Investing can be complicated enough as it is; it only gets more complicated if you get into the weeds of trying to improve your returns. Luckily, it’s not necessary to do it on your own. Tools like the Goldman Sachs Smart can help you get better returns without spending hours researching.

But if you are new to investing, you probably have no idea what Smart Beta is all about. It’s not necessary to know more than the basics, though. As mentioned in our Betterment review, Goldman Sachs Smart Beta can be integrated into portfolios so you don’t have to do any of the work.

Still, we’ll cover the basics to help you understand how Smart Beta can improve your portfolio. Whether you invest via Betterment or some other way, it helps to understand what’s going on behind the scenes.

What is Beta in Investing?

Before we get into talking about Smart Beta, it helps to know what “beta” refers to. This is a general investing term and not something Goldman Sachs concocted.

Beta is a statistical measure and is a measure of a stock’s volatility in relation to the overall market. This is expressed as a number, and a benchmark such as the S&P 500 will have a beta of 1.0.

Stocks that are more volatile than the benchmark have a beta above 1.0 while those that are less volatile have a beta below 1.0.

As we will see, Smart Beta expands upon this idea and assess far more than just volatility. In doing so, it identifies investment opportunities that can help you beat the benchmark performance.

What is Goldman Sachs Smart Beta?

Smart Beta is an investment methodology developed by Goldman Sachs. It aims to select stocks based on certain attributes of performance. In doing so, it has a goal of beating the market while maintaining low fees.

Goldman Sachs uses certain “factors” which measure investment performance. The performance attributes it targets are:

- Good value: Value investing is what led Warren Buffet to massive investing success. This method of investing looks for companies with strong financials; for example, those with strong net income. The value comes from the fact that the company’s stock is priced unjustifiably low.

- High quality: Another principle Buffet holds in high regard, high-quality companies are those with sound business models. These companies consistently create value and are viable in the long term.

- Positive momentum: Positive momentum is exactly what it sounds like. This means the share price is trending in the right direction. While there may be temporary dips, an overall upward trend line means this is a good place to invest.

- Low volatility: We typically think of investments such that greater risk equals greater reward. And greater risk usually means more volatility. However, research has shown that low volatility stocks actually tend to have higher returns.

Robo-advisors such as Betterment invest in Smart Beta exchange-traded funds (ETFs) that employ these investment factors. In doing so, they may expose you to more risk in the pursuit of better returns.

As such, it Betterment only recommends this strategy for those who have tolerance for more risk. However, some investors prefer to avoid cap-weighted funds, and the Smart Beta portfolio shies away from that kind of approach.

Cap Weighting: the Trouble with Total Stock Market Funds

Some investors sing the praises of total stock market index funds, commending their low fees and easy diversification. While those praises are warranted, there is one potential pitfall they ignore: cap weighting.

One of the biggest benefits of total stock market index funds is they invest in every publicly traded company. That means that by buying shares in a single fund, you invest in the entire stock market. Pretty cool, right?

But cap weighting is a red flag for some investors. For example, if we check the portfolio page for VTSAX, a popular total stock market fund, we see all of the breakdown of its portfolio.

You will notice two things: nearly 28% of its portfolio is invested in tech. That’s more than a quarter invested in a single sector. Hence, it’s no surprise that six of its top 10 holdings are tech companies. Seven if you include Tesla, as its cars are basically smartphones on wheels. This is the result of cap weighting; these companies have extremely high valuations, so the fund invests more in them.

When times are good, this isn’t a problem. But say we have another event like the Great Recession where an entire industry tanks. Except this time, it’s tech instead of real estate. That very idea is why some investors aren’t too keen on cap-weighted investing.

How Smart Beta Can Help

The exact reason some investors don’t want to settle for something like an index fund or the Betterment Core portfolio vary. For some, it’s an aversion to cap weighting; others simply want stronger performance. Whatever the reason, Smart Beta can help.

Going back to Betterment, it says it selects all of its portfolio strategies with the following core principles in mind:

- Personalized planning

- Balance of cost and value

- Diversification

- Tax optimization

- Behavioral discipline

As Betterment says, Smart Beta considers all of these principles. However, its Smart Beta portfolio considers cost, value, and diversification differently than the Betterment Core portfolio.

Instead of valuing them the same way Betterment does, it uses the factors mentioned above. In doing so, it find the ideal mix of price, performance, and low volatility.

Smart Beta Portfolio Performance

You are probably wondering how the Smart Beta portfolio performs. After all, Betterment for its part says you take on added risk when investing in this portfolio. Thus, there must be superior performance to go with that added risk.

