RealtyMogul Review 2022: The Future of Real Estate Investing?

| By: Bob Haegele | Sep 04, 2021 |

In a nutshell: RealtyMogul is a crowdfunding platform for real estate investors who want to diversify their investment portfolios and gain exposure to the commercial real estate sector.

Our RealtyMogul review believes this is an ideal investment option for certain types of investors.

| Fees | Service Type | Promotion |

|---|---|---|

| 1% to 1.25% | Real estate | None |

Pros & Cons

PROS

- High rates of return

- Open to non-accredited investors

- REIT buyback program

CONS

- Short track record

- Complex investment option

- High investment minimum

How RealtyMogul Compares with Similar Products

| |

| Fees1% to 1.25% |

| Investment TypeReal estate |

| Minimum Investment$5,000 |

| PromotionsNone |

| |

| Fees1% |

| Investment TypeReal estate |

| Minimum Investment: $500 |

| PromotionsNone |

| |

| Fees0.5% |

| Investment TypeReal estate |

| Minimum Investment$5,000 |

| PromotionsGet a free account |

Are you looking to get into real estate but don’t have a huge lump sum to hand?

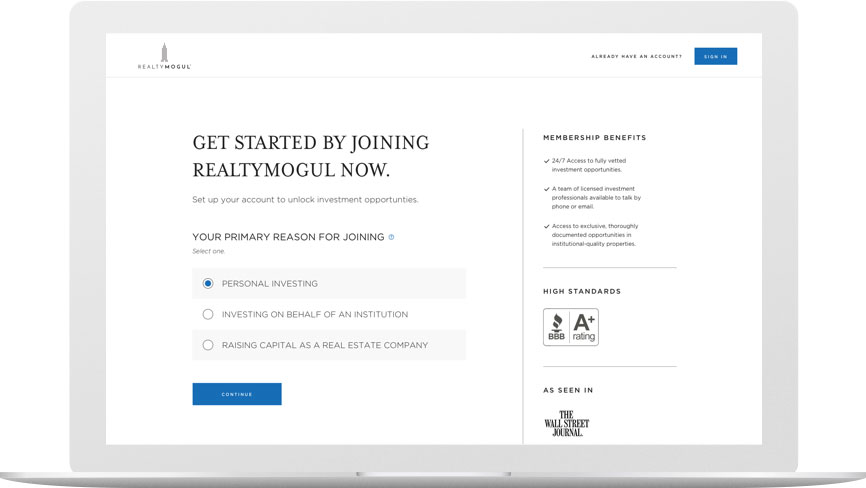

RealtyMogul real estate investing is a crowdfunding platform that enables you to gain exposure to the commercial real estate sector. Investments are made exclusively from an online dashboard and are open to both accredited and non-accredited investors.

According to the company, investors have received $172 million in profits and have financed more than $2 billion in property value. The company also boasts 200,000 registered members. However, its short track record means that its long-term performance is currently unknown.

Keep reading our RealtyMogul review to find out more about investing in commercial real estate on this platform.

What is RealtyMogul?

| Product Name |

|

| Services |

|

| Minimum Investment |

|

| Customer Service |

|

| Promotions |

|

RealtyMogul was founded back in 2012 by current CEO Jilliene Helman and Justin Hughes. This FinTech company focuses on investing in commercial real estate options across the country. Based in Los Angeles, California, more than $400 million of equity capital has been deployed and the company has a portfolio valued at over $2 billion.

Commercial real estate has been notoriously difficult to get into unless you either knew the right people or had a huge bank balance to finance new projects.

Its focus on high return targets means that investors could receive as much as 15% on their investments per year. However, these figures are for private placement investors. Its REIT investments offer returns closer to 4% to 8%.

The big benefit of RealtyMogul is the investment process takes place entirely online and requires no legwork from you.

How Does RealtyMogul Work?

Most reviews on RealtyMogul praise it as an option for getting into commercial real estate. On the other hand, the amount of fine print makes it tough for less experienced investors to use the platform.

Let’s take a look at how you can get started with RealtyMogul.

Where Does RealtyMogul Source its Investments?

RealtyMogul works directly with developers. The developer submits a deal for consideration and the company’s real estate team examines the terms of the deal and the likelihood that the investment will deliver a profitable return.

According to the company, thousands of property deals are submitted to it every year and they only accept 1% of deals.

Who Can Invest with RealtyMogul?

While both accredited and non-accredited investors are welcome to invest on the platform, non-accredited investors are limited in what they can invest in.

Accredited investors have full access to every deal within the RealtyMogul marketplace, whereas non-accredited investors are only eligible to invest in REITs. This lack of access to standalone commercial real estate deals is a big downside of the platform.

RealtyMogul Investments

There are two types of investments at RealtyMogul, nontraded public REITs and private placements.

Its REITs work like this:

- MogulREIT I – This public nontraded REIT is registered with the SEC and invests in commercial real estate equity and debt assets. Property types include self-storage, office, industrial, and retail. Pays monthly dividends.

- MogulREIT II – This REIT invests primarily in equity investments that include multifamily apartments. Dividends are paid quarterly. Dividends are usually lower than MogulREIT I, but the company claims this is due to a focus on the long-term growth in share prices.

Private placements are exclusive to accredited investors and focus on diversified funds and opportunity zone eligible investments. Due to their nature, they aren’t registered with the SEC and don’t provide the same protections for investors.

RealtyMogul Fees

Every asset class comes with its own fees. You are charged based on the investments you hold. There are no account fees or minimums, but to invest you need a minimum of $5,000.

Here’s a breakdown of their fees:

- Private Placement – Differs by investment but averages out at 1%.

- MogulREIT I – 1% of your total equity value.

- MogulREIT II – 1.25% of your total equity value.

When compared to other similar offerings, RealtyMogul’s fees are considered average. Make sure you factor the fees into any investment you make.

RealtyMogul FAQ

For those new to crowdfunding commercial real estate investing, RealtyMogul can seem intimidating. Here are the answers to some of the most common queries regarding the RealtyMogul platform.

What is the Minimum Real Estate Investing?

The $5,000 minimum only applies to REITs. For private placements, investment minimums can be as high as $30,000 or more.

Does RealtyMogul Offer a REIT Buyback Program?

Yes, but it depends on the company’s availability of capital. Also, there are fees associated with this program of up to 2%.

Is My Money Safe with RealtyMogul?

Yes, because when you own a stake in a property it’s in your name, rather than RealtyMogul’s. The only exception is if you invest in a RealtyMogul owned development.

Is RealtyMogul Right for You?

Most reviews on RealtyMogul claim that this is an intriguing commercial real estate investment option, and we have to agree. The downsides are the relatively high minimum investment and the fact that you need to be an accredited investor to gain access to private placements.

However, it’s a start for a notoriously closed-off area of the real estate sector. At Good Credit Info, we believe that this is an excellent investment platform if you want to invest in commercial real estate.

Check out RealtyMogul now to learn more about investing in the commercial sector.