Firstrade Review 2022: Best Low-Cost Broker?

| By: Bob Haegele | June 24, 2021 |

In a nutshell: Firstrade is aimed at the low-cost investor who doesn’t want to pay high trading costs. It offers no-contract fees for options trades and there’s a $0 account minimum for beginners to get started.

With three trading platforms and a mobile app, our Firstrade review believes this is a strong low-cost brokerage option for the new investor.

| Fees | Service Type | Promotion |

| $0 | Trading platform | None |

Firstrade offers commission-free trading of stocks, options, ETFs, and more. It also has a mobile app with no account minimums, making it a great place to start trading.

Pros & Cons

PROS

- $0 cost on stocks/options trades

- Streamlined trading platform

- Free market research

CONS

- No advanced charting

- No 24/7 customer support

Compare to Similar Services

| |

| Fees$0 |

| Minimum Deposit$0 |

| PromoNone |

| |

| Fees$0 |

| Minimum Deposit$0 - $59.95/month |

| PromoNone |

| |

| Fees$0 |

| Minimum Deposit$0 |

| Promo2 stocks free |

Full Firstrade Review

Firstrade is a low-cost broker and trading platform perfect for those who won’t want to pay high trading commissions. Its no-fee service is great for those who are just getting started.

Firstrade is best for:

- Fee-conscious investors

- Mobile traders

- Customized experience

Do you have a small budget and want to start investing?

Firstrade is a low-cost broker aimed at the investor who only has a small amount to invest. They offer simple charting options, no trading fees on stocks and options, as well as low fees on many popular ETFs.

Investors gain access to an extremely basic yet functional interface for getting into trading. While not ideal for investors who are looking for more advanced analysis, our review on Firstrade believes this is an excellent option for beginners.

Read more of our Firstrade review to learn more about this brokerage.

What is Firstrade?

| Product Name |

|

| Services |

|

| Membership Fee |

|

| Customer Service |

|

| Promotions |

|

Firstrade has been in business since 1985. It was originally founded in Queens, New York, to serve the needs of Chinese immigrants. This is why Firstrade offers support in English, traditional Chinese, and simplified Chinese.

In recent years, Firstrade has shifted from being a traditional brokerage to offering $0 commissions on stocks and options trades. However, there is a lack of advanced tools on the platform. Most beginners who want to invest in stocks will benefit from a streamlined desktop and mobile trading platform.

Its low costs are what make Firstrade stand out from the competition. There’s also no minimum deposit amount to create an account.

Firstrade Features

Our review on Firstrade believes that this is one of the best low-cost brokerages available to U.S. investors today. It’s gradually adapted to the needs of the average retail investor through its core features, which we examine below.

Commission-Free Trading

Firstrade was always one of the pioneers when it came to low-cost investing. Their commission-free trading options for stocks, options, and many ETFs led to many other brokerages matching them.

The fact they charge no per-contract fees on options makes it a unique broker, with only Robinhood matching them in this category.

Free Mutual Funds Trading

Trading mutual funds with low-cost brokers is rarely an option. Although some brokers have this available, they often charge up to $50 for trading mutual funds that are not on their approved lists. There are no trading fees on any of the mutual funds offered by Firstrade.

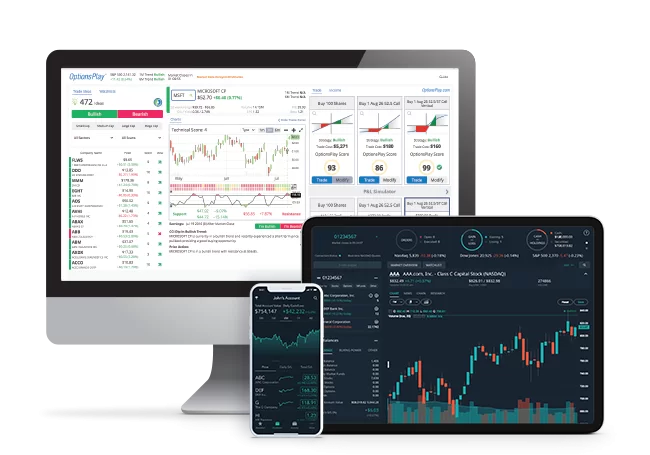

Three Different Trading Platforms

There are three different trading platforms available for investors to use. The Firstrade Navigator, Options Wizard, and a standardized desktop platform are all available for making different types of trades.

However, these are extremely basic platforms and come with nothing more than the simplest of charts. It’s not the ideal platform for in-depth technical analysis.

On the other hand, the fact Firstrade isn’t bogged down by rarely used screeners and scanning tools is a boon for smaller investors. For day traders and swing traders who require real-time charting options with complex tools, Firstrade is not the ideal platform for them.

Free Market Research

Investors can access free market research from several reputable sources, including Benzinga, Morningstar, and Zacks. Firstrade has also come up with the Firstrade Heatmap, which offers broad overviews of generalized market trends segregated by industry.

Its Morningstar reports are the best aspect of Firstrade’s market research options. This well-known stock and market analysis firm regularly produces unique asset reports for large-cap companies. These reports include important information, such as market capitalization and dividend yields.

Ordinarily, Morningstar market reports require a paid subscription, but Firstrade users gain access to these premium reports entirely free of charge.

Newbies can also take advantage of biweekly seminars to learn the intricacies of investing.

Education Center

Firstrade is also geared towards helping new investors to get into trading for the first time. The Firstrade Education Center focuses on introductory articles, such as how the stock market works, different order types, and how to place your first trades. There’s also a useful guide to abbreviations and common pieces of investment terminology.

While it’s an extremely basic educational resource, the simple language in English, traditional Chinese, and simplified Chinese is incredibly useful for investors who are only just discovering the markets.

Firstrade Pricing

There are no fees associated with creating a Firstrade account. Furthermore, there are no account minimums, so investors are free to open an account without making a deposit. One of the big plus sides is you have access to every feature on the platform.

Firstrade makes their money through broker-assisted trades, which do come with fees. A broker-assisted stock/options trade is charged at $19.95 plus $0.50 per contract.

Firstrade FAQ

Firstrade is aimed primarily at newer and budget investors. Here are the answers to some of the most common questions people have about this platform.

Is Firstrade a US Only Platform?

No, you don’t need a Social Security number to create an account and trade. Firstrade offers its services to the residents of more than 60 countries and territories around the world.

Does Firstrade Offer Support for Crypto/Forex/Futures?

No, Firstrade doesn’t support these types of investments. If you want to invest in more speculative assets, you’ll need to look elsewhere such as TopStepTrader.

How Does Firstrade Customer Support Work?

Live chat is available during business hours. It’s also possible to request a callback from a human support agent. However, customer support is not available 24/7.

Does Firstrade Offer a Mobile App?

Firstrade does offer an app with many of the same features as the desktop platform, including simple funding and the opportunity to execute trades.

The app has undergone a major overhaul to deliver a wider set of tools to optimize the Firstrade experience. This includes access to advanced charting and more customization options.

Is Firstrade Right for You?

Our review on Firstrade believes that if you’re an investor who wants to keep commission costs down, there’s no better option. When comparing Firstrade vs. Robinhood, we believe this is a platform you can rely on.

Investors looking for more advanced screening and research options may want to look elsewhere, however.

Overall, we believe this is a solid low-cost brokerage platform for entry-level investors.

Check out Firstrade and sign up for a free brokerage account now.