BlockFi Review 2022: Best Cryptocurrency Trading Platform?

| By: Bob Haegele | April 5, 2021 |

In a nutshell: BlockFi offers cryptocurrency investors the chance to maximize the potential of their crypto assets.

This bank-like platform offers an alternative to traditional investing with yields comparable to that of real world monetary assets. Our BlockFi review recommends it as one of the best options for crypto investors.

Pros & Cons

Pros:

- Best interest rates on the market

- Offers borrowing and trading of cryptocurrency

- Very few fees

Cons:

- Requires a base knowledge of cryptocurrency to get started

- High interest rates not available on all coins

Full BlockFi Review

Are you looking for an investment platform that caters to cryptocurrencies?

BlockFi is one of the few options available to crypto investors today. The goal is to offer a hub for borrowing, trading, and earning interest on cryptocurrencies. Although it’s not officially a bank, it conducts business like one.

BlockFi interest rates are 43x higher than standard high-yield savings accounts. This fast-growing platform is valued at over $3 billion and revenues are increasing every month.

With all these advantages, find out more in this BlockFi review.

What is BlockFi?

| Product Name |

|

| Services |

|

| Membership Fee |

|

| Customer Support |

|

| Promotions |

BlockFi was founded in 2017 by Zac Prince. The venture was largely funded through seed funding, including from the investment platform SoFi Invest.

The main attractions consist of non-existent BlockFi fees, high interest rates, and a reliable platform in which to manage crypto assets. For cryptocurrency traders looking to consolidate their investments, BlockFi is one of the best bank-like options on the market.

BlockFi Banking Options

With our review on BlockFi, we were particularly impressed with its banking options. Thanks to its opportunities to earn high yields from interest, customers can also take USD loans out against their crypto assets. Furthermore, BlockFi supports a wide range of cryptocurrencies, including bitcoin, ethereum, and litecoin.

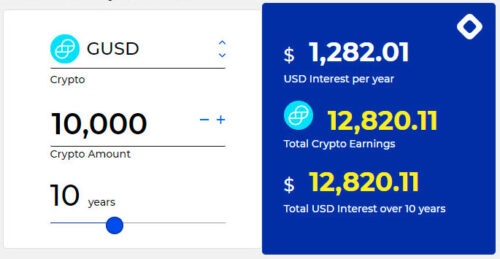

BlockFi Interest Account (BIA)

The primary account available to consumers is the BIA. Minimum balances are not required, but interest rates vary depending on the coin you choose to hold your balance in.

For example, for accounts with more than 20 bitcoins, the interest rate is as low as 0.5%. On the other hand, holding the Paxos Standard Token (PAX) yields an interest rate of 8.6%.

Coins can be converted into other coins, so you can diversify your portfolio to meet your goals. Stablecoins yields the highest interest rates, with more volatile cryptocurrencies commanding smaller interest rates.

Deposits can be made through wiring USD and interest can be paid into any coin you choose.

Crypto Loans

BlockFi Crypto Loans enable you to borrow USD against your deposited coins. The minimum amount you can borrow is $5,000 USD, with a loan-to-value ratio of 50%. In other words, you’ll need to put up collateral of no less than 50% of your coins.

Crypto loans have a duration of 12 months and the standard interest rate on the loan is 4.5%.

The downside is that due to the volatility of crypto, if your loan-to-value ratio reaches 70% a trigger event will occur, which means you’ll need to put up more of your coins as collateral to bring it back down.

We believe there are far better alternative lending options.

BlockFi Bitcoin Rewards Visa Credit Card

Launched in early 2021, the BlockFi credit card works similar to a cash-back credit card. The BlockFi Visa offers rewards in the form of bitcoin.

All card purchases offer a 1.5% rewards rate paid in bitcoin. When spending $3,000 or more in the first three months, you’ll earn a $250 bitcoin bonus.

However, it’s an expensive card to hold as it comes with a $200 annual fee.

BlockFi Fees

Does BlockFi have any fees?

No. There are no fees for holding an account with BlockFi and no minimum balances.

There are fees, however, for withdrawals. Everyone gets one free withdrawal per month. Fees vary depending on the coins withdrawn.

For example, 0.0025 bitcoin is charged per 100 bitcoins withdrawn per 7-day period. This works out to about $30.

BlockFi FAQ

Want to know more about BlockFi? Here, we answer your most frequent questions.

Is BlockFi Legitimate?

Yes. It adjusts its interest rates and fees based on the market. It also makes most of its money through lending.

Is My Deposit Protected?

Digital assets are not covered by the government through FDIC. However, BlockFi keeps the majority of its funds offline, and client funds are kept ahead of equity and employee funds in the event the company suffers losses.

It’s not as safe as a high street bank, but there’s little reason to worry.

How Can These Interest Rates Be Sustainable?

Interest rates are subject to change every month. Clients are notified of any changes at least 1-2 weeks prior to any changes, so they can alter their portfolios accordingly. All interest rates are judged based on current crypto market conditions.

Is BlockFi Right for You?

Most BlockFi reviews have heralded the platform as the future of cryptocurrency investing. We have to agree because although it doesn’t have the same protections as a traditional bank, no customer has ever lost money with BlockFi.

Its security precautions and the way it operates in this low-interest environment makes it an ideal location to store and earn money on crypto assets.

Create an account with BlockFi today and claim up to $250 in bitcoin when you make a deposit.