Fundrise Review 2022: The Future of Crowdfunded Real Estate

| By: Bob Haegele | January 18, 2022 |

In a nutshell: Fundrise is a real estate crowdfunding platform that makes it easy to invest in real estate.

With low fees and low minimum investments, Fundrise is removing the high barriers to entry for real estate investing.

| Fees | Account Minimum | Promotion |

|---|---|---|

| 1% | $500 | None |

Fundrise’s platform allows real estate investors to buy shares in a real estate projects, providing a steady source of income. Fees are relatively low and Fundrise makes the process easy.

Pros & Cons

PROS

- Low Minimum Investment

- Low Fees

- Strong Investment Performance

CONS

- Fees Can be Complicated

- Not Easy to Sell Investments

- Investments can be complex

Compare to Similar Platforms

| |

| Fees1% |

| Minimum Investment$500 |

| PromoNone |

| |

| Fees0.5% |

| Minimum Investment$5,000 |

| PromoGet a Free Account |

| |

| Fees1% to 1.25% |

| Minimum Investment$5,000 |

| PromoNone |

Full Fundrise Review

Fundrise allows individual investors to buy shares in real estate investment trusts (REITs). With a $500 minimum investment, it significantly lowers the barrier to investing in real estate properties.

Fundrise is best for:

- New real estate

- Passive investors

- Those who can’t afford down payments

- Those looking to diversify their investment portfolio

Fundrise at a Glance

| Fees |

|

| Minimum Balance |

|

| Minimum Investment |

|

| Account Fees |

|

| Investment Options |

|

| Redemption Options |

|

| Customer Support |

|

| Transparency |

|

What is Fundrise?

Fundrise is a crowdfunded real estate platform that makes it easier for individual investors to invest in commercial real estate.

In this Fundrise review, we’ll look at the fees, features, and whether this real estate investment platform is really worth trying.

With its real estate investment trusts, which it calls eREITs, Fundrise is making private real estate investing more accessible to the average investor.

Plus, real estate assets can give your investment portfolio some much-needed diversification.

In the old days, regular people couldn’t invest in big real estate projects. Only accredited investors could get in on the action.

“Accredited” is a snotty term the SEC used for people with more than a million dollars in personal net worth (not including primary residence), or those making $200-$300k per year, or more.

Clearly, this kept a lot of potential investors out of the game, but things changed in 2012 when the SEC opened the door for crowdfunded major real estate investments.

Click for Fundrise pricing and details.

How Fundrise Started

Enter the Miller Brothers, Dan, and Ben. These two entrepreneurs saw the writing on the wall in 2010.

They started laying the foundations of Fundrise back then and were finally able to open up shop in 2012. The company is based in Washington, D.C.

That was just when the SEC started to show signs of making real estate investment more accessible to all.

Since then, Fundrise has gradually eliminated barriers for entry into low-stakes, high-return real estate investment. Its platform makes it easy to find real estate deals to suit your investment needs.

At first, Fundrise only accepted accredited investors. Then they accepted everyone, but only with a minimum $5,000 first investment.

Today, they accept all investors with the ability to make a single $500 investment with its eREITs. Note that eREITs have no discernible difference from REITs.

REITs allow investors to pool their money and invest in large commercial real estate such as shopping malls, office buildings, and apartment complexes.

Rather than buying your own rental property, as with Roofstock, you buy a piece of an investment. And while those investments are usually commercial properties, it can include single-family homes, too.

Commercial real estate is considered a long-term investment

Fundrise Investment Options

Fundrise offers three different core investment plans: Supplemental Income, Balanced Investing, and Long-Term Growth.

Each portfolio contains a different mix of eREITs and eFunds.

eREITs work much like an exchange-traded fund (ETF). On the other hand, eFunds are private funds that focus on long-term growth rather than income.

Each Fundrise portfolio invests in both eREITs and eFunds, meaning you’ll earn both quarterly dividends and income from asset value appreciation.

Fundrise eREITs

Fundrise’s eREITs are non-traded REITs, which means they are not listed on public exchanges such as the NYSE. This helps cut back on fees by removing the middleman, but it also makes the funds less liquid.

If investors outside the Fundrise program aren’t able to buy shares in its eREITs, that means lower liquidity.

Income eREIT vs. Growth eREIT

Fundrise has two new investment options: the Income eREIT and Growth eREIT.

The Income eREIT focuses on debt investments in commercial real estate that generate steady cash flow. The current dividend on this fund is 4.99%, which is slightly above average for most dividend stocks.

The Growth eREIT focuses more on appreciating assets as a means to create wealth. In other words, it targets assets it expects to appreciate considerably.

As a result, the dividend on the Growth eREIT is lower, currently at 1.78%.

