There’s an expression that has gained steam in the past couple of years on Twitter: “Personal finance is personal.” It has become something of a cliché at this point, but that doesn’t make it any less true. The fact is that personal finance is very different for everyone, and that can make it tough to make sense of it all.

As a result, we decided to put together a master list of personal finance statistics. This will cover a wide variety of different areas, from budgeting to student loans to financial literacy.

While it will be tough to capture all of that in a single article, we’re going to give it a shot. Hopefully, this will help you gain some perspective on personal finance in the US.

Now, let’s get to the personal financial statistics.

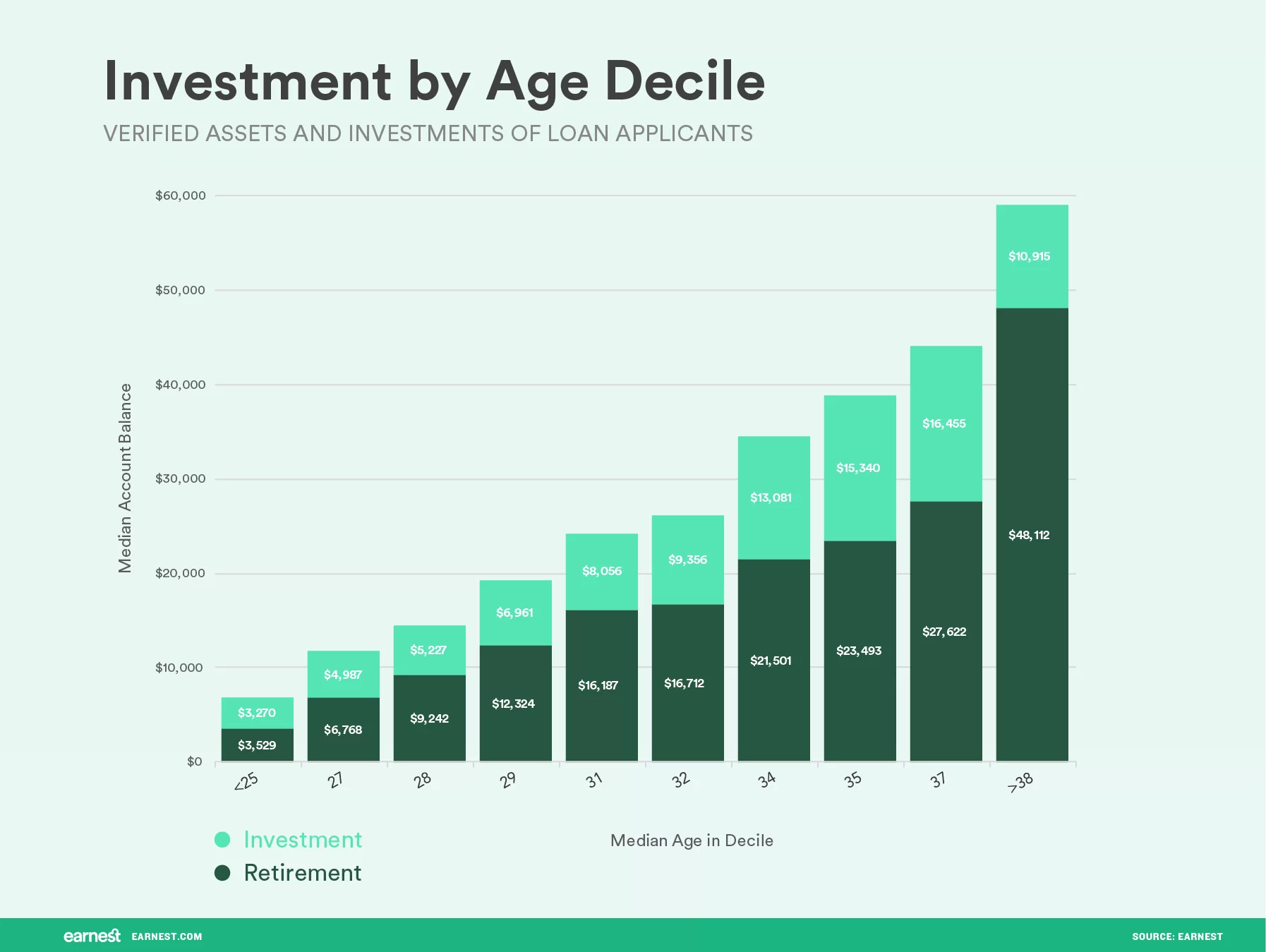

Investing

Investing is one of the best ways to grow your net worth and secure your retirement. However, many people find the market scary or intimidating, as you’ll see in the investing statistics below.

