Option Strategies Insider Review 2022: Powerful Options Alerts

| By: Bob Haegele | April 4, 2021 |

In a nutshell: Option Strategies Insider provides options trade alerts and educational materials for new and experienced options traders.

With both free and paid subscriptions, Option Strategies Insider is a solid introduction to options trading.

| Fees | Service Type | Promotion |

|---|---|---|

| $0 - $167/month | Options trade alerts | $7 trial membership |

Option Strategies Insider makes it easy to start trading options with both free and paid memberships. It also offers a $7 trial which allows you to try its highest membership tier.

Pros & Cons

PROS

- Track record of success

- Extensive educational content

- Numerous discounts available

- $7 trial membership

CONS

- Only active and new trade positions are available

Compare to Similar Programs

| |

| Service TypeOptions trade alerts |

| Fees$0 - $167/month |

| Promo$7 trial membership |

| |

| Service typeSwing trade alerts |

| Fees$47/month |

| PromoNone |

| |

| Service TypeStock trade alerts |

| Fees$99/year |

| Promo50% off your first year |

Full Options Strategy Insider Review

Would you like to try your hand at options trading but don’t know where to start? Option Strategies Insider can help with both free and paid resources and services. The goal of Option Strategies Insider is both to help people learn about options trading and to make better trades. It offers three membership tiers which includes a free membership.

Options Strategy Insider is best for:

- Options traders

- Those who want to learn about options on a budget

What is Options Trading?

Options trading involves buying contracts which give you the right, but not the obligation, to buy or sell an underlying asset on a specified date. A call option then allows the holder to buy a stock and a put option gives the holder the right to sell a stock.

It is not too difficult to see how trading options could be lucrative. For example, if you buy a call option which is the option to buy a security and the price increases, you can buy it at the agreed-upon price and sell for a profit.

With a put option, you can sell shares at a higher price if the price drops.

What Is Option Strategies Insider?

| Product Name |

|

| Services |

|

| Membership Fee |

|

| Education & Support |

|

| Promotions |

Option Strategies Insider was founded by CEO Chris Douthit. The company has a high success rate with 87% winning trades since 2015.

Prior to founding Option Strategy Insider, Chris was a professional trader for several well-known companies in the finance industry. Those include TFM, Spear, Leads & Kellogg and Goldman Sachs.

In 2014, Chris was consulting for a man named Jim. Back then, Jim was convinced to sign up for an options trade alert system that was a total bust. Basically, there was zero transparency as far as how its trades worked and there was no exit strategy.

Jim was losing big even though the site claimed 100%+ returns. It turned out that the site was run by people with no real experience in finance who had no idea what they were doing.

It was this predatory scenario that inspired Chris to start Option Strategies Insider. He wanted to both educate people about options trading and also provide them with trade alerts based on real expertise.

And that’s exactly what he did. Chris has over 20 years of experience working as a professional trader, so he has a solid foundation in place for a winning options trade alert service.

If you are looking to learn more about options trading and perhaps even give it a try, this program is worth a look. Even if you decide not to subscribe, there is quite a bit offered for free.

Plus, there are some nice discounts regularly offered, including an exclusive discount for Good Credit Info. We’ll get to all of that in more in the Option Strategies Insider review below.

But does Option Strategy Insider really deliver? Let’s find out.

Option Strategy Insider Features

Option Strategies Insider is more than just a simple trade alert service. Instead, it has several features that make it well worth a look.

Education

As a member, you gain access to a variety of educational materials, and some are even available with a free membership. Educational resources include:

- Options trading video courses

- Thinkorswim lessons

- Investing books

- Webinars

- Option dictionary

The really nice thing is that all of these resource are included with a free membership. The one exception is advanced options course. Still, a free membership includes the beginner and intermediate courses, which is great.

As mentioned, you gain access to both Beginning Options and Intermediate Options with a free membership. Because you have access to so much educational material for free, you can learn all about options trading without spending a dime.

Then, if you decide you want to get into advanced strategies and actually start receiving alerts, you can go ahead and sign up.

