PocketSmith Review 2022: Your Ideal Financial Advisor?

| By: Bob Haegele | April 5, 2021 |

In a nutshell: PocketSmith is an online personal finance app that makes it easy to manage every aspect of your finances. It also forecasts your future finances to enable you to make the best financial decisions.

Our PocketSmith review considers this to be the ideal app for keeping track of your finances.

| Fees | Service Type | Promotion |

|---|---|---|

| $9.95 - $19.95/month | Personal finance app | None |

PocketSmith is a personal finance app that makes it a breeze to manage your finances. While it could be cheaper, we found it enjoyable to use.

Pros & Cons

PROS

- Lots of flexibility

- Track one-time events with ease

- Forecast future finances

- Up to 1 year free

CONS

- Expensive

- Steep learning curve

Full PocketSmith Review

Do you need to get a better handle on your finances? PocketSmith is an app to help you manage your finances. With forecasting and full synchronization with your financial accounts, this is one of the best virtual financial advisors around. You can track how your spending habits will impact your finances six months down the line to thirty years into the future.

PocketSmith is best for:

- In-depth personal finance management

- Budgeting

- Financial planning

Our review on PocketSmith believes that this is a financial tracking app that goes further than its competitors. By providing lots of important insights, the PocketSmith app can help you control your finances.

Keep reading our PocketSmith review to find out more.

PocketSmith at a Glance

| Product Name |

|

| Services |

|

| Membership Fee |

|

| Customer Service |

|

| Promotions |

|

PocketSmith was founded in 2008 by a group of New Zealand entrepreneurs. The goal of the app was to create a platform that allows people to manage their finances and receive vital insights via a calendar-like app.

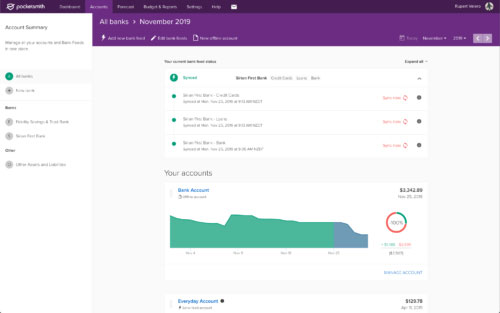

The software uses a Google-like calendar to provide you with information on your current balances and future forecasts. It offers full synchronization with your financial accounts and the different budget categories enable you to drill down into your finances quickly.

PocketSmith Features

Our review on PocketSmith believes that the platform comes with features that go beyond what’s ordinarily available with financial tracking apps. The forecasting feature is especially potent and the focus on modifying consumer behavior is a real selling point for this app.

We examine the core features of PocketSmith.

Future Financial Forecasting

Perhaps the main selling point of this app is it uses your data to allow you to make financial projections up to 30 years into the future. It will even estimate your daily bank balances. You can perform these calculations using several different time periods.

Budget Calendar

The PocketSmith budgeting calendar pinpoints your recurring costs and tracks them through their calendar. Use this data to plan your projected expenses. These can be color-coded by category, and the platform also allows you to come up with your own customized categories.

Scenario Testing

Want to spend a year travelling overseas and don’t know how it will impact your finances?

PocketSmith scenario testing allows you to plan for the future by examining the impact of different life decisions. Just click a button and you’ll see how your big life decisions will impact your finances.

Income and Expense Statements

Press a button and PocketSmith will report all your income and expenses in one simple report. Turning your personal finances into a profit & loss statement is a great way of getting a high-level view of your finances.

PocketSmith Pricing

Most reviews on PocketSmith point out the problematic pricing scheme. The issue is that even though they offer a free version of PocketSmith, the free option is so gutted of useful features that it’s barely worth using at all.

Instead, if you’re going to use this platform you must consider paying for a subscription plan. You have two options to choose from:

Premium ($9.95/month $90/year) – Automatic bank feed updates, transaction importing, and categorization. Forecast up to 10 years of accounts.

Super ($19.95/month $169.92/year) – Unlocks the 30-year forecasting feature and removes all account limits.

PocketSmith FAQ

PocketSmith is one of the more advanced financial tracking apps around. We answer some of the most common questions below.

Is PocketSmith Too Complicated to Use?

There is a learning curve, particularly when it comes to importing transactions and setting budgets. However, once you figure it out the app is easy to manage.

Should I Pay the PocketSmith Fees?

With no automatic importing and no additional features, the free version of PocketSmith is severely lacking. A subscription is well worth paying for.

Who is PocketSmith Ideal For?

It’s the ideal platform for those who are serious about their long-term finances. The forecasting feature is its primary selling point.

Is PocketSmith Right for You?

Our review on PocketSmith can conclude that this is the perfect app for people who want to get serious about taking their finances to the next level. Personal finances are tough to manage, but this app goes beyond basic tracking of day-to-day spending.

It can also be fully integrated with Mint, which many customers enjoy. Overall, other than the high pricing, we can’t say anything negative about PocketSmith.

Check out PocketSmith and sign up for a free account today.