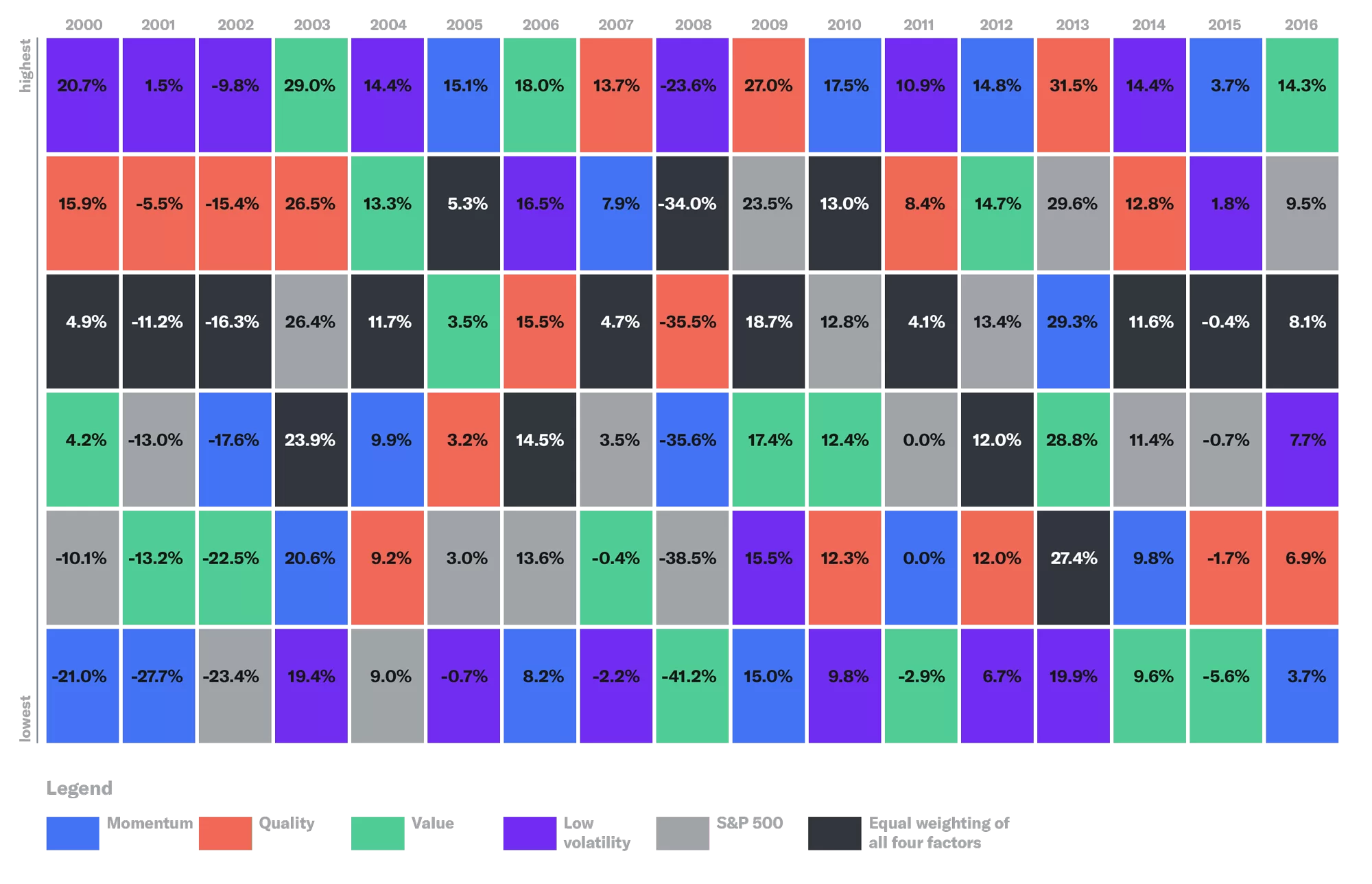

Betterment does give some insight into its performance with the following illustration:

Note that this is hypothetical performance and not actual performance. Betterment introduced the Smart Beta portfolio in 2017 and the above chart spans years 2000-16.

This is a little complicated, but the easiest way to compare is to look at the black and grey squares in each column. The grey squares are the S&P 500 while the black squares represent an equal weighting of all four Smart Beta factors.

In five of the 17 years, the S&P 500 would have fared better. Thus, Smart Beta would have done better in 12 of the 17 years.

The biggest disparity would have been in 2000, when the hypothetical Smart Beta would have returned 4.9% to the S&P 500’s -10.1%.

While the Smart Beta portfolio isn’t better every year, recent history shows it has been better more often than not.

Smart Beta Fees

Betterment’s Smart Beta portfolio does invest in specific Smart Beta ETFs. These come with higher expense ratios than the ETFs in the Betterment Core portfolio.

According to Betterment’s website, Smart Beta ETFs incur expense ratios from 0.11% to 0.24%. That compares to fees of 0.07% to 0.16% for the Core portfolio.

Whether you invest in the Core portfolio or Smart Beta, you’ll also have to pay Betterment’s management fees.

Should You Invest in Smart Beta?

Smart Beta is a relatively new methodology, but it was developed by an older firm in Goldman Sachs. It uses sound investment principles to find strong investment opportunities. And in doing so, it allows investors to shy away from a cap-weighted approach.

And although Betterment’s Smart Beta portfolio has only been around since 2017, hypothetical performance figures show its approach would have won out. Fees are slightly higher, but better performance could justify them.

The other thing to consider is risk. Yes, you should have a slightly higher risk tolerance if you want to choose this portfolio. As such, a longer time horizon is recommended. If you can stomach higher levels of risk, Smart Beta might be the right opportunity for you.

To get started with Smart Beta, head over to Betterment and select the Smart Beta portfolio.

By: Bob Haegele

By: Bob Haegele