Personal Capital in a Nutshell

Personal Capital is an online platform and mobile app to help you understand your money and invest it more wisely. Personal Capital is really two services: 1) a Personal Finance aggregator, for every financial/investment account you have, and 2) a discounted investment advising and wealth management service aimed at wealthy users with internet savvy. Personal Finance uses a “freemium” business model, where a handful of paying users cover the cost of the free tools used be everyone.

Click to Check out Personal Capital for Free.

The personal finance aggregation is free. It syncs every single financial account a user has: checking, savings, mortgages, credit cards, 401(k), IRA, etc. Users can see their net worth, spending habits, upcoming bills and credit card payments, and on and on and on. Personal Capital is also great for retirement planning. Users can see all of their investments brought together in one handy dashboard visualizer, organized by market cap, industry, and other variables. Simply put, Personal Capital makes it easy to SEE your money in motion.

Though some compare Personal Capital to Mint, it’s not focused on debt reduction and budgeting like Mint. Instead, Personal Capital is the logical next step after Mint – the place you go to keep an eye on all of your money while you watch it grow, after you’ve learned to budget and eliminate debt. We’ll cover the fine points of Personal Capital for both of its customer bases (Personal Finance and Investment) below. CNBC Disruptor 50 has included Personal Capital two years in a row. Personal Capital is (in its own words) “a 360 degree view of your financial life”, and we agree.

The Personal Capital Story

Personal Capital was founded in 2009 by (then and now) CEO Bill Harris. If that names sounds familiar, it’s because Harris was formerly CEO for Paypal and Intuit. Personal Capital has enjoyed steady funding and growth ever since. Personal Capital is a registered investment advisor with the Stock Exchange Commission.

Today they track the finances of more than one million users, to the tune of $240 Billion. They manage another $2.4 Billion in investments, for their users with between $25,000 and $2,000,000 in liquid assets. This class of investor has been historically underserved by Wall Street. Wealthy by most standards, quality and affordable investment advising hasn’t been the norm until Personal Capital.

Personal Capital’s Unique Methods

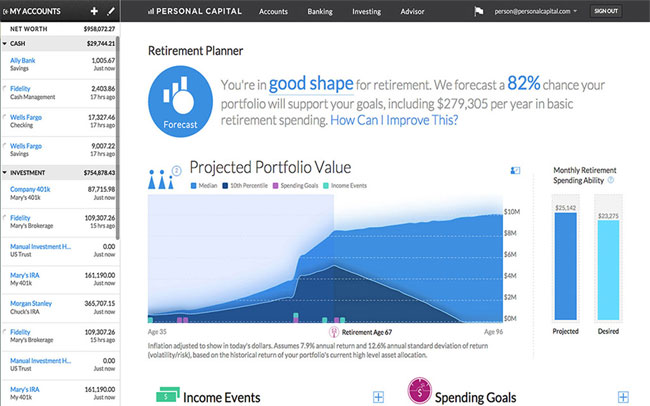

Personal Capital offers a variety of services, without ever becoming cluttered. For people just hoping to keep better track of their finances, its Cash Flow and Spending tools offer amazing clarity. For people who want to make sure they’re on track for retirement, the Retirement Planner tool offers analysis, targets, backtesting for new allocations, and more. For experienced investors, Personal Capital provides personalized advising with a real-live advisor, all for less than almost all traditional advising services.

There are plenty more details to cover, but we can already say that EVERYONE should try Personal Capital for its free services alone. It takes only a couple of minutes to sync all of your financial accounts, then BOOM – there’s all of your money, investments, and spending in one handy dashboard. It’s never been easier to understand the movement of your own money. I personally use Personal Capital for this purpose every single day, and I don’t expect to quit anytime soon.

Personal Capital Review: Frequently Asked Questions

Here are some quick answers to common questions about Personal Capital. Check these out before digging into the full review below.

Personal Capital Vs. Mint? They’ve for different customers. Mint is about budgeting and debt reduction. Personal Capital is the app to move to after you’ve graduated from Mint. It can help you build wealth and avoid debt forever. Frankly, Personal Capital also works much better than Mint – fewer bugs, blips, and bungles.

Personal Capital Vs. Quicken? Quicken was owned by Intuit. Mint is a service of Quicken. Personal Capital’s CEO, Bill Harris, used to be CEO of Intuit. This should tell you something. Quicken is an old-fashioned way of managing your finances and investments on your PC, with limited mobile power. Personal Capital is in the cloud, available on every device you use. It’s faster, sleeker, and much more agile. Personal Capital cannot import Quicken data, but integration of all accounts is so fast, that likely won’t be a problem. Legacy Quicken users often keep their Quicken records, and you may want to do the same.

