Investing in the stock market is a great way to build wealth. However, having the right strategy is just as important as investing itself.

While investing may seem like a complicated game only rich people can play, that isn’t usually the case.

The reality is that, while investing in stocks can be complicated, that isn’t a necessity. In fact, unless you’re a day trader, the goal should be to keep things as simple as possible.

Thus, this article will help you understand a basic, step-by-step approach to investing in the stock market.

Without further ado, let’s take a look at the steps you need to start investing in stocks.

Choose Your Strategy

These days, there are many different ways to buy stocks. For the purpose of this article, we are going to assume you’ll buy your own, individual stocks.

However, investing can take many forms:

- Mutual funds in a retirement account (401k, IRA, etc.)

- Exchange-traded funds (ETFs) in a brokerage account

- Using a robo-advisor

These are just a few ways to invest. Determining which strategy works best for you depends on several factors: time, fees, investing knowledge, risk tolerance, and your goals.

One of the reasons people invest in individual stocks is that returns can be greater than with mutual funds or ETFs. Plus, more and more brokerages have commission-free trading these days, meaning it’s free to buy stocks.

However, in doing so, you increase your risk, and potentially the time needed to research companies.

Are you willing to take on greater risk for the chance of greater reward? Are you willing to spend more time managing your investments to avoid fees? Do you have a high tolerance for market volatility?

These are the questions that will help formulate your strategy – questions only you can answer.

This is why financial advisors often recommend index funds to beginning investors, as they provide diversification with minimal effort.

In this article, though, we’re going to walk through the process of opening a brokerage account and purchasing individual stocks.

Open an Account

If the plan is to trade individual stocks, all you have to do is open a brokerage account. The process only takes a few minutes, and you can use any broker you choose.

If you’re not sure where to start, here are some quality brokers to consider:

<td”>Brokerage, IRA, custodial & 529

| Broker | Monthly Fees | Min. Investment | Account Types |

| Fidelity | $0 | $0 | Brokerage, IRA, custodial & 529 |

| Vanguard | $0 | $3,000 (Most index funds) | Brokerage, IRA, custodial & 529 |

| Charles Schwab | $0 | $0 |

Yet again, you have many choices. You can hire a human stockbroker, buy your own stocks through a full-service online stock broker like Charles Schwab or Fidelity. Alternatively, you can open an investment account with the M1 Finance app.

For the purposes of this article, we’ll assume you will open your own brokerage account.

The process is quick: it only takes a few minutes, and anyone can open an account. It’s not like opening a credit card, which can sometimes have stringent approval criteria.

All you have to do is fill out the application and wait for approval, which is usually immediate. Then, link your bank account and transfer money in.

Once that is done, you are ready to start trading.

Research Investments

The next step in the process is to research which investments you will buy. Don’t overthink it: oftentimes, the companies you know of are some of the best investments. Think Apple, Amazon, and Tesla.

These are known as blue-chip stocks in the investment world as they provide consistent returns in the long term. Past performance doesn’t guarantee future returns, but it can be a strong indicator.

How you will research companies will also depend upon your preferences. If you’re more of a DIYer, you can pore over documents like annual reports.

There’s nothing wrong with doing things this way if that is your style. However, there are also much easier ways, such as using tips from The Motley Fool Stock Advisor.

The Motley Fool is a financial advice company that regularly gives its best picks for individual stocks. While that is never a sure thing, it can save a lot of time.

In reality, the best stocks to buy are ones you want to own. That may sound overly simplistic and obvious, but the point is to invest in companies you believe in.

Every stock has its strengths and weaknesses and can be volatile at times. This is why it’s important to believe in the company’s mission and not just its financials.

As Warren Buffett once said, “Price is what you pay. Value is what you get.”

Decide How Much to Invest

Determining the amount of money you want to invest is a very personal decision. It can also be a very arbitrary one without specific goals in mind.

Needless to say, it may be difficult to stay on track if you are saving “just because.” That why tools like a Betterment IRA have tools to track specific goals.

The most common financial goal is probably retirement, but you can also save for goals like a major purchase or vacation. It then helps you determine how much you have to save in order to meet those goals.

Of course, return on investment is impossible to predict with 100% accuracy. Thus, they’ll tell you how likely you are to meet your goals by a certain date with your current investments.

There are other systematic ways to save, too. Some people enjoy challenges such as the one percent challenge.

The concept is simple: each month, save one percent more than you usually would. If you usually save nothing, start with one percent of your income. Then, every month, increase it by an additional one percent.

By the end of the year, you’ll have an extra 12 percent saved – something you can repeat every year, or increase to 15-20 percent.

Indeed, there are various ways to increase your savings, but having a specific goal in mind is critical.