Beginning Options

This course covers the basics of options. It establishes the “why” and how to read options. Then, it covers how options pricing works, combining factors, and option and position Greeks.

As you can see, this course lays the groundwork for options trading. It doesn’t so much go into the nitty-gritty but serves more as an introduction. Later, you will learn more about how trading actually works.

Intermediate Options

Intermediate Options is all about buying and selling. If you are trading options to turn a profit, this is what you will spend most of your time doing. Thus, it’s important to understand the ins and outs of how buying and selling work.

Chris walks you through buying and selling on thinkorswim, which is TD Ameritrade’s platform. Many traders prefer thinkorswim because it can work well for both intermediate and advanced traders.

Advanced Options Strategies

The last course, Advanced Options Strategies is, of course, the most advanced of the three. It’s also the only course not included with a free membership. It also has 11 different modules, making it the meatiest of the three.

As you might expect, Chris devotes the entire time in these videos to advanced trading strategies and how they actually work. You’ve already learned the basics; now it’s time to become a real pro.

Trading Tools

This service includes a few trading tools to help make things easier for you. The main sets of tools you will have are:

- Thinkorswim plugins

- Short put calculator

- Stock price alert

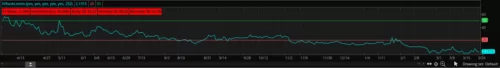

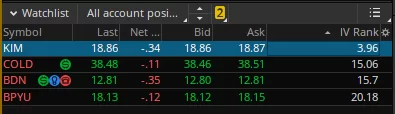

To get the full experience, I added the thinkorswim plugins on my computer. You can see the results below:

IV Rank (Watchlist)

This plugin adds an implied volatility (IV) column to your watchlist to show where the security’s IV lies compared to its yearly high and low IV.

IV Rank (Chart)

This plugin provides the same information as the watchlist plugin, but it allows you to view the data on the chart. Thus, you get a more visual way to see the data.

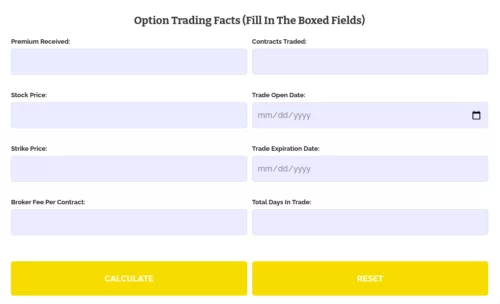

Short Put Calculator

The short put calculator helps you calculate the percent discount you can receive on a stock or ETF compared to where it trades today. Once you fill in the required information, it will show you whether the security finishes above or below the strike price.

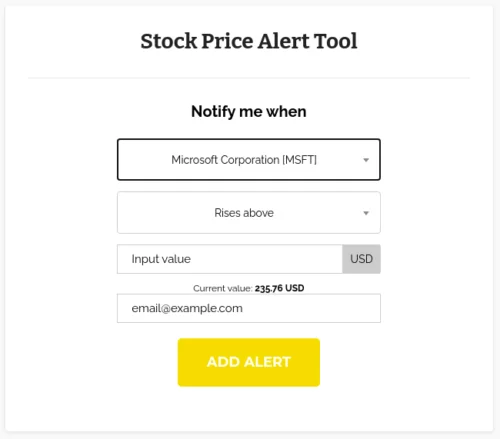

Stock Price Alert Tool

The Stock Price Alert Tool is a relatively simple tool you can use to receive alerts when a stock you are monitoring rises above or falls below your specified price.

Trade Alerts

Trade alerts are what we’re all here for, just as they are for The Motley Fool’s stock picks. It’s nice that they include so much educational material to help you understand how options trading work, of course.

But if you aren’t a full-time options trader, you likely won’t have time to research every single trade. That’s where Option Strategies Insider’s trade alerts come in.

They don’t inundate you with a crazy number of trade recommendations, it the frequency varies as different opportunities arise. However, you can expect somewhere around one trade alert per week, on average.

