginner investors

- Those who are starting from $0

- Investors who need an extra nudge

Acorns at a Glance

| Account Minimum |

|

| Management Fees |

|

| Investment Expense Ratios |

|

| Tax Strategy |

|

| Customer Support |

|

| Promotions |

|

| Account Fees |

|

| Accounts Supported |

|

What is Acorns?

For many people, it’s not easy to start investing. Whether the problem is income, keeping up with the Joneses, or any other reason, it can be tough.

That is exactly the target market for Acorns. This investing app makes it easier for people to start investing. And in this Acorns review, we’ll find out just how well it does.

So if you need a little extra nudge, you’ll want to keep reading. You might find out Acorns is the perfect app for you.

Acorns is an investing app that helps you invest your spare change. It does have many of the features of other robo-advisors, but round-ups are how it differentiates itself.

While Acorns might be a newer name to some investors, it isn’t all that new. The founders, Walter Wemple Cruttenden III and Jeffrey James Cruttenden launched the app in 2014. It now has an Android app and an iPhone app.

Since its founding, the company has raised $100 million from venture capitalists.

Another notable point about Acorns is that it was built with help from Dr. Harry Markowitz, the creator of Modern Portfolio Theory. Markowitz backs the app to this day.

How it Works

How Acorns works is simple, especially when it comes to round-ups. To get started, you just link your credit or debit card to Acorns.

Then, any time you make a purchase, it will be rounded up. So if you buy something for $4.56, Acorns will round it up to $5.00

The extra 44 cents will then be added to your account.

Once you have at least $5, Acorns will invest your money in low-cost exchange-traded funds (ETFs).

It gives you some level of choice here, as you can invest in one of five different portfolios. Each one carries a different level of risk, from conservative to aggressive.

Best for: Those who need a little extra help saving and don’t want to be too involved in the process. Also, Acorns Family allows you to create investment accounts for children.

Acorns Features

As mentioned, round-ups are the feature that first differentiated Acorns. However, it offers several other interesting features and services.

Invest

Acorns Invest is the flagship feature of Acorns. This is where you will see your round-ups, invest, and build wealth.

Invest gives you a few different settings you can adjust. Those include your risk tolerance, round-up settings, and recurring investments.

You can also choose from one of Acorns’s five different portfolios. Plus, you have the option to schedule automatic transfers to your Acorns Portfolio.

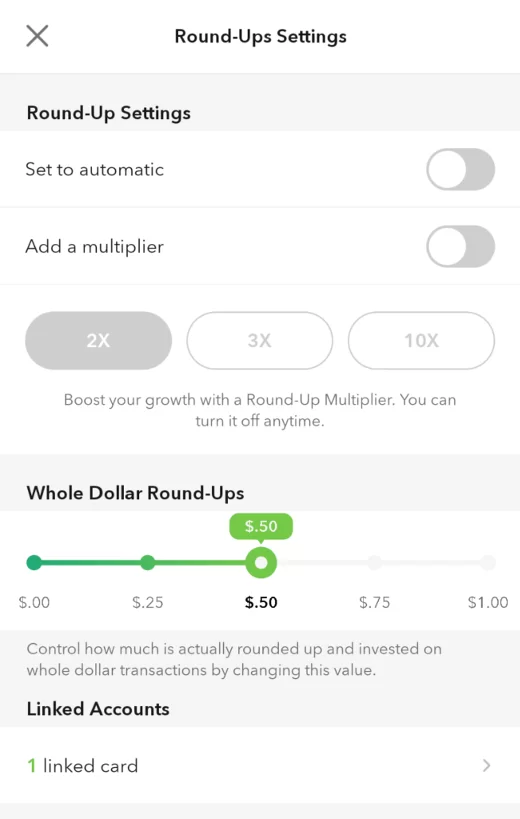

Under Round-Ups Settings, you’ll find a couple of interesting features:

In addition to setting Round-Ups to automatic, you can also give your Round-Ups a multiplier. Plus, for the odd whole-dollar transaction, you can specify how much to round up, in 25-cent increments.

Spend

Acorns Spend is an online checking account. It gives you access to 55,000+ Allpoint ATMs and is FDIC-insured up to $250,000.

Earn

Acorns Earn is a unique feature that works like a cash-back program. That means you earn a few percent on purchases from popular retailers.

However, instead of getting cash back, Acorns invests the money instead. It may be a small amount for each purchase, but it adds up.

Early

Acorns Early allows you to open custodial accounts for kids. You can automatically invest as little as $5 every day, week, or month.

This account acts as a UTMA/UGMA account. That means you can easily transfer funds when the time is right.

And, your kids can use the money for anything that benefits them.

Later

Acorns Later is an individual retirement account (IRA). IRAs are tax-advantaged accounts that let you invest while lowering your taxable income.

Types of IRAs supported:

- Traditional IRA

- Roth IRA

- SEP IRA

Acorns says it calls these accounts “Later” because, as it rightly points out, retirement can be fluid these days.