Personal Capital Vs. YNAB? Like Mint, YNAB is about getting out of debt and budgeting your income for long term growth habits. It’s about the bare basics of personal finance. Once you’ve gotten this under control, you need something more. Personal Capital is that thing.

How Does Personal Capital Work? Personal Capital syncs all of your financial and credit accounts into one easy-to-understand dashboard. It also offers investment advice for a fee to high-net-worth users.

How Does Personal Capital Make Money? Personal Capital is a freemium service. Hundreds of thousands use its personal finance tools for free. A few thousand wealthier users pay fees for personalized investment advice and management. These fees cover the cost of the free portions of the platform, and pay the salaries of Personal Capital’s executives.

How Much Does Personal Capital Cost? Personal Capital’s fees for investment advising and management are below. These costs cover everything (ETF expense ratios, rebalancing, tax loss harvesting, everything you buy, everything you sell, one-on-one calls with your advisor, etc.). These fees are higher than other “robo-advisors”, but less than the services of traditional investment managers. We’ll cover this in more detail later in this review.

- $1 Million or Less — 0.89% Annual Fee

- $1 Million to $3 Million — 0.79% Annual Fee

- $3 to $5 Million — 0.69% Annual Fee

- $5 to $10 Million — 0.59% Annual Fee

- $10 Million or More — 0.49% Annual Fee

How Often Does Personal Capital Update? Frequently. Unlike old-school programs like Quicken, however, you never have to worry about performing updates yourself. Users tend to like Personal Capital’s updates, as they always seem to make the platform sleeker and more powerful. This Personal Capital review highlights the company’s great response to user feedback, so expect to see crowdsourced solutions to platform weaknesses.

Is Personal Capital Safe? Yes, Personal Finance is one of the safer finance apps we know about, actually. You’ll register every device you use Personal Capital on, and each login calls for two-step verification. That might sound like a lot, but it’s as convenient as possible while still providing users with extra security. IOS apps enable fingerprint scan technology. Account info is never stored in plain text. Free users can’t perform withdrawals or transfers online – all information is read-only.

Is Personal Capital Available in Canada? Yes, indeed.

Digging Deeper into the Personal Capital Review

By now, you should understand the basics of Personal Capitals’ functionality. We’ll help you figure out if Personal Capital is right for you by breaking it all down even further. We’ll start by talking about what Personal Capital offers free users.

Personal Capital – the Free Stuff

So you’ve decided to create your Personal Capital account. (Everyone should do this. It’s free. It takes less than ten minutes. No one is going to try to upsell you. There simply isn’t a downside.) You start by inputting the account numbers for all of your checking and savings accounts, credit accounts, loans, investments, IRA and 401(k), etc. In this Personal Capital review, we’re glad the company has even integrated with Zillow, so that if you own your home, the latest estimated value appears as part of your overall net worth. It’s about as comprehensive as you’ll get with any financial app out there, and it only takes five or ten minutes to set up.

Once you’ve added all of your financial accounts, Personal Capital unfolds. Your dashboard shows every aspect of your financial life, down to the penny. As the weeks go on, you’ll see every purchase and saving decision as it happens. You’ll see your bills paid, and receive notifications for when new bills and credit card payments are needed. You can measure your budget with ease, as it relates to your weekly/monthly/yearly cash flow.

Personal Capital’s “You Index” is a very interesting feature. Unlike competitors who only show financial projections for how your investments will (hopefully) grow in the future, Personal Capital can backtest investment strategies to give you even more insight and decision-making power. You’ll see all of your stocks, ETFs, and mutual funds, from a historical perspective. Their performance will be extrapolated backward so you can see how a current allocation model would have performed in years past. It’s no crystal ball, but it’s certainly an interesting feature that isn’t seen on other financial apps.

We could go on, but free users should open an account and play around. There are so many ways to use this information. Some users will want to focus on daily spending, but other users will focus more on retirement and investing. This is another area where Personal Capital shines.

