Are you looking for an easier way to invest?

One which ensures you're buying amazing stocks that will make your

money grow...

...without hundreds of hours of research and analysis?

Sounds pretty good, right?

Well, the Dividend Aristocrats ETF could be what you're looking for.

In fact, all it really takes are 5 minutes of work to get started. In this article, I'll show why you should consider this ETF and where to find it.

Dividend Growth Stocks

But first thing's first...

Let's talk about dividends and why they are so powerful.

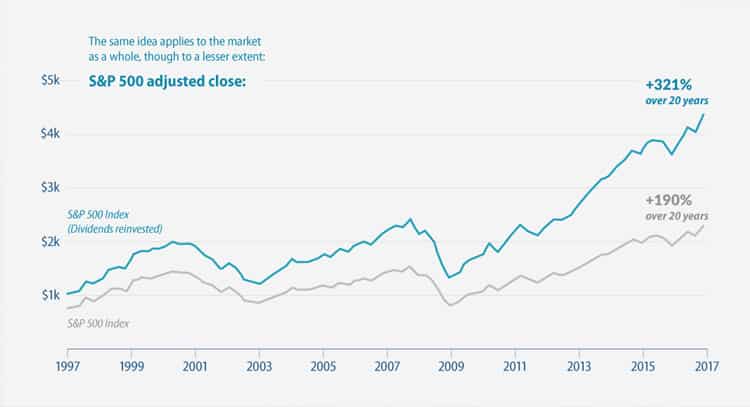

I'm sure you're familiar with the S&P 500 - the top 500 companies in the American market. Its returns over the past few years look like this:

Courtesy of Visual Capitalist

As you can see, dividends form a very large part of the returns of the market,

and the effect is even bigger the longer time passes.

And while dividends are fantastic in terms of earning actual money that can be used to pay the bills...

They are also a sign of an excellent business.

You see, it's easy for a company to have a couple of good years and make lots of money. They'll feel great and will want to share the wealth with their shareholders.

But the they'll have worse years... And money will be tighter. That's when dividend cuts will happen.

But what if a company is so good that it makes lots of money consistently? What if it is so well-managed that it rarely rushes into paying dividends.

And then - just to add the cherry on top - it increases its dividend every single year?

Well, then you have a truly exceptional company on your hands.

Dividends Are a Symptom of a Great Business

Given the extreme difficulty of raising dividends every year despite countless adverse factors, it's no wonder that people love stocks with a long history of dividend increases.

When you buy one of these stocks, you're getting:

- A dividend (AKA cash!)

- More income each year

- Market-beating performance

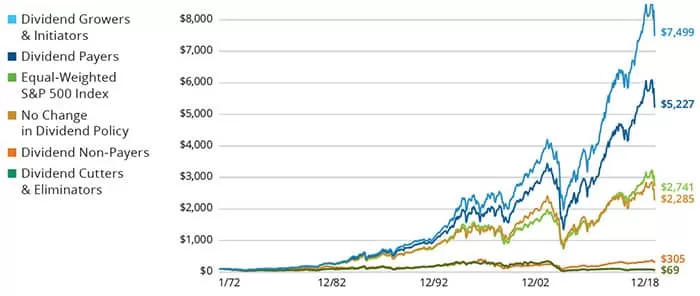

Don't take my word for it. Check out this graph:

Data Sources: Ned Davis Research and Hartford Funds

It shows that, out of all the stocks in the S&P 500, those that are able to keep growing their dividends perform much better than other stocks.

In other words, focusing on the dividend growth rate is a fantastic filter to find the stocks that are most likely to give you the best returns.

Dividend Aristocrats ETF

Dividend aristocrats are stock which have been increasing their dividends for 25 years or more.

Just one year without raises, and the counter goes back to zero!

Earlier in this article, I promised that I'd show you the easiest way to invest in the dividend aristocrats.

Well, now is the time! 🙂

The ETF is called S&P 500 DIVIDEND ARISTOCRATS ETF and it's managed by Proshares.

Its ticker symbol is NOBL.

(I'm convinced there's a joke there...)

Tip: One easy to buy ETFs is by using the M1 Finance app.

Anyway, this is fantastic way to invest in the American dividend aristocrats as you'll own a small piece of 57 different companies.

Below are the top 10 holdings and the sector they belong to:

Company | Sector |

|---|---|

Target Corp. | Consumer Cyclical |

Abbvie Inc. | Healthcare |

Johnson & Johnson | Healthcare |

Leggett & Platt Inc. | Consumer Cyclical |

Archer-Daniels-Midland Co. | Consumer Defensive |

Stanley Black & Decker Inc. | Industrials |

Illinois Tool Works Inc. | Industrials |

Dover Corp. | Industrials |

Air Products & Chemicals Inc. | Materials |

Becton Dickinson & Co. | Healthcare |

Let me now show you how well NOBL has performed in recent years.

Since its inception in 2013 (it's a baby!) it has returned a 12.32% per year (CAGR).

This is admittedly worse than the S&P 500 index, which has returned around 14% per year...

But considering the lower volatility of dividend aristocrats index (0.87 vs 1.0) and the fact that this is one of the best market performances in history, I expect NOBL to come out on top in the long run.

Are ETFs Perfect?

ETFs are a fantastic way to invest in top-quality companies such as Motley Fool picks. Investing in them is easy, quick, and takes very little effort.

However, there are also some disadvantages:

- You have to pay an ongoing commission to own them.

While in the case of NOBL, it's only 0.35%, this can add up over the years, and your performance will suffer. - You can't take advantage of great buying opportunities.

When you invest into an ETF, you can only buy the whole thing. That means that you won't get

The solution?

Build your own personal portfolio of stocks! 🙂

You'll have complete control over which stocks you own, how much you pay for them, and you won't have to pay any ownership fees.