In addition, socially responsible investing is becoming a large theme. This has even led some to investors to turn to Betterment investing, which offers social impact portfolios. Some investors also prefer Motley Fool stock picks for the best returns.

Here are some of the numbers:

- According to a Triodos poll, almost two thirds of 18-34-year-olds said they would prefer their money support companies making a positive contribution to society. (Capital.com)

- 66% of people aged 18-29 say investing in the stock market is scary or intimidating, compared with 65% of those aged 30-39. That figure drops to 58% for those 40 to 54, and 57% for those 55 and older. (Forbes)

- 52% of those aged 21-36 have their savings in cash, according to Capital.com.

- According to Forbes, 20% of Millennials have their retirement money invested mostly in bonds, money market funds, cash, or other low-risk investments. That compares to 15% each for older generations.

Net Worth

Net worth can be a bit of a sore subject for many people. Financial literacy and investing play a big role, and those who are born into wealthy families often have an advantage. Despite these issues, though, younger generations have seen their net worth increase more rapidly in recent years.

Below are some key net worth statistics:

- In 2019, the median household net worth was $121,700, and the mean was $748,000. (Federal Reserve)

- Those aged 20–39.9 had a median net worth increase from $31,500 to $44,000, a 40% increase, from 2016-2019.

- Those aged 80 and above saw their net worth decrease in the same time period.

How do you compare?Net Worth By Age: Are You Saving Enough?

Credit Card Debt

Credit card debt is significant in the US. Although credit cards can be a very useful tool, their utility is greatly reduced if you are constantly paying interest.

A sure way to keep paying interest is to carry a balance on your credit cards. It seems many of us do, as Americans had hundreds of billions of credit card debt in 2018.

Here are more credit card debt statistics:

- Americans had $870 billion in credit card debt as of 2018. (Lexington Law)

- When accounting for other sources of revolving debt, that figure climbs to $1.057 trillion.

- In 2018, 35% of Americans paid just the minimum on their credit card balances. That’s down from 2009 (40%), but up slightly from 2015 (32%). (FINRA)

- Average credit card debt was $5,315 in 2020, a decrease of $879 from 2019. (Experian)

- Total credit available for all credit cards in Q2 2020 in the US was $3.06 trillion. (Statista)