Personal Capital amazing free tools for investment, 401(k) analysis, and Retirement savings/investment. For retirement, you’ll be able to see how your current savings and investment patterns will work to achieve your retirement goals. You’ll see how events like homebuying and social security will factor in. You’ll also see easy ways to save money on your 401(k) and maximize its performance. At this free stage, Personal Capital doesn’t actually manage these investments. The visuals they offer mimic those provided by Betterment. For DIY-minded investors, these tools alone may be a defining value proposition of Personal Capital vs. Betterment.

Personal Capital – the Stuff You Pay For

Personal Capital’s offerings completely change when users start to pay. Morphing for financial aggregator to full-on investment management think-tank, Personal Capital offers more hands-on attention than any other “robo-advisor”. Personal Capital calls it “tech-enhanced” advising. Their strategies demonstrate strong returns and a slightly unconventional investment allocation strategy.

As stated earlier in this Personal Capital review, the company seeks out users with between $25,000 and $2,000,000 in liquid assets. These users are underserved by Wall Street money management firms, and Personal Capital strives to provide world class human advising for a lower price than you can get anywhere else. The fees are available above, but we’ll include them again here for convenience:

- $25,000 to $1 Million — 0.89% Annual Fee

- $1 Million to $3 Million — 0.79% Annual Fee

- $3 to $5 Million — 0.69% Annual Fee

- $5 to $10 Million — 0.59% Annual Fee

- $10 Million or More — 0.49% Annual Fee

You get a lot for your money, even at the introductory $25,000 level. This includes support for IRAs, joint accounts, trusts, taxable accounts, and more. All direct investing costs and fees are included. Tax harvesting and automatic allocation rebalancing are also included. Users with up to $100,000 in managed assets get one personal advisor. This advisor strategizes with Personal Capital’s advisory committee, then brings recommendations back to you. You always have the final say of where your money goes.

Users in the $25,000 to $100,000 level have their funds diversified into ETFs (expense ratios of about 0.09%). Things get a little more complex for users with more than $100,000 of managed funds. Their money goes into ETFs and individual securities, according to an algorithm model known as Smart Indexing. Smart Indexing is a unique Personal Capital value proposition, investing funds equally into all sectors instead of traditional index models. Backtesting shows that Smart Indexing would have outperformed the S&P by 1.5% each year since 1990.

Users with more than $100,000 in managed funds get two advisors. Users with more than $1,000,000 in managed assets become part of the “Private Client Group”. This opens up private banking services and investment plans including assets not help with Personal Capital (real estate, stock options, personal businesses, etc.). The more you invest, the cheaper and more personalized the service. Your globally diversified funds are made part of an intensely personal investment strategy, including life goals, expense milestones, and individual learning opportunities.

Personal Capital – To Pay or Not to Pay?

This is a point of controversy among users, reviewers, and internet commenters everywhere Personal Capital is discussed. It’s clearly worth a closer look. For investment management, Personal Capital charges between 0.49% and 0.89%. That’s expensive for a robo-advisor….but Personal Capital is much more than a robo-advisor. Your advisor (or advisors) is a real human being. They can implement personalized strategies that are far more nuanced than (admittedly cheaper) alternatives like Betterment.

Lots of investors have knee-jerk aversions to these fees. At the same time, Personal Capital’s Smart-Indexing investment model is promising. Simple research shows that sector-derived diversification has outperformed index fund models in recent years (+1.5% annually, according to Personal Capital’s own numbers). This advantage alone would negate the management cost. What’s more, traditional Wall Street management usually costs more than 1% annually, at least. Personal Capital is a deal by comparison.

In the end, it’s all about what you want. If you want personal investment management from a qualified human being with whom you can talk on the phone, Personal Capital is something of a steal. If you are a salty DIY index fund devotee who has carefully scrubbed your portfolio of all unnecessary costs, Personal Capital’s paid investment management services may not be for you. No single aspect of these considerations make these services good or bad – it’s all about the needs of individual customers.

Pro-Tips and Details About the Personal Capital Experience

- Everyone should use the free service. I’ve been a user for some time, and I honestly don’t have any other resource that more clearly shows the details of my financial life.

- Be exhaustive with your linked accounts. At first I didn’t include every credit card, checking account, brokerage account, and loan balance in my Personal Capital account. Now I have, and I wish I had done so earlier. It only takes a few minutes. Doing so gives you an incredible amount of information and saves a ton of time. I can’t think of another way to better gauge your own financial health.

