We talk quite a bit about M1 Finance here as it’s one of our favorite ways to invest. However, something we haven’t discussed much is the M1 custodial account. This accounts lets you open an account in the name of a family member (usually your child) to give them a head start at building wealth.

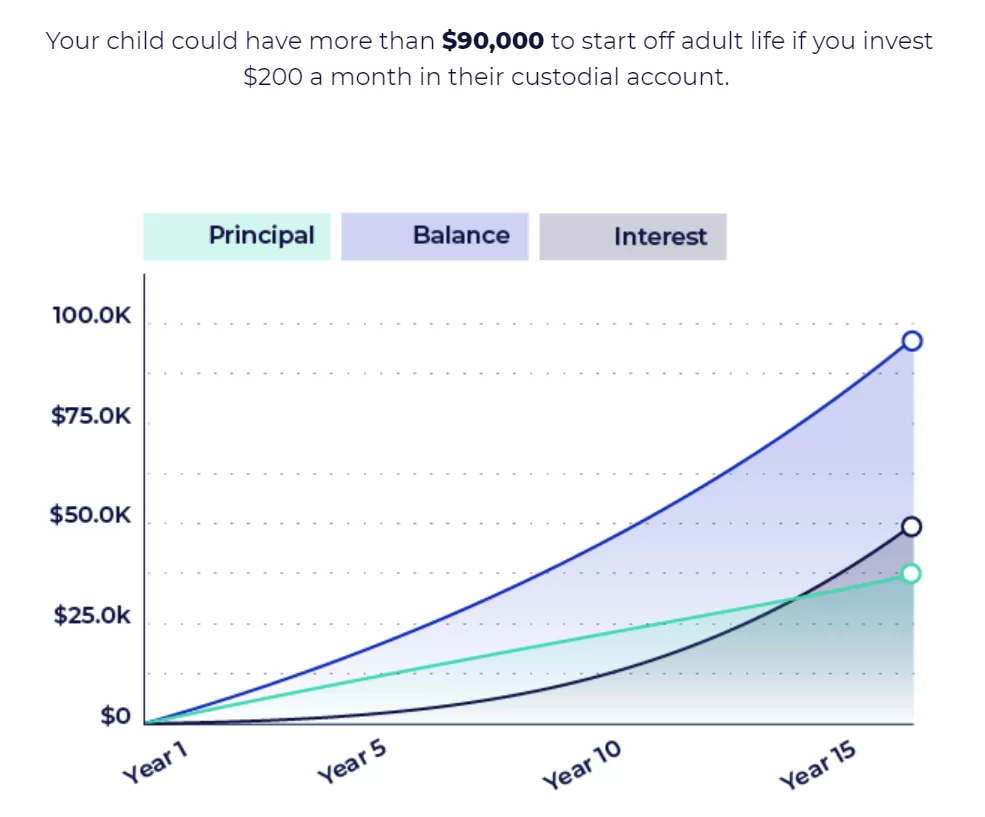

We love this idea for those who have the means because compound interest is more and more powerful the longer the time horizon. Note: M1 custodial accounts are only available to M1 Plus subscribers which is available for $125/year.

What is an M1 Custodial Account?

Custodial accounts are investment accounts you open on behalf of a minor (typically your child). This type of account is not exclusive to M1; it is common for brokerages to offer them.

While the child is a minor, these accounts will continue to work much like a brokerage account. If you open an M1 custodial account for your child, you will manage all of their investments under your login.

UTMA vs. UGMA

Depending on where you live, your custodial account with M1 will either be designated as UTMA or UGMA. The two acronyms stand for:

- UTMA: Uniform Transfers to Minors Act

- UGMA: Universal Gifts to Minors Act

While this is a seemingly minor difference in naming convention, it has an impact on how you handle the account. In fact, each state has its own majority age for both UTMA and UGMA. Majority age is the age at which the account will be transferred to the beneficiary.

Funding an M1 Custodial Account

As M1 states on its website, each deposit into the account is considered an irreversible gift to the beneficiary. While there is no maximum contribution amount, there could be tax implications for making deposits. If you have questions about taxes, it’s best to meet with a financial advisor.

Because M1 custodial accounts integrate directly with M1 Finance, it all works quite seamlessly. You can fund the account with your own money, manage the investments in your account, then easily transfer the funds once your beneficiary reaches majority age.

M1 Custodial Account Features

M1 custodial accounts use the same system as other M1 Finance investment accounts, meaning you get all of the same features. That includes its pie investing system, expert pies, and more.

Clearly, this is an easy and convenient way to start building wealth for your child or children. To learn more about features specific to M1 Finance, see our M1 Finance review.

Are There Any Fees?

There are no fees specific to the M1 custodial account. However, this feature requires an M1 Plus subscription which costs $125/year. M1 Plus also has other features, such as two daily trading windows, cash back on debit card purchases, and lower interest rates for M1 Borrow.

Frequently Asked Questions

You probably have some questions about using a custodial account with M1 Finance. Don’t worry: we’re here to answer your questions.

Can I invest with a custodial account?

You can certainly invest with a custodial account. In fact, that is one of the best things about them. M1 Finance gives you access to thousands of stocks, bonds, and ETFs. Your M1 custodial account will let you invest in the full suite of these funds for your child.

Does M1 Finance have custodial Roth IRA?

Custodial accounts at M1 Finance are taxable accounts that cannot be transferred to an IRA. They can only be transferred to a taxable account or liquidated when the minor reaches majority.

However, M1 does offer inherited IRAs, including a Roth option.

Can you take money out of a custodial account?

While it is possible to do this before the majority age, it’s not recommended. Money taken out must benefit the child, such as covering school expenses. Plus, money taken out may have tax implications.

Should You Open an M1 Custodial Account?

Custodial accounts are a great option for parents and legal guardians looking to build wealth for their beneficiaries. One thing to keep in mind, however, is that custodial accounts can reduce financial aid eligibility more than 529 savings plans.

In other words, if you think your child will attend college and will need to take full advantage of financial aid, a 529 plan may be a better option.

Still, M1 Finance has simple portfolio management and M1 custodial accounts integrate seamlessly with the M1 system. While they do require an M1 Plus subscription, you also gain several other useful features to make M1 even better.

To get started with M1 Finance, head to their website and create your account.

By: Bob Haegele

By: Bob Haegele