Grow

Grow is a big part of the Acorns brand lately. It has partnered with CNBC and produces articles, interviews, and videos.

It even has its own Twitter. It’s basically a glorified blog, but there is plenty of interesting content.

Acorns Pricing

Acorns offers three different pricing tiers:

- Lite: $1/month. Includes an investment account and round-ups.

- Personal: $3/month. Adds access to Acorns Spend and Acorns Later.

- Family: $5/month. Adds access to Acorns Early.

Acorns Mobile App

Acorns has several nice features, but one that can’t be overlooked is its mobile app. In fact, both the website and mobile app are beautifully designed.

You can do anything on the mobile app you would do on the desktop site. Whether it’s setting up round-ups, choosing an asset allocation, or turning on automatic investments.

The same is true for Acorns Spend, Acorns Later, and Acorns Early. In other words, the app is fully functional.

Acorns Support

Acorns provides support via phone, email, and even has its own Twitter account. Considering how affordable the subscription is, the support options are better than expected.

Acorns FAQ

There is no shortage of questions about Acorns, and we’ll answer them here.

Is Acorns a Good Investment?

Acorns is a good investment, though it also depends on your goals and how you use it. This app is a great way for beginner investors to test the waters of investing. After all, its round-ups can help people see the magic of compounding with small investments.

That being said, investing your spare change with Acorns only goes so far. While you can invest manually with Acorns, more serious investors might prefer apps like Betterment or M1 Finance.

Is Acorns Worth It?

Acorns can be worth it, but it somewhat depends on your situation. Ironically, although you can start investing with just $5, Acorns is actually a better deal if you have a larger balance.

Why? Because you are charged a flat monthly fee rather than a percentage.

If you pay a percentage, the dollar amount you pay increases with your balance. That isn’t the case if there is a flat monthly fee, though.

Is Acorns Legit?

Yes, Acorns is a legitimate and safe app. You can see all of its legal protections in the website footer.

There, you will see a number of memberships and insurance offered. Acorns is an SEC-registered broker-dealer and member of FINRA.

As far as balances, investments are SIPC-insured up to $500,000. Acorns Spend balances are FDIC insured up to $500,000.

As you can see, Acorns has all its bases covered.

One thing to keep in mind is that these insurance programs only cover you if Acorns goes bust. The FDIC insurance won’t protect you against loss in investment value.

How it Compares

Now, let’s see how Acorns compares to some other popular investing apps.

Acorns vs. Betterment

Acorns and Betterment both have plenty to offer, but they have different target markets. Acorns is great for getting people on the path to investing. Its round-ups can give you an extra nudge and start investing with just $5.

If all you want is round-ups, the cost is $1 per month. That’s not bad, especially since you can also set up recurring investments with a basic account.

It also gives you choice between five different portfolios for different risk levels. That’s pretty good, although less control than Betterment gives you.

Betterment is ideal for hands-off investors who want access to a powerful robo-advisor. In other words, someone is serious about investing, but without all the hassle.

Compare: 11 Best Robo-Advisors of 2021

After you answer an initial questionnaire, it will suggest a risk tolerance for you. And it comes with automatic tax-loss harvesting and rebalancing.

Betterment gives you more control over your portfolio than Acorns (though not as much as DIY investing). The fee for a basic account is 0.25%, which is better for smaller portfolios.

For a more detailed breakdown, see our Betterment vs. Acorns comparison.

Acorns vs. Robinhood

Again, both apps are good, but these two are quite different.

Acorns is best for newer investors who want a hands-off experience. It also offers retirement accounts and custodial accounts.

It doesn’t have a free account option, but the lowest tier costs $1/month.

Lastly, Acorns has built-in robo-advisor functionality. However, your only option ETFs – there are no mutual funds or individual stocks.

Robinhood is better for more active traders. This is likely the reason it gained so much popularity during the COVID-19 pandemic. In other words, people stuck at home wanted to try their hand at active trading.

And that is the biggest draw to Robinhood: its viability as an active trading app. It has no commission fees and allows you to buy ETFs, options, and even cryptocurrency.

In addition, there is no monthly fee for a basic account. But, unlike Acorns, it has no robo-advisor functionality and no round-ups.

Is Acorns Right For You?

Acorns is a great app for people who need a little extra nudge to start investing. Its monthly fee is affordable and allows you to start investing with just $5.

Plus, it has built-in robo-advisor functionality. That means it will invest your $5 in low-cost ETFs and then manage it for you. It does that all according to the risk tolerance you choose.

Of course, Acorns is not without its drawbacks. It doesn’t have tax-loss harvesting like Betterment, and Betterment gives you more control over your portfolio.

Plus, its monthly fee can be higher than Betterment’s. That is all despite the fact that you only need $5 to get started with Acorns.

And investing just your spare change likely won’t be enough to retire comfortably. Luckily, Acorns does allow you to set up automatic investments.

That is available with its Lite account tier, which only costs $1/month.

While Acorns isn’t perfect, it’s a viable option, especially for those who need that extra nudge.