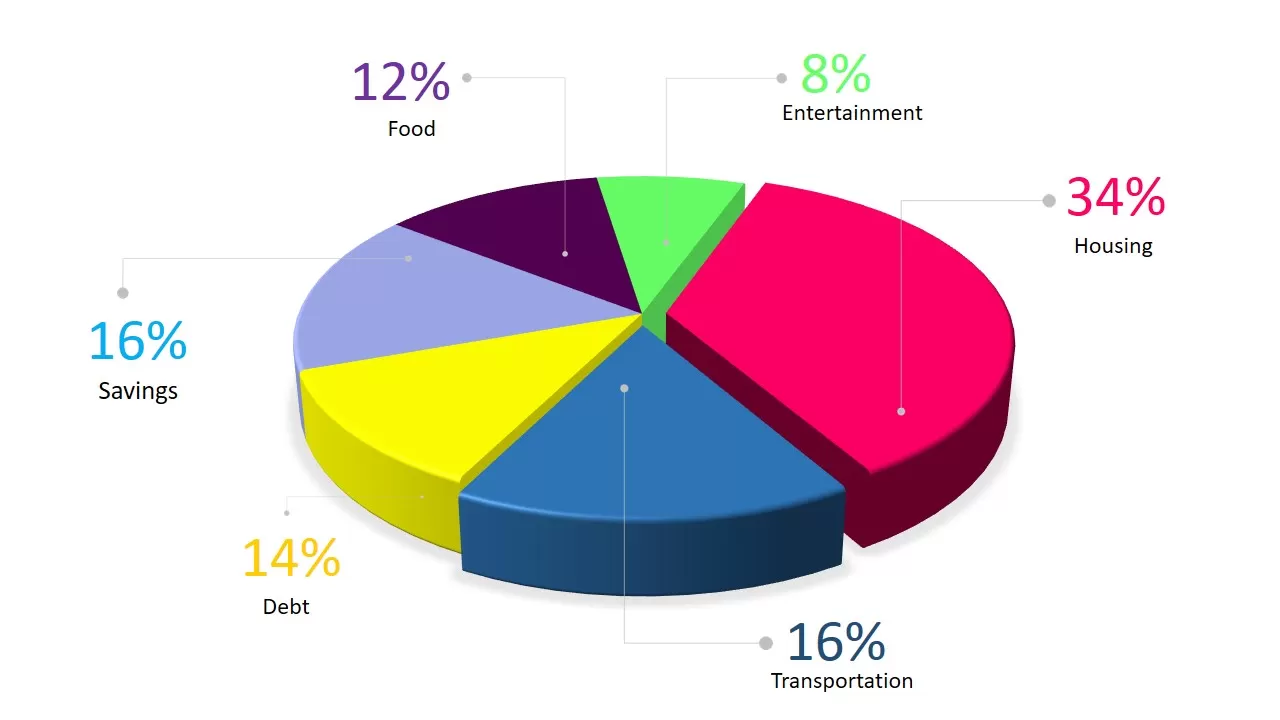

Budgeting

Budgeting is an important part of maintaining your finances. Unfortunately, it turns out that more people don’t keep a budget than those who do. And the average American spends the most on housing and transportation.

Budgeting is helpful practice because you don’t always know where your money is going until you track it. It could be the case that there are a few areas where cutting back just a bit would go a long way, but until you see it spelled out, that can be difficult to determine.

Below, you’ll find some key budgeting statistics for Americans:

- According to a 2013 poll, just one in three Americans (32%) keeps a budget. (Gallup)

- The percentage of budgeters increases slightly with a college education (38%).

- Those who earn $75,000 budget slightly more (39%) than those who earn less than $30,000 (32%).

- One survey found that among those who don’t keep a budget, the largest group (27%) said it’s because they don’t need one. (Credit.com)

- As of 2013, household income was higher than expenditures for every age group except age 75 and older. (Bureau of Labor Statistics)

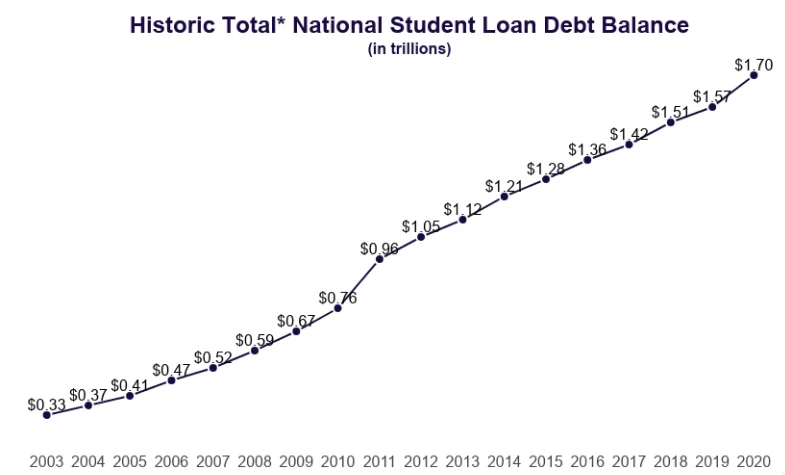

Student Loan Debt

Student loans are a pain point for a growing number of Americans. Although there are talks of possible $50,000 in relief per borrower, it isn’t clear that that will come to pass. For now, millions of Americans are dealing with increasing amounts of debt.