Fundrise iPO

Fundrise has another new investment option – its “internet public offering” (iPO) where it is allowing users to buy shares in the company.

There is a minimum investment of $1,000 in a Fundrise portfolio to participate.

In addition, your iPO investment is limited to 50% of your real estate principal invested. Thus, if you have $1,000 invested in your Fundrise portfolio, your maximum for the iPO is $500.

Redemptions

The Fundrise redemption program allows investors to sell their shares back to Fundrise for a price. Redemptions are free if you have held your shares for a minimum of five years. Selling your Fundrise shares before the five-year cutoff point will incur a 1% fee.

Be aware that Fundrise reserves the right to suspend redemptions. It has done so before already. From March 2020 to July 2020, all redemptions were prohibited at the start of the COVID-19 pandemic. This is something to be aware of in the event of a market downturn.

Make sure you don’t require immediate access to liquidity if you choose to invest your portfolio with Fundrise. Take note, Fundrise has yet to react to a severe market downturn in the real estate market.

Interval Funds

Investors searching for more liquidity may want to consider the Fundrise Interval Fund. When you invest with the interval fund, you gain more access to your money via quarterly repurchase offers. That means you can liquidate any or all of your shares every financial quarter without paying the 1% fee.

The Fundrise Interval Fund is the biggest fund held by the company. It contains more assets and offers greater diversification yet still provides the benefits of eFunds and eREITs.

How to Redeem Your Investment

Fundrise shares aren’t as easy to sell as shares of stock normally are because they are non-traded.

However, if you want to redeem them, you’ll have to submit a redemption request. This can be done on Fundrise’s website.

There is a 60 day waiting period after which you can claim liquidity. However, your shares may be subject to a penalty if you withdraw before the real estate is sold.

Fundrise Pricing

Fundrise has an asset management fee of 0.85% plus a 0.15% advisory fee. That works out to a total 1% annual fee.

Other fees may apply, though you have to dig through complicated offering circulars to find them.

Fundrise sometimes runs promotions that will waive advisory fees for new customers, although there is no promotion currently.

Fundrise Portfolios

Fundrise offers four different portfolio tiers, from its Starter Portfolio all the way up to its Premium Portfolio.

For each investment strategy, Fundrise will invest your money in a set of eREITs and eFunds.

| Portfolio | Min. Investment | Features |

| Starter Portfolio | $500 | Diversified mix of eREITs and eFunds |

| Core Portfolio | $1,000 | Dividend reinvestment, IRA support, 3 months free per referral |

| Advanced Portfolio | $10,000 | Direct fund allocation, 6 months free per referral |

| Premium Portfolio | $100,000 | Priority access to investment team, 12 months free per referral |

Although you can get started for $500, Fundrise recommends upgrading to one of its core plans. These plans provide not only passive income but also great diversification and customization.

Fundrise Performance

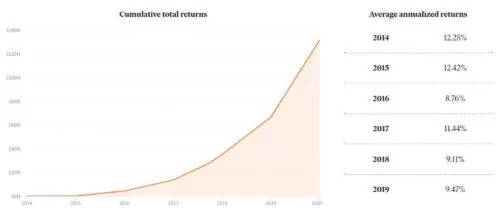

Fundrise has a table and graph of its annualized return figures by year on its website. As you can see, performance figures are encouraging:

Indeed, annual returns look quite strong. Of course, every year is different, and past performance does not guarantee future performance.

Nevertheless, there should always be a demand for real estate; thus, there’s no reason to think returns won’t remain strong.

Strengths, Weaknesses, and Exciting Possibilities

Fundrise isn’t the only game in town when it comes to online real estate crowdfunding. Sharestates, Realty Mogul, and RealtyShares all come to mind.

They are the first organization, however, to offer so much to the average investor. If you have $1,000 scraped together, you can take part. Here is how it all works.

Fundrise has several levels of screening before they decide to fund a real estate project. Developers approach them with proposals.

After a basic screening, a full 50% of these submissions are rejected, because they don’t meet Fundrise’s standards.

These proposals are then examined with a fine-toothed comb, and only about a quarter of these are moved forward to a final level of scrutiny. In the end, Fundrise only funds 1% of the proposals it receives.

Why is that?

Fundrise pre-funds all selected real estate proposals before making them available to its stable user investors. This is a lot of risk for Fundrise to take on, but this risk also cuts both ways.

By this I mean that, were a developer to renege on their repayment agreement, Fundrise would work to get their money back first, before repaying the investor.

