Roofstock is a real estate investing platform founded in 2015. Hence, while it isn’t exactly brand-new, it hasn’t been around nearly as long as America’s oldest businesses. And people know that when a business has been around since before World World I, for example, it’s a name they can trust.

Perhaps more to the point for investors, though, is having a track record of success. When a new investment service is introduced, it doesn’t always have a track record to show it’s a legit investment opportunity.

These are the concerns we’ll explore in this post about Roofstock.

What is Roofstock?

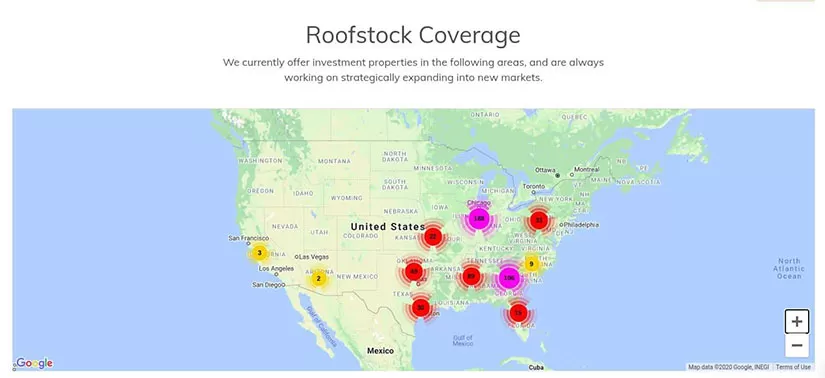

Roofstock is a real estate investing platform based in Oakland, California. Its emphasis is on single-family homes, and it helps investors by handling nearly all of the legwork normally involved with buying investment properties. Roofstock has properties in over 40 markets across the U.S.

The Zacks Industry Overview for real estate development showed an investment return of over 35% in the summer of 2021. While it has cooled since then, real estate is perennially a strong investment.

As we detail in our Roofstock review, Roofstock streamlines the entire process, Roofstock not only removes most of the work, but also makes it easier for newer, inexperienced investors. After all, there is a lot of paperwork involved, and that is to say nothing of managing your investment properties.

To help with all this, Roofstock acts as a single platform where you can purchase investment properties; then, Roofstock does the rest of the work for you. The properties on its marketplace are already occupied, and you can see the investment returns for each of them. Annualized returns can be greater than 35% for some properties.

What Services Does Roofstock Offer?

Roofstock offers a real estate marketplace and a subscription that allows investors to investors to buy property shares. Here are the services Roofstock offers:

- Roofstock: buy and sell occupied investment properties

- Roofstock One: buy shares in properties starting at $5,000

- Lennar: buy new-construction homes from Roofstock’s partner, Lennar

Roofstock doesn’t charge a subscription for its services; instead, it makes money by charging a fee on the sale of properties on its platform. That fee is assessed as 0.5% of the purchase price or $500—whichever is higher.

Buying and selling investment properties on Roofstock is much the same as buying them on your own except that Roofstock makes the process much easier. However, that means that the minimum investment is the cost of whichever property you want to buy. That could be well under $100,000, or it might be over $1 million.

Roofstock also connects you with lenders if you need financing. That process is similar to taking on a mortgage with any other lender, meaning you will likely need a minimum of a 20% down payment.

Is Roofstock Safe?

No one wants to invest in a platform they don’t know is safe and trustworthy. Fortunately, Roofstock goes to great lengths to ensure their properties are safe and fully vetted.

The Roofstock guarantee comes with several protections to help ensure you won’t lose your investment. First, Roofstock arranges a comprehensive property inspection with a third-party vendor. Then, Roofstock reviews the inspection thoroughly to ensure the property meets its high standards, such as necessary repairs not being excessive and HVAC compliance.

Roofstock also ensures there are no issues with the title or disclosure and that rent payments are current.

Roofstock also has two guarantees to give you peace of mind: a 30-day money-back guarantee and the lease-up guarantee. While the former is self-explanatory, the lease-up guarantee applies to vacant homes purchased through Roofstock. With this guarantee, if your investment property is not occupied within 45 days, Roofstock will pay you 75% of the market rate for rent. It will continue to do so for up to 12 months.

Roofstock Eligibility Requirements

If you want to invest in Roofstock properties, there are no requirements to use Roofstock’s basic service. If you want to use Roofstock One, though, you must be an accredited investor.

To be an accredited investor, you must have at least $200,000 in income ($300,000 for couples) for the past two years or have a net worth of $1 million or more. If you don’t meet either of these requirements, don’t worry because you can still use the Roofstock marketplace.

Ready to Get Started?

If you want to start investing on Roofstock, anyone can start using the service. There are no requirements to get started as an investor; the only requirement is having the capital to invest in Roofstock properties.

Part of the Roofstock service is connecting you with lenders, but their requirements will be much the same as any other lender. That includes putting 20% down for a conventional loan.

That said, if you feel you are ready to start investing, head over to Roofstock and start browsing properties.

By: Bob Haegele

By: Bob Haegele