- As you improve your financial life, prepare to be advertised to. We’ve already covered the fact that a small number of paying users cover the cost of the free user experience. As your net worth increases – specifically, when you have about $25,000 in liquid assets – you’ll start to get friendly emails and phonecalls from Personal Capital, offering help. These are sales calls. They’re nice sales calls, but sales calls all the same. This isn’t a problem for me, but it’s the small price you pay for using this awesome free service. And who knows, maybe you want to pay for the company’s investment management services.

- There’s an Apple Watch App! I haven’t tried it, but the apps for smartphones and iPad are choice.

Personal Capital Customer Reviews

- The Warrior at MoneyUnder30 had this to say:

“When I first hear about Personal Capital just a week ago, I thought about how difficult it would be to get everything aggregated. Boy, was I wrong. Highly suggest this site for seeing allocations of growth and cash flow. In just the last week, it has been so easy to see how we are doing financially and what areas to address. Highly suggest Personal Capital.”

- Bill at CashCowCouple had this to say:

“I signed up for their paid service this week. They offered me 3 months free (apparently this is offered if you deposit more than $250k). I moved a couple of accounts from XXXXXXXXXXXXX where I was paying 1% and not happy with the performance (it was broker who my mother-in-law used and we decided to stay with him when she passed away since the money was already there and he had history with the family) so at least with PC I’m still paying less than I was if I stick with them after the fees kick in. We’ll see how it works out. We have a larger distribution coming from the estate in a few months (some real estate sold) so this way I will have an opportunity to see how I like them before having to decide what to do with the new money. I will say that I was impressed with the rep I’ve been dealing with.”

- Zman in SC at CashCowCouple had this to say:

“I’ve used Personal Capital’s full services for 3 years and have had absolutely no problems, with the site, functionality or security. Currently they manage 4 accounts – 3 qualified (tax sheltered IRAs) and 1 non-qualified. Their performance has consistently negated the management fee.

Tax-harvesting is a plus… Case in point; their investment strategy takes advantage of a position that is sliding “left” and at year end the offset against right-moving gainers keeps Uncle Sam’s cut lower than I could ever do on my own.

Portfolio diversification is perhaps their strongest offering – their approach to Sectors and weighting takes the sting out of market fluctuations; even contractions such as those we just went though in August 2015. I’m quite certain having a well diversified portfolio is why the “correction” had a negligible impact on the qualified accounts and while the non-qualified account did flex down, it recovered to very near par just as fast.

The Dashboard is a very handy tool as well. It lets me have a one-stop snapshot look at income, spending, investments, consumer credit and liquid assets on a single page and the option to take a closer look at each investment account and categorize income and expense. There are also some other “bells and whistles” for analyzing fees and doing investment checkups.

Working with a knowledgeable adviser has its benefits as well. My portfolio is “my portfolio” not a cookie cutter product. It is a collaborative effort; with portfolio diversification positions proposed by a professional investment committee based on my individual timeline, risk vs. reward tolerance, income vs. expense and tax position.

To close, perhaps the most important element of my relationship with Personal Capital and why I chose them is that at every level Personal Capital is committed to act in a fiduciary capacity regarding my portfolio. Seek out and read what Bill Harris has to say about fiduciary responsibility; he practices what he preaches. Our mutually agreed mantra is, “if I do well, Personal Capital does well”. It works for me…”

- Dawn at FrugalRules had this to say:

“After using Mint for years, I made the switch last month to Personal Capital. It is awesome! Though our 401s see our only investment right now,I am watching the net worth feature as I pay down debt. This app is the best freebie!”

- Wolfman at MoneyCrashers had this to say:

“After a year using Personal Capital on a free basis I took the plunge and invested 100K as a paying client. I actually wanted to do this for three reasons. First, I wanted to consolidate 3 accounts (a XXXXXXXXX account; some random stocks in XXXXXXXX, and some under-performing “socially responsible” funds) into a single account managed by Personal Capital. Second, I felt that I didn’t have enough knowledge how to position myself in the event of market correction and Personal Capital seemed to have some knowledge in the area of alternatives like gold, materials, commodities, etc. Lastly, I really don’t know finances that well and I liked how Personal Capital diversifies evenly across a wide range of investment types, many of which just didn’t understand. Transferring funds from 3 accounts to Personal Capital did take about 1-2 weeks, but in the end, it really wasn’t that hard. The people at Personal Capital were terrific and really worked with me to facilitate this. All I really had to do was e-sign documents on a regular basis and in the end, the 100K transfer went off without a hitch. In terms of performance, we had a slight dip in the market last week and I noticed my Personal Capital account hardly changed. This was I believe due to the great diversification of their plan. It will be interesting to see how this holds up in the future. Given the user interface, the competency of the Personal Capital advisors, and the overall strategy and results to date, I’m liking it. If things go well in the next few years, I will roll-over my 403B when I retire.”

