The price-to-earnings (P/E) ratio is considered an essential valuation indicator and has been historically associated with “value investing.” Simply put, the PE ratio defines how much an investor is willing to pay for each dollar of net earnings.

Formula: PE Ratio

P/E Ratio of a Stock = Current Market Price of the stock/Earnings per share

For example, if the company’s stock price is $200, and has an earning per share of $10, the PE ratio of the company then would be 20 ($200 divided by $10). This is the simplest way to assess PE ratio.

Let’s dive a bit deeper into what PE ratio means and how we can use it in our investments.

Variations of PE Ratio

There are two PE variations. The first is the trailing PE ratio, which you calculate by using the earnings of the previous year. Because the trailing PE ratio is more objective, it is one of the of the most popular benchmark ratios out there.

The other PE variation is the forward PE ratio. It is calculated by using the estimated earnings for the upcoming year. This forward-looking ratio is effective for predictions and valuation estimations.

There are also some other variations like PEG and CAPE, but the forward and trailing ones are quite popular. The easiest way to remember the difference is the trailing PE looks at the past while the forward PE looks at the future.

How to Use the PE Ratio

One way of using the PE ratio is when the investor compares the PE ratio of one company with similar organizations within the same sector, as well as the average PE ratio of the industry. It will help give the investor a glimpse of the stock’s performance and if it’s is trading at a premium or discount to its peers.

The investor can also compare the current PE ratio of the company with the past PE Ratio trend of the same company. Using this method helps to see the historical financial performance of the company, and if the stock is trading at a premium or discount. For instance, if the company is trading at a current PE of 12, but the average PE for the last 20 quarters was 15, the investor needs to study the difference and see if it’s worth buying into the stock.

What is High and Low PE Ratio?

It’s best to evaluate the PE ratio in conjunction with other financial indicators. Otherwise the above or below average PE ratio does not necessarily indicate anything meaningful. A high PE ratio may suggest that investors are optimistic about the future earning potential of a company. However, it could also mean that the company is priced merely higher than similar organizations, and will likely revert to the average PE of the sector.

On the other hand, a low PE ratio could speak to the stock being undervalued. Without considering the reasons for the low PE though, a so-called “safe” stock can be a value trap for investors.

PE and Understanding Context

Growth vs. Value: You should note that a stock cannot be valued on the same parameters as a value stock. A fintech lender which is growing at over 20% per year in revenue cannot be assessed on the same PE scale of a traditional bank. A growth stock would naturally tend to have higher PE due to the expectation of growth in profits in the long term.

Industry: There are two things to remember when looking at a company within a set industry. The first is that you must compare companies within the same industry. The second, the companies must also be similar in size. Both of these are crucial for making a conclusive decision. Since each industry has different financial and profitability metrics, not using these parameters could lead to inconclusive results. For example, comparing PE of a B2B software company with $100 million in sales with Microsoft’s PE will give inconclusive results even though they are in the same industry.

Recommended Stock Investing Posts:

Market Timing

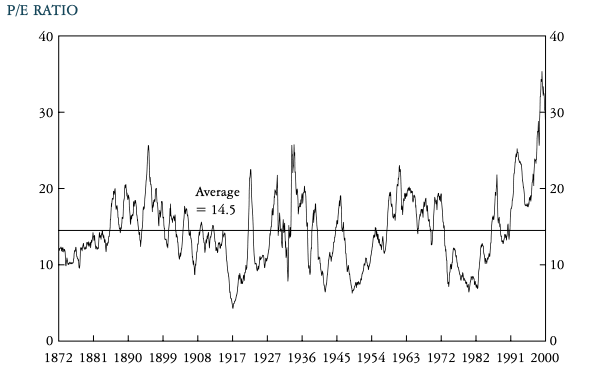

There’s a research paper by Kansas City Fed that sheds light on how you can use PE to time the market. The average PE on analysis of over a hundred years’ worth of data was around 14.5%.

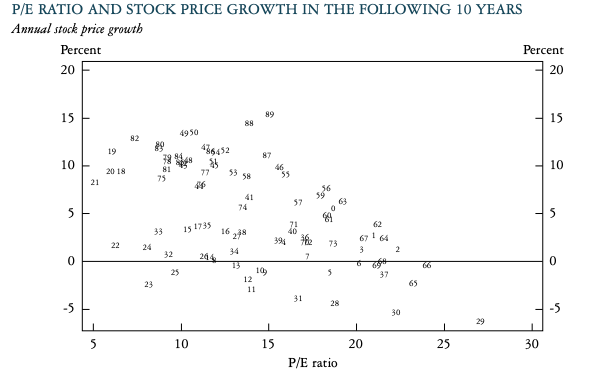

The number in and of itself gives minimal perspective to an investor though. However, the next chart helps us understand the performance of stocks at different PE Ratios. In the diagram, “each observation is marked by a number, which stands for the year the P/E ratio was calculated.”

As you can see, we mostly witness subpar (below 5%) or negative returns when the PE ratio tends to be higher than 20. Whereas, the chart depicts a fantastic buying opportunity when the PE ratio is less than 10. Only 1923 and 1925 saw negative returns when the PE was less than 10. Also, the outperformance of 10% or more growth in stock prices is clustered in the 10-15 PE Ratio segment.

PE Ratio: Relevance in the Current Scenario

PE investing is basically a prerequisite for common sense investing. A high PE is an indication for bad news on a particular stock (usually), and broader Index (almost always). PE bubbles in the charts above are strong evidence that PE should be on the top of an investor’s list when considering an entry or exit in the market.

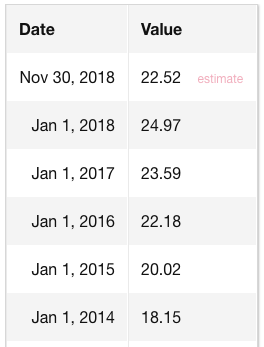

Let’s look at S&P 500. The current PE Ratio of S&P 500 is 22. The previous four years have seen PE constantly remaining over 20. Does that mean the PE ratio has lost relevance?

Source: https://www.multpl.com/s-p-500-pe-ratio/table/by-year

Those considering the PE ratio is outdated or not in tune with the dominance of “growth-focused” tech stocks in the Index are in for quite the surprise. An investor should always remember that “this time is different,” is the rallying cry of an investment expert. However, we know that data never lies. Over 100 years of analysis is proof enough that valuations tend to revert to the mean. Using the PE ratio is an essential tool in determining if you are on the right side of the market.

Takeaways:

- PE ratio is an important valuation indicator, but it is critical to evaluate it subjectively and judiciously.

- When comparing the PE ratio of companies, you should always look at organizations in the same sector, and that is the same size.

- Index PE is an important indicator of overall performance. An investor can reliably use it to selectively invest in either the index or in a basket of index stocks.

- If you have an Index PE ratio of less than 10, it is screaming a buying opportunity. An Index PE of over 20 is your chance to dump stocks en masse.