Let’s face it – with eye-popping year-over-year gains in property values, lots of young people have serious real estate FOMO (fear of missing out).

There are plenty of tools to invest in the financial markets with platforms like M1 Finance and SoFi Invest, but many just don’t sleep well knowing how far out of reach real estate is moving each day.

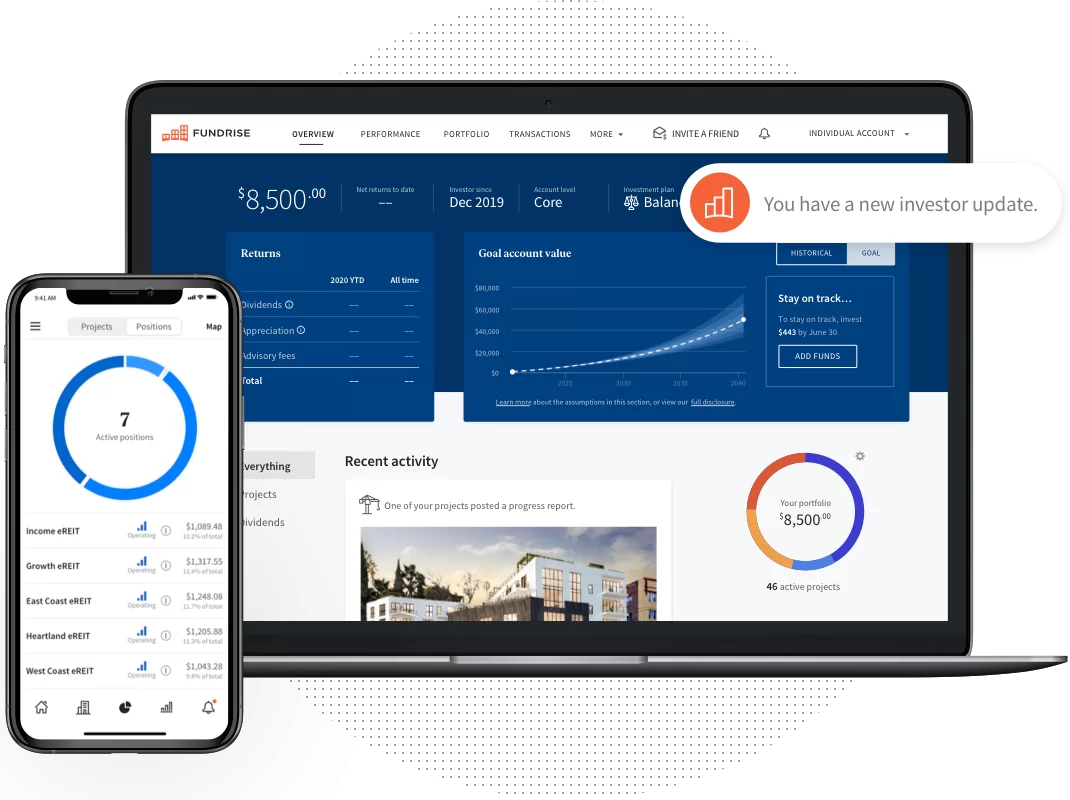

If you want exposure to real estate but cannot plunk down a big down payment, you may have considered investing with Fundrise.

There’s good news – you can be assured it’s definitely not a scam or a fraudulent scheme. The bigger question is whether their service fits your individual needs.

So, how can we be so certain Fundrise is legit and how can you determine if this is the best option available for your money in the real estate sector?

What is Fundrise?

If you’ve yet to read our full Fundrise review, here’s a brief breakdown of what you need to know about the platform.

Fundrise has been operating since 2012 and has processed more than $5 billion in real estate transactions. This is the oldest and largest real estate crowdfunding platform available now.

Create an account with Fundrise and you can invest in eREITs for as little as $500, with fees of just 1%. While not traditional REIT investing, Fundrise has created the eREIT and eFunds, which are diversified REITs rolled into one.

What’s more, you don’t need to be an accredited investor to get started, like on other platforms.

Why We’re Sure It’s Legit

Asking if an unfamiliar platform is legit before plunking down $500 and up is just common sense. Fortunately when it comes to Fundrise, the answer is clear.

The Internet is dotted with positive reviews showing good results and most importantly a real service behind Fundrise. Lots of individual investors have shared their success stories, and tellingly it has a stellar 4.8 out of 5 rating on the App Store with more than 15,000 reviews.

The very credible Better Business Bureau (BBB) offers a solid A rating. If you read through the comments and reviews, even negative ones are not alleging fraud/illegitimacy but rather offering views on the substance of how the program works.

Can You Make Legit Returns with Fundrise?

Fundrise is a legit platform where you can make money. According to the National Council of Real Estate Investment Fiduciaries (NCREIF), the average annualized returns of private commercial real estate properties was 10.3%.

On the other hand, through the end of 2020 Fundrise has reported a 10.11% average annual return since 2014. The difference is with Fundrise you don’t need to spend your time managing your real estate. With an eREIT, the platform handles everything for you.

How Strong is a Fundrise Investment?

There’s little doubt about the authenticity of this crowdfunding real estate platform. Fundrise has a solid track record over a long period. It regularly files reports with the Securities and Exchange Commission (SEC) for all of its REITs.

The latest figures from June 2019 say it originated $816 million in debt and equity investments in real estate since it was founded.

Why does this matter?

Other similar platforms tend to be private companies with little to no filing requirements. It’s Fundrise’s transparency that gives it credibility unrivaled by its competitors.

It’s important to fully understand what you are signing up for in order to make sure it’s the right place to invest your money. The most common criticism or problem identified is liquidity. We know for sure your money isn’t going to go anywhere, and we know there’s a good chance it will appreciate, but you need to very carefully read the fine print on when and how you can withdraw cash from your Fundrise investment. Make sure you’re investing money you won’t need as cash tomorrow – and preferably not for several years’ time.

Is Your Money Safe with Fundrise?

Rise Companies is the organization responsible for managing Fundrise investments. There are some risks associated with the business model because the biggest revenue stream is not asset management but originating developer funding.

One day the market will take a downturn, and this could pose some risk for Rise Companies, including:

- Reduced access to investor capital

- Less capital demand from developers

- Increased redemption requests

Does this pose a problem for individual investors?

It’s unlikely because this is a short-term issue and would not impact the REITs held by investors. Plus, as we can see from the balance sheets and the management experience inherent within Rise Companies, they have all the tools needed to navigate a market downturn.

Plus, if the worst-case scenario did occur, your REITs are separate from the rest of Rise Companies. Even if creditors went after Rise Companies, they wouldn’t be able to touch investor holdings, except for the Fundrise IPO.

In other words, your money is extremely safe when you decide to invest in a Fundrise REIT.

The Bottom Line: Should You Invest with Fundrise?

In our review on Fundrise, we praised it for eliminating the high barriers to traditional real estate investing. Just about anyone can open an account and invest with Fundrise.

The safety and security of the platform are guaranteed, and its long track record of success shows it to be an investment option that can make you money. Its management team has also displayed an astute approach to real estate management, which should give investors peace of mind.

Like anything at Good Credit Info, we preach diversification. If you want to invest in real estate through Fundrise REITs, make sure you maintain a diversified portfolio to help you negotiate tricky market cycles.

By: Bob Haegele

By: Bob Haegele