Buy Your Shares

The last step is buying stocks you have decided are a good investment. For example, if you use a robo-advisor such Betterment, it’s as simple as moving money into your account.

On the other hand, if you prefer individual stocks, you can buy any stocks that are traded on a stock exchange such as a NASDAQ. Most of these stocks can be purchased with an online brokerage account through Vanguard, Fidelity, TD Ameritrade, or wherever you prefer to invest.

Stock trading often comes with commission fees – something to keep in mind.

However, if you buy individual stocks with a mobile app like Robinhood or E*TRADE, you can make commission-free trades.

Either way, buying individual stocks means you’ll have to deal with different order types, such as market orders and limit orders. They aren’t too complicated once you understand what they are, but it can seem foreign to new investors.

Market orders are orders you place to immediately buy or sell stocks immediately at the best available share price.

Limit orders allow you to trade stocks at a specified price. In other words, if you are buying, a purchase won’t be made until the price is at or below your specified stock price. And if you are selling, a sale won’t be made until the price is at or above your specified price.

More information about order types can be found here.

Set it Up for the Long Haul

One of the biggest keys to investing success is growing your money over years – or even decades. Most brokerages and investing tools support auto-investing to allow you to add money without even thinking about it.

And if you use a robo-advisor, like Betterment or M1 Finance, your money will even be invested automatically. That means you don’t have to purchase shares of stock each time money comes in.

Betterment and M1 Finance give you the option in invest in index funds, meaning your money will grow with little to know ongoing work needed. Both platforms also purchase fractional shares, meaning you don’t have to have your money sitting in cash.

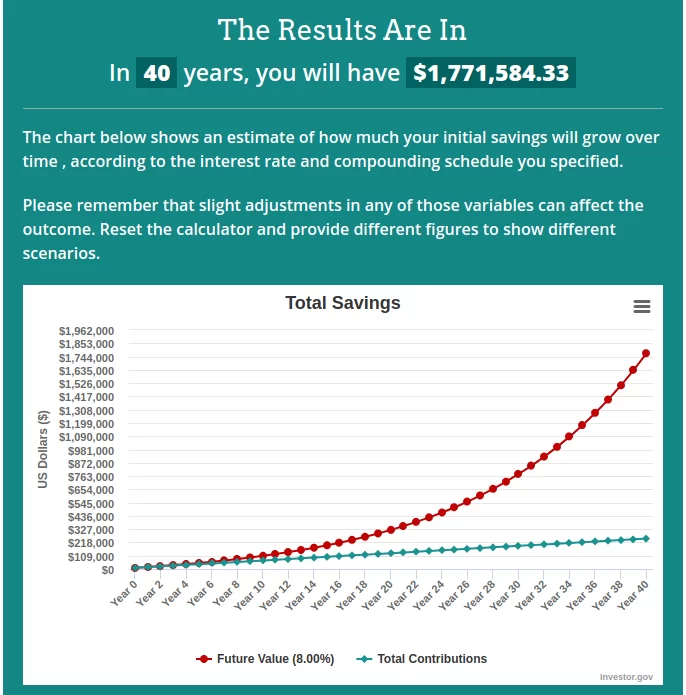

Arguably the most important reason to invest for the long run is the magic of compounding. To illustrate this point, consider that a $10,000 investment, with no additional contributions, will grow to over $200,000 with 8 percent interest.

If you’re lucky enough to see 9 percent interest on average, it will be over $300,000 after 40 years.

To give another example, if you invest the same $10,000 but contribute $500 monthly, you’ll have a whopping $1.7 million after 40 years.

But here’s the crazy part: only $244,000 of that is your contributions. I used the investment calculator on Investor.gov to find these numbers:

Keep in mind that 8 percent is considered quite optimistic by most standards. You’ll often see 7 percent mentioned as a more “realistic” return.

Regardless, sticking to your goals is critical. As you can see from the above graph, returns are quite flat for the first 15 years or so. Stocks are not a short-term wealth creation tool.

This can be discouraging or even make investing seem like it isn’t worth it. But compounding rewards those who remain committed.

Start Early – And Stay Committed

Another example from the Department of Labor illustrates the power of compounding:

If you put $1,000 a year into an IRA every year from age 20 through age 30 (for 11 years) and stop – and the account earns seven percent annually – your savings will equal $168,514 at age 65. |

In addition, remaining committed is key. In fact, Fidelity found that the most successful investors were forgetful – or even dead.

Why? Because these are the investors least likely to make constant changes to their portfolios. While it is natural for us to incessantly be tempted to tweak our portfolios, the reality is that we do so at our own peril.

So, if you really want to be a successful investor – set it and forget it.

By: Bob Haegele

By: Bob Haegele