Conclusion

Personal Capital is useful and easy to understand. It’s free services give users a comprehensive look at their own personal finance health, investments, and retirement potential. Paying customers can get help to take their investments to the next level. While wealthier users will have to determine whether the paid advisor services are worth the cost, everybody should sign up for a free account with Personal Capital. The free personal finance tools are simply too helpful to resist. We believe that Personal Capital can give you a stronger grip on your finances, no matter who you are.

Click to Check out Personal Capital for Free.

Rating: 4.6 / 5

I have briefly considered using sites such as Betterment or Personal Capital; however, the fees make me incredibly leery. Thanks for the review and something to chew on.

What are the fees with these companies?

The fees for Personal Capital are outlined above. For Betterment refer to this review: https://www.goodcreditinfo.com/betterment-review/

The fees do prevent it from being a good option for a more active investor, but for someone who wants a managed portfolio, the fees are not bad.

A always, it comes down to value. Any money that is not invested, or is paid out as fees from an investment, is not benefiting from compound interest. The question is, does the service or advice you are paying for exceed the value of what that money would have earned in an investment or x number of years? For anyone that hasn’t watched PBS’ The Money Gamble (https://www.pbs.org/wgbh/frontline/film/retirement-gamble/) and is not familiar with John Bogle (founder and former CEO of Vanguard), I highly recommend. It is also available for streaming at Amazon.

If you’re heavy into scrutinizing your investments on a regular basis, I can see the desire to go with Personal Capital over Mint.

I’ve become decidedly hands-off so I stick with Mint due to all the spending history I have there.

If there’s a good migration tool, maybe I would think about a switch?

I thought Mint was more for day to day budgeting and not for investing. Either I just don’t know all the features of Mint or maybe you’re mixed up. For budgeting software it does seem that you get committed to using one tool once it’s all setup and history builds up.

I’ve never heard of Personal Capital so I appreciate the detailed review of its benefits. I’ll check it out when I have more to invest, thanks!

Like you Monica I have never heard of them. There are so many investing companies and tools out there its hard to keep up. Thanks for the review Joshua.

I’m not sure if they are relatively new or just haven’t done much marketing. I hadn’t heard of them until recently, but they sound like a good option for someone who wants decent returns on a managed portfolio.

Definitely their price structure is for big investors and probably we need to find other alternatives which can work with our lower budget. A very good detailed review

It does make sense that they would specifically target bigger clients with more favorable rates for them. There’s a lot more potential gain with less hassles when dealing with that demographic.

Hmmm…

Sounds like a pass. Thanks for the detailed review Jeremy!

Yeah it’s not for everyone. Each investment service does seem geared toward specific people. I guess it’s tough to create an investing product that really satisfies everyone.

There are a few more things that I don’t care for with Personal Capital. For example, their 401(k) fee analyzer and investment checkup tools look pretty, but don’t offer up any actionable guidance. They also lack in daily money management functionality as much as they shine in the investing side of Personal Finance.

With that said, I still really dig Personal Capital. Their interactive site and Apple/Android apps plus their dazzling visuals (with drill-downs, no less) are enough to make even a minimalist like me appreciate what a great graphic can do.

Personal Capitals has all kinds of great things that you can enjoy for free like ease of use, tax benefit tools and free analyzers. But personal capitals do not manage the investment management fees. Overall, personal capital is a great company to work with. They charges five tier pricing structure to follow. There are various tools offered by Personal Capitals like Tax Benefit Tools, Universal check books, Net Worth updates, Fee Analyzer, Asset allocation tools, Performance Checker, Availability tools etc. It is a great company with incredible tools. For big investors they have the tools and expertise to make your dollars work harder.

I really like Betterment, it’s really helped me gain confidence as a investor, the platform is so easy to use and I enjoy tracking the progress. Great post and thanks for all the recommendations.

Do not take any Bonus offer from your broker or your manager, do not allow your broker manager trade on your behalf. That is how they manipulate traders funds. If you need assistance with retrieving your lost fund from your broker or Your account has been manipulated by your broker manager or maybe you are having challenges with withdrawals due to your account been manipulated. Kindly get in touch with me and I will guide you on simple and effective steps to take in getting your entire fund back.