This obviously doesn’t happen often, and I can’t find user reviews to explain how this might have actually gone down in the past. This is the language from Fundrise’s website:

“Payment on the corresponding project investment will remain due even in the event Fundrise goes out of business. However, payments on Notes issued by the National Commercial Real Estate Trust could be delayed or modified in the event of a business disruption.” |

Indeed, I wouldn’t worry about this too much. Fundrise has 130,000 user investors and more than $1 billion of assets under management.

In many ways, though, it’s still a developing company.

I am curious and optimistic about this as a bold, accessible model for low-stakes real estate investment, and well worth a $500 gamble. Real estate can be a great way to earn supplemental income, so it’s worth a try.

Also, keep in mind that distributions are taxed as ordinary income. That may be higher than the 15% tax rate on dividends.

Roofstock vs. Fundrise

Roofstock and Fundrise both have a lot to offer for those interested in real estate investing. The minimum investment for Fundrise is much lower.

That isn’t too surprising since Fundrise allows investors to buy shares in its eREITs, while Roofstock focuses on buying single-family homes outright.

As you can see, fees are reasonable on both platforms, with Roofstock having a lower 0.5% fee and Fundrise having a 1% fee.

See a more detailed comparison of Roofstock vs. Fundrise.

Fundrise vs. DiversyFund

Fundrise and DiversyFund are very similar: both allow you to buy shares in a REIT that invest in a variety of real estate projects. Plus, both have a $500 minimum investment. Oh, and that’s not all: both programs accept non-accredited investors.

At this point, you might be wondering if anything is even different between them. The biggest difference comes in the form of fees: Fundrise charges a 1% management fee, while Diversyfund doesn’t have any ongoing management fees.

That might make Diversyfund sound unequivocally better, but not so fast: there may be other fees. Specifically, there may be finder’s fees between 2% and 8%.

And another difference between Fundrise and DiversyFund is that DiversyFund owns the properties in which investors buy shares. Again, while there are benefits to this arrangement, it does limit the scope of DiversyFund investments. For now, DiversyFund only has properties in a few states.

Fundrise FAQ

Now, let’s answer a few common questions you may have about Fundrise.

Can You Really Make Money With Fundrise?

Yes, you can make money with Fundrise. Just in case you missed it, take a look at the Fundrise Performance section.

Typical returns for most investors are between 9% and 11%. If you invest in stocks at all, you know that return is on par with what you would get in a bull market.

It’s worth noting however that these numbers are averages, so your results could be different. Every property is different.

Still, results look relatively strong across the board.

Is Fundrise a Good Investment?

In general, Fundrise is a good investment. The average 10-year stock market return for the past 140 years is 9.2%.

Considering Fundrise’s returns either match or beat that number, it certainly looks strong.

It’s also good to have real estate in your portfolio for diversification purposes. The housing market doesn’t typically influence the stock market and vice versa.

Of course, the Great Recession is a notable exception. But, in general, having real estate in your portfolio can help during a bear market.

People still need a place to live regardless of the stock market, after all.

Having strong returns and making your investment portfolio more well-rounded, Fundrise is indeed a good investment.

Read more: Is Fundrise Legit? Read This Before Investing

How is Fundrise Doing?

Things are going well for Fundrise. Since 2012, it has invested more than $4 billion and has more than 130,000 individual investors.

In addition, Fundrise continues to expand, having acquired a commercial redevelopment and apartment pre-development in Los Angeles.

As you can see, Fundrise is doing quite well and continues to grow and expand its operation.

Final Thoughts

Fundrise is definitely an interesting concept. By providing short-term loans to major developers (1-3 years, early repayment accepted), then making those investments available to Average Joe investors, they’ve made a true innovation in the crowdfunding investment marketplace.

I have yet to use Fundrise for more than a couple of months, so I can’t speak to the long-term user experience. However, more experienced Fundrise users say that liquidity can be a problem.

It’s conceivable that as this model takes hold, there will be more and more investments available. In the meantime, the investments I’ve seen have seemed strong and trustworthy, and I have no complaints.

But the night is young…we’ll definitely update this review as we learn more.

Try Fundrise out for yourself. It’s the cheapest and easiest way to get equity stakes in major real estate development, without having to sink millions into a single project.

Real estate is a great way to earn passive income.

Plus, real estate is a great investment if you want a diversified portfolio. Stocks and mutual funds are great, but the stock market can be volatile at times.

Real estate can be somewhat illiquid, but owning stocks also helps in that regard.

You can also buy stable real estate debt from your self-directed IRA or other accounts. Try Fundrise and let us know your experience.

It fills a unique spot in the investment landscape and we’re excited to see how it develops. Just be sure to do your due diligence before becoming a real estate investor.

Click for Fundrise pricing and details.

Related Investing Product Reviews:

Fundrise achieved 22.99% average returns across all client accounts in 2021Learn More