Most people don’t know it…

But the dividend growth rate of a stock is one of the most important factors when it comes to growing your wealth.

And if you’re here reading this, I’m going to take an educated guess that more wealth is something you want!

In this article, I’ll show you why the dividend growth rate is so important and I’ll also teach you how you can use it to predict how much money an investment could bring your way.

I’ll also show you something which took me an embarrassing amount of time to understand…

…but changed everything about the way I invest.

What Are Dividends?

Let’s begin with the basics.

If you already know this, you can skip to the next bit 😉

A dividend is an amount of money that a company – or stock – will pay its shareholders.

This amount of money comes from the company’s earnings and gets paid to its shareholders just for owning shares in the company.

Pretty neat, right?!

For example, if Coca Cola Company earns, let’s say, $1,000 one year, it has to choose what it does with them.

It might decide to use 500 of those dollars to reinvest back into the business and build more factories, hire more people and generally improve the business.

What about the other $500? What does it do with them?

Well, the company will pay it as a dividend to their shareholders!

But not all companies pay dividends…

Some will be better off reinvesting everything they earn back into the business to grow quicker. This is why you won’t see a young company like Tesla paying a dividend anytime soon…

Just to recap… A dividend is basically free money and it is truly passive income.

Nice. 😀

Dividends Payers vs Dividend Growers – What’s the Difference?

So why do some companies just pay a dividend…

While others grow it?

It’s a great question.

It comes down to the management of the company – the people at the helm. Ideally, all companies would increase their dividends.

Investors LOVE it.

But it’s tough… very, very tough. A company must be extremely good at what it does and be under outstanding leadership if it wants to keep increasing its dividend!

Here’s how I look at it (and how I think you should look at it too).

Choosing stocks that grow their dividends every year is a filter.

It filters out the rubbish, the OK companies… even the pretty good ones. And leaves only the excellent ones. The ones that provide results like these:

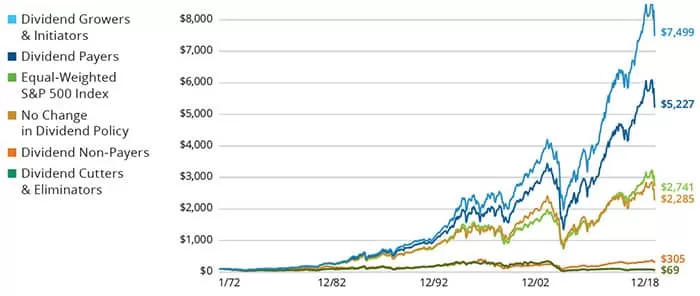

Returns of S&P 500 Index Stocks by Dividend Policy: Growth of $100 (1972-2018)

I love this graph.

It’s all the companies in the S&P 500 over the last 48 years…

Sorted by their dividend policy – i.e. what they do with dividends.

You can easily see that stocks that pay no dividends don’t do so well… In fact, they do terribly.

Those that do pay dividends do better… much better than the S&P 500 index.

But those that grow their dividends…

Wow!

Those ones outperform all other stocks in the S&P 500. Even the S&P 500 itself (by a lot)

The important thing to remember is that it’s a great filter.

Dividend Growth Rate Formula

So now we’ve got that out of the way, let’s talk about the dividend growth rate.

This is how quickly a stock will increase its dividend per year.

It’s a percentage, and the formula is simple:

Dividend Growth Rate = ((New Dividend-Old Dividend) / Old Dividend) *100

For example, if Coca Cola currently pays $1 in dividends but then announces it will start paying a dividend of $1.1…

The dividend growth rate would be 10%.

DGR = ((1.1-1)/1)*100 = 10%

Pretty easy.

Of course, when looking at dividend growth stocks, you’re normally looking at the dividend growth rate over several years – so that formula won’t work.

In most cases, you’ll know the dividend growth rate each year – but they can fluctuate wildly…

5% one year and 20% the next.

So in this case, you can simply work out a simple average. For example:

Year 1: 5%

Year 2: 14%

Year 3: 8.5%

Year 4: 6.8%

Average Dividend Growth Rate = 8.58%

Now, before you take that formula and go out there in search of the biggest dividend growers, there’s something else you need to know…

High Dividend Growth Rate… Or Low?

You see, most people want the best return on their money.

You do.

I do.

Everyone with any common sense does!

But going for stocks with the highest dividend growth isn’t the best way to do it.

You need to look at the bigger picture.

You need to look at the dividend yield as well as the dividend growth.

Because some stocks will boast massive yields of 8 or 10%… but a puny dividend growth rate.

It’s like a very fast car.

Sure, it will get you from 0 to 60 in 2.4 seconds!

Which is very impressive…

But it won’t get you very far when it guzzles fuel so quickly!

On the other hand, others will parade their huge 20% dividend growth rates and hope people don’t notice that the dividend yield is lower than 1% (I’m looking at you, Visa!)

Instead, you need a balance between the two.

What’s The Best Growth Vs Yield Combination?

A high yield will give you a lot of money now…

But there are 2 problems with that:

- The dividend probably won’t last very long and it might get frozen or cut.

- It won’t grow very quickly.

On the other hand, a high dividend growth rate will grow your income quickly…

But it will take a very long time to get to any meaningful dividend income.

The answer?

A good combination of the two.

- At least a 2.5% dividend yield.

- More than 7% dividend growth rate over the last few years.

Get those two right, and you’ll be in for a treat!

Just to put this into perspective, a 7% dividend growth rate will DOUBLE your income every 10 years…

So in 20 years, your dividend income could be 4 times what it is today. And in 30 years, 8 times!

Pretty amazing.

The Key

Now, earlier I hinted at the key to all of this.

Remember?

The thing that took me too long to understand, but that when I did was a game-changer.

You see, it’s hard to know if a stock’s price will increase.

Sure, a good company will always make more money over time and therefore its stock price should go up accordingly.

But what if you could predict by how much?

Wouldn’t that give you a warm feeling, knowing that your money will grow by a predictable amount?

So here’s the key.

Generally, a stock’s price will go up at the same rate as the dividend grows.

Without getting too deep into it, after a while, a company will only be able to grow its dividend if its earnings per share are increasing…

And guess what happens when earnings increase?

The stock price also increases – roughly by that amount.

What does this mean in practice?

That your annual return (again, the most important thing for most of us) will be equal to the dividend yield + the dividend growth rate.

So if you pick a 3% yielding stock that is gonna grow its dividend by 7% per year…

You’ve got yourself a stock that will give you a 10% annual return.

Now that is how you get ahead in your financial life. That’s how you put your money to work in ways that will improve your life.

This is just a part of the puzzle. Dividend growth investing is a wonderful money-making strategy that I honestly believe most people would benefit from.