Hello everyone,

I hate to bring bad news, but there is something going on around you, something you may have missed until now, but it is something we absolutely can no longer overlook as responsible individuals and investors. If you have a family you are accountable for, or you are planning on ‘big’ retirement dreams for yourself, this article should help you wake up, unfortunately.

I am talking about an environment of VERY, very low investment returns, for quite some time.

Consider these headlines I’ve been seeing recently:

“Prepare for lousy stock and bond returns for years.”

~ CNN Money, July 2016

“We absolutely, absolutely cannot rely on stocks and bonds to produce over the next 20 or 30 years what they produced over the past 30.”

~Marketwatch.com, April 2016

“Leading investment analysts think you will be lucky to squeeze out an average return of 2% annually, after inflation and fees, from a typical portfolio of stocks and bonds over the coming decade or so.”

~Jason Zweig, Wall Street Journal

And finally,

“Northern Trust is telling clients to expect average stock returns of 5.5% a year, including dividends, for the next five years, well below the historical 9% average. Wilmington Trust is looking for a 6.8% average annual stock gain for the next five years, including 2.6% from dividends. David Kostin of Goldman Sachs is talking about average total returns of 5% a year for 10 years.”

~ Wall Street Journal, Feb 2016

There is near consensus now among major banks and “key individuals” I’ll call them (such as John Bogle, Founder of Vanguard Group), that say you are more likely to get somewhere between 4% and 6.5% a year in real terms. Bogle specifically says 6% nominal (non-inflation-adjusted) equity returns during the next decade and 3% bond returns.

Ok, you say, low returns going forward…got it. But do you really understand its impact on your ability to retire and to achieve your financial goals?

Consider the following:

Just to make up for a 2 percentage point drop in average returns, a 30-year-old would have to work seven years longer, or almost double his or her savings rate (from the McKinsey Global Institute).

Seven years longer or double my savings rate?! And that is only for 2% lower average returns. If it is say, 4% lower, which is a very real possibility, the 30-year-old now has 14 years longer of working!

My key point is that investors should stare a cold, hard truth straight in the face: Future returns on stocks are likely to be far slimmer than the fat gains of the past few years. Even Motley Fool stock picks could see lower returns in the future.

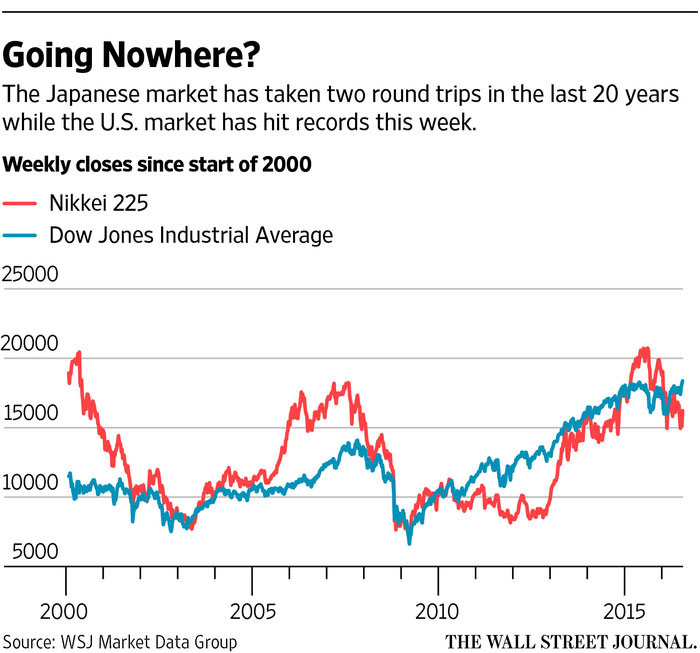

Consider this graph showing Japan’s stock returns (in the red line) over the last 15 years:

You’ll notice that from 2000 to 2016, Japan’s stock market has returned almost exactly 0%. This could be a very real possibility for the U.S. market as well. Ponder what sixteen years of a 0% return does to our retirement plans.

In closing, I chose the picture at the start of this article intentionally. It is a baby tree under a few coins. If we are not careful, our retirement portfolios will not grow much more than that! Mr. Kinniry, an investment strategist at Vanguard, recently said that “Investing is always a partnership between you and the markets.” Sometimes things are good and Mr. Market does most of the work. But with what I expect to be very low returns for the foreseeable future, “now you are going to have to be the majority partner.”

I will save further comments for what to do elsewhere on my website and in future articles, but I’ll close with the following advice that I think should be heeded immediately:

1) SAVE MORE.

2) Minimize your fees.

3) Consider your new capital allocations very carefully before buying.

4) Prepare, perhaps, to have your dividends be the large majority of your total return.

What do you think? I’d love to hear your perspective and comments.

Thanks Good Credit Info! Appreciate the guest post!

Passive Income Dude

I don’t really put much weight into stock market predictions. No one, and I mean NO ONE, knows where the stock market will go for any short period of time. There are just too many variables at play. With that being said, it makes absolute sense to increase your savings rate until it hurts. And for those with a long term horizon of 15-20 years, it might be wise to be almost all in with stocks instead of bonds. Interest rates are so low it is going to be hard to make money anywhere else after inflation.

Stocks provide the best long term return and as long as you keep contributing regularly and reinvest your dividends, you give yourself the best chance of success.

No matter what actually does happen, there will NEVER be a better investment vehicle than the stock market. So like Syed said, focuse on what you can control, your saving rate, and invest every dime you can into the stock market. I think all of those doom and gloom predictions are silly and not worth worrying about. NOBODY knows, but what we DO know, is that historically, the stock market will go up. Period. So put your money there.