Not only does that have implications for your portfolio's performance, but more and more investors are interested in socially responsible investing these days. Whatever the reason for your curiosity, this post will take a closer look at Betterment index funds and its reasoning for selecting those funds.

Betterment Index Fund Mix

Betterment invests your money in a mix of up to 14 different exchanged-traded funds (ETFs). ETFs are highly liquid, trade freely on the open market, and have very low fees. As of 2018, the average expense ratio for Betterment ETFs is between 0.07% and 0.15%.

Wondering what exact selection of funds Betterment uses? Here are the primary funds it uses for taxable accounts:

Stocks | Bonds |

|---|---|

Vanguard U.S. Total Stock Market (VTI) | iShares Short-Term Treasury Bond Index (SHV) |

Vanguard US Large-Cap Value Index (VTV) | iShares Core U.S. Aggregate Bond (AGG) |

Vanguard US Mid-Cap Value Index (VOE) | Vanguard Short-Term Inflation-Protected Securities (VTIP) |

Vanguard US Small-Cap Value Index (VBR) | Vanguard US Total Bond Market Index (BND) |

Vanguard FTSE Developed Market Index (VEA) | iShares National AMT-Free Muni Bond Index (MUB) |

Vanguard FTSE Emerging Market Index (VWO) | iShares Corporate Bond Index (LQD) |

iShares J.P. Morgan USD Emerging Markets Bond (EMB) |

As you may have noticed, all of these funds are either Vanguard or iShares funds. Every one of its stock ETFs is a Vanguard fund while adding some iShares funds for bonds. These funds are ideal because they give you a wide range of exposure while maintaining very low fees.

With each Betterment portfolio, you can adjust your stock/bond allocation. For example, 80 percent stocks and 20 percent bonds. Betterment will then choose the optimal allocation to match the percentages you specify.

Why Does Betterment Invest in These Funds?

Betterment details the reasoning for its portfolio on its website and it has an in-depth explanation. It says it uses a two-part process: asset allocation and fund selection.

Of course, diversification is important. Betterment diversifies not just domestically but also internationally. In doing so, it balances your portfolio against both historical and forward looking downside behavior.

Betterment says it uses the Black-Litterman Global Portfolio Optimization model to forecast returns. In short, this model optimizes asset allocation to match your risk tolerance market views. The result is a portfolio that gives you exposure to different economic regions, investment styles, and security types.

In addition, Betterment's fund selection helps smooth interest rate risk with its global diversification. In doing so, it notes that it avoids home-bias, which is the tendency of investors to favor domestic companies.

What About Taxes?

Taxes are an important consideration for any portfolio. Just like expense ratios and other fees, paying too much in taxes can drag down your returns.

The good news here is that Betterment's preference for ETFs is also best when it comes to taxes. Not only does Betterment use tax-loss harvesting; ETFs themselves are generally tax-efficient.

The easiest way to understand why is to look at mutual funds. These funds are sometimes actively managed, meaning the fund manager is constantly buying and selling securities to optimize the portfolio. But each sale has the potential to trigger capital gains, something that doesn't happen with ETFs.

Granted, capital gains taxes on passively-managed mutual funds from Vanguard are able to avoid capital gains. Nevertheless, Betterment's choice to use ETFs is no coincidence; tax advantages are just one of the benefits they provide.

Can I Invest in Individual Stocks with Betterment?

Betterment does not have a way to invest in individual stocks. That means the upper limit on your returns will be lower with Betterment than some other strategies like that of The Motley Fool.

But investing in a diverse portfolio of ETFs also reduces volatility. It also means you don't have to monitor your portfolio all the time. And because of the platform's automatic rebalancing, you can fully automate your investing strategy.

We'll cover portfolio rebalancing in the next section, but the only additional step with Betterment is to set up automatic deposits. If you do that, it is a true "set it and forget it" investing solution.

Portfolio Rebalancing

An important part of the Betterment strategy is automatic rebalancing. If you aren't familiar with automatic rebalancing, not to worry. While the technical details of how it works can be a bit complicated, it's easy to understand at a high level.

All you need to know is that over time, some funds will inevitably outperform others. Hence, some funds will occupy more of your portfolio than intended; others will be allocated less than expected. To fix this, Betterment periodically rebalances your portfolio by selling shares in some funds and buying some in others. It calls this sell/buy rebalancing.

It can also rebalance using what it calls cash flow rebalancing. The way cash flow rebalancing works is even simpler. When you make a deposit to Betterment, it distributes that cash to the under-allocated funds first, then moves to the next fund until it brings each fund back to its target.

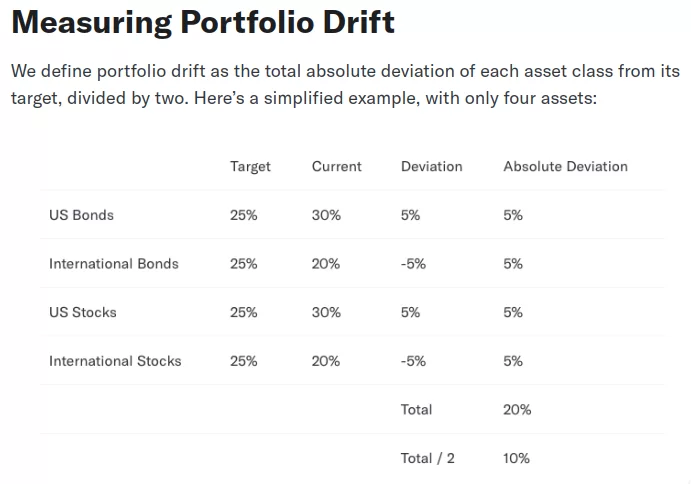

Cash flow rebalancing is triggered when there is two percent drift and sell/buy rebalancing is triggered when there is three percent drift.

It does get a bit complicated as you can see. All you really need to know is that drift is the absolute deviation divided by two. If that number reaches Betterment's drift threshold, automatic rebalancing will be triggered.

The Bottom Line

Betterment invests your money in a diverse set of ETFs that accounts for historical and forward-looking behavior, both domestic and international exposure, and just how much risk you can tolerate. It doesn't let you invest in individual stocks, but it does allow you to charge your stock/bond allocation.

Betterment also invests in ETFs to maximize tax efficiency as well as rebalancing your portfolio automatically. All of these pieces work together to create an excellent investing experience for new and average investors.

To get started, create your portfolio at Betterment.

By: Bob Haegele

By: Bob Haegele