Chris provides guidance for both when to buy and when to sell. As Chris points out, there are some services that tell you when to buy, but not when to sell.

“Don’t be fooled by other option investing sites that post huge return numbers,” he says. “What these sites all do is tell you when to buy the option and then totally leave it up to you to pick when to sell. What kind of service is that?”

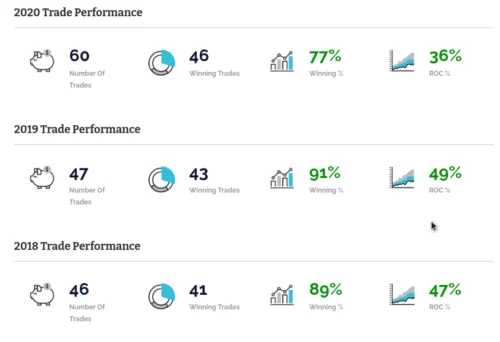

Here are some of the performance stats from its recommendations the past two years:

As you can see, performance was down slightly in 2020, but overall, the numbers look quite good. More than 75% of their trades have been winners with over 40% return on capital, on average.

Note that these alerts are different from the Stock Price Alert tool; those are alerts you set up for yourself. On the other hand, these trade alerts are the ones Chris and his team send to members.

You can either receive OI’s trade alerts via email or via Twitter, if you prefer. Trade alerts are automatically sent to the email tied to your OI account. If you also want to see them on Twitter, the team posts alerts on its Twitter page.

Note: they don’t share their trades on Twitter; you must be a paying subscriber. On Twitter, they simply alert you that there are no recommendations when they are released and instruct you to log in to view them.

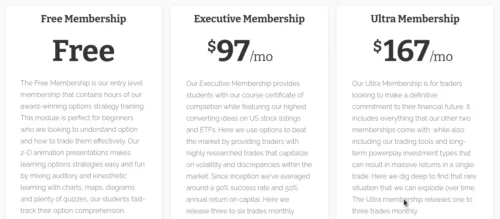

Pricing & What’s Included

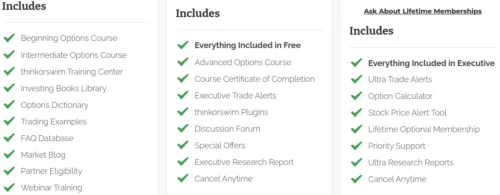

Option Strategies Insider has three membership tiers, and each one has a generous number of benefits. Even the free tier includes quite a bit.

As with most tiered pricing structures, each tier includes everything the previous tier does while adding additional benefits.

You can see the monthly cost of each membership tier above, but note that those are only the monthly costs. If you sign up for the Executive Membership or the Ultra Membership and pay annually, you’ll get two months free.

Then, only for Good Credit Info readers, you can get an additional 20% off your membership forever. That is a very exciting deal!

Most of the features for each tier are fairly self-explanatory, but some are less obvious. With the Ultra membership, you get:

Ultra trade alerts: These are trade alerts on top of what you get with the executive membership. In other words, you’ll get an extra one or two alerts per month to maximize your returns.

Lifetime optional membership: OI doesn’t always advertise the rates, but they do give you the option to pay once for a lifetime membership. This can be a great deal, especially if you have confidence in the service.

Is Option Strategies Insider Right For You?

Option Strategies Insider is a “strong buy” for anyone who’s looking to trade options. They have almost 90% winning trades since 2015, and their annual return on capital is usually around 50%.

That is definitely solid performance and makes it worth a look. Plus, they give members access to a large amount of educational material free of charge.

In other words, if you aren’t sure about trading options yet, you can sign up for a free membership just to learn the ropes. Better yet, you can try the Ultra Membership for $7 for 7 days (normally $167/month) and explore everything the service has to offer.

Because of the wide range of options OI offers, this service is right for just about anyone who’s interested in trading options.

If you are ready to take the next step, get started with your trial membership for $7.

Related Investing Product Reviews:

Exclusive Offer! $7 Trial Membership - Then 20% Off ForeverClaim Offer