Year-Over-Year: Why Investors Must Understand This Common Phrase

April 15, 2019

Investors and business leaders tend to use the phrase “year-over-year” on a frequent basis when discussing a company’s results. Year-over-year is often abbreviated as YoY. The concept of YoY is ..

Five Investments That Preserve Capital, Reduce Risk

February 7, 2019

Almost 34 percent of Americans said they planned to make at least one financial resolution for 2019, reported US New & World Report. Rebalancing one’s investment portfolio was o..

2 Easy Ways to Use Arbitrage to Make Money in the Stock Market

October 8, 2018

Are you familiar with the term arbitrage? It is simply the process by which you make money by taking advantage of pricing differences. And there are many ways you can use arbitrage to your advantage, ..

Complete Beginners Guide to Closed End Funds

September 24, 2018

There are many investment options for investors to choose from. While mutual funds are a huge business, many investors are unaware that there are two types of mutual funds, open end and closed end fun..

Why a Roth 401K Plan Makes Sense For You

September 11, 2018

Most everyone knows about a 401k plan. It is a typical benefit employers provide to help their employees save for retirement. While there are many benefits to investing in a 401k plan, there ar..

Understanding Market Timing and How to Profit from It

August 21, 2018

There is money to be made in the stock market. How you go about investing however is totally up to you. Some investors are buy and hold types. This means they buy a stock, mutual fund or ETF and hold ..

How to Profit by Investing in Exchange Traded Notes

July 23, 2018

There are a lot of investment instruments for investors to choose from when investing their money. The most common are stocks, bonds, mutual funds, and exchange-traded funds. But there are some other ..

Understanding and Reducing 5 Risks of the Stock Market

July 16, 2018

When it comes to investing in the stock market, you might think that the only risk you face is the risk of losing money. While you do risk losing money, there are many risks within the market that lea..

Why Blue Chip Stocks Should Be Your First Investment

June 25, 2018

There are a lot of options to invest in when it comes to putting your money into the stock market. Aside from investing in individual stocks, mutual funds or exchange traded funds, investors have to c..

4 Overlooked Benefits of A Roth IRA

June 20, 2018

You hear a lot about how great a Roth IRA is for saving for your retirement. After all, who wouldn’t want their money to grow tax-free and be able to withdraw it tax-free too? But there are some add..

4 Alternative Investments That Will Make You Money

June 19, 2018

The stock market is a great way for you to grow your wealth. After all, if you simply follow the indexes and invest for the long term, you can achieve an average 8% return on your money. There are ver..

Critical Reasons To Invest In Small Cap Stocks

May 10, 2018

When it comes to investing, you need to make sure you have a well diversified portfolio so that you can lower your risk. A great way to add diversification to your portfolio is with small cap stocks. ..

4 Reasons Why Preferred Stocks Are Smart Investments

April 26, 2018

If you are an income investor, it could make sense for you to look into owning preferred shares. This is because for income and dividend investors, owning preferred shares has many benefits, most of w..

Do You Know the Secret Costs Of Mutual Funds

April 11, 2018

Mutual funds are a great way for people to invest in the stock market. By allowing for instant diversification, investors without a lot of money are able to control risk and earn a higher return than ..

6 Concrete Reasons Why Smart Investors Own Gold

March 16, 2018

6 Concrete Reasons Why Smart Investors Own Gold Gold has always been a smart, long term investment for investors. It hasn’t been until the housing bubble crushed the stock market and volatility star..

3 Easy Investing Tips to Lower Your Taxable Income

February 27, 2018

One of the biggest reasons investors earn lower than expected returns is from taxes. Taxes eat up on any gains you earn, causing you to earn less than what a mutual fund or exchange traded fund earned..

Using Beta to Build a Risk Adverse Portfolio

February 14, 2018

If you are a nervous investor, what is your process for building a portfolio? Do you do massive amounts of research before settling on the right investments? Or are you so scared of stocks, you only i..

How to Use Opportunity Cost to Grow Your Wealth

February 13, 2018

Are you familiar with opportunity cost? Most people in business have come across this term early in their careers, but everyone, regardless of profession or interest, can use opportunity cost to their..

Investors Guide to Surviving Volatility in the Stock Market

February 9, 2018

It’s back!!! After well over a year of a smooth ride in the stock market, volatility is back with a vengeance. Even on days where the market closes down a few points, a closer look shows..

Irrational Exuberance: How to Cash in When Others Are Losing Money

January 31, 2018

Greed and fear rule the market. For individual investors, the majority base their investing decisions on these two emotions and as a result, end up losing money more often then make money. You might e..

Why Your 401(k) Plan Is Your Most Powerful Investment Account

January 16, 2018

As an investor, you have many different accounts that you can use to invest your money in. And each of these different accounts has its own advantages and disadvantages. But there is one account that ..

Why Investing in Exchange Traded Funds Will Grow Your Wealth Fastest

January 10, 2018

As an investor, you have many options for where to put your money. You could invest your money into certificates of deposit at your bank, in mutual funds or even in stocks. While all of these choices ..

Investing Is Not A Zero-Sum Game – Leads To Money For Smart Investors

January 5, 2018

Ask the majority of people about investing and they will probably tell you that when the stock market rises, everyone wins and when it drops, everyone loses. But this isn’t the case. Investing in th..

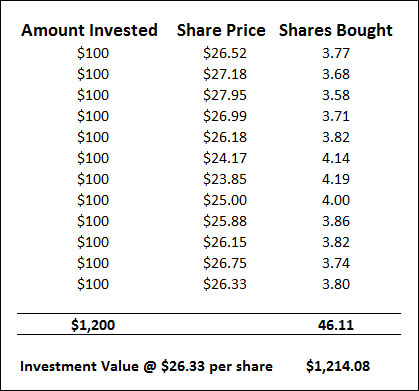

Dollar Cost Averaging: The Simple Investing Strategy That Works

December 18, 2017

Many times we investors make investing much harder than it needs to be. We spend countless hours researching trying to find the next Apple or Amazon. In reality, we could just deploy a simple dollar c..