Image credit: EducationData.org

Here are some student loan statistics:

- Total student loan debt is $1.70 trillion as of 2020, and it grows six times faster than the country’s economy. (Education Data)

- The average student loan debt amount is $37,500 as of 2020. (Investopedia)

- Approximately 35 million Americans may qualify for student loan forgiveness due to the CARES Act. (Kiplinger)

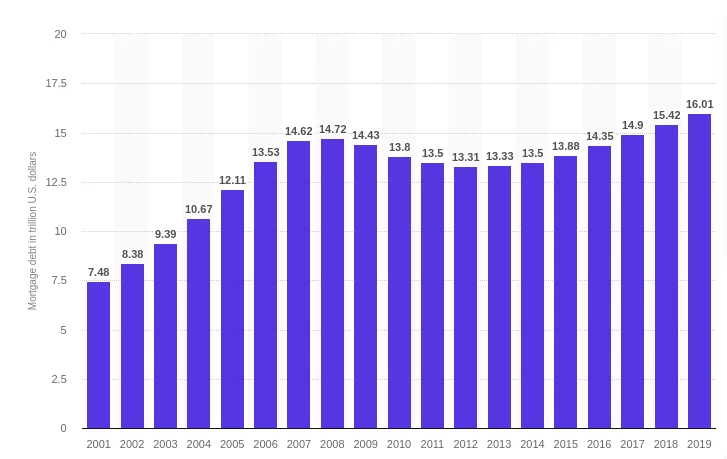

Mortgages

For most Americans, buying a home is the largest purchase they’ll ever make. That means a lot of financing and, unsurprisingly, the mortgage industry follows suit. Plus, mortgages take a long time to pay off, leading to a lot of outstanding debt.

Image Credit: Statista

Here are some key mortgage statistics:

- Purchase volume is expected to go from $1.6 trillion in 2020 to nearly 1.7 trillion in 2021. (Fannie Mae)

- Fannie Mae also projected refinance originations would be $2.7 trillion in 2020.

- Total outstanding mortgage debt was $16.01 trillion in 2019 in the US. (Statista)

Personal Loans

Personal loans are a large source of debt in the United States. While they don’t come close to the level of credit card or student loans, they are significant.

Personal loans tend to have high interest rates and can be used for many purposes. That includes not only financing large purchases but also consolidating other loans.

Here is a list of personal loan statistics:

- The total amount of outstanding personal loan debt in the United States is $143 billion. (Chamber of Commerce)

- Average interest rates for personal loans vary between 10% and 28%.

- There are 21.1 million outstanding personal loans in the U.S.

- The average debt per borrower is $8,402.

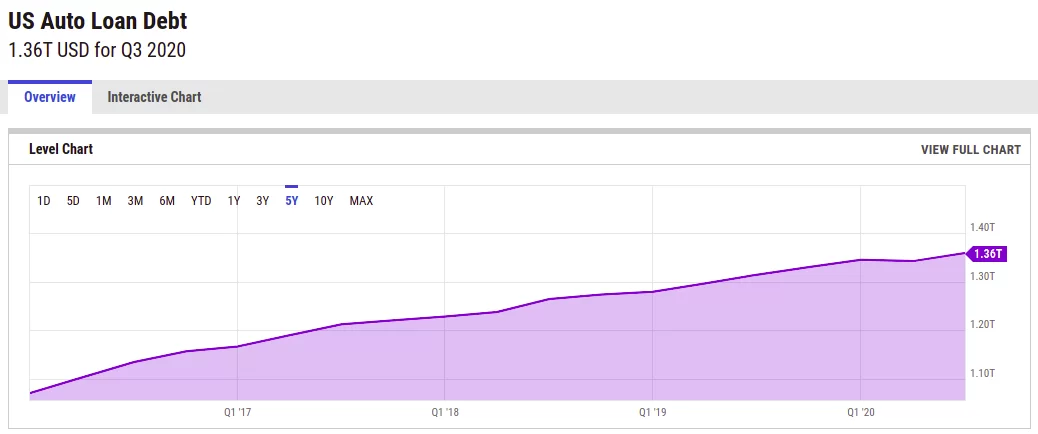

Auto Loans

In recent years, Americans have been buying bigger and bigger cars. This means bigger and bigger auto loans. As such, auto loans are a major source of debt.

Image credit: YCharts

Here are some of the auto loans statistics:

- As of Q3 2020, total auto loan balance in the US is $1.36 trillion. (New York Fed)

- In April 2019, there was a $52.8 billion dollar volume of new loans, or a 3.6% increase year over year. (CFPB)

- The average payment for new vehicles hit an all-time-high of $569 in March, 2020. (Edmunds)

- Also according to Edmunds, the average auto loan amount in Q1 2020 was $33,631.

Financial Literacy

Financial literacy is an underappreciated skill. The reality is that “you don’t know what you don’t know” when it comes to money management. As a result, many of us end up having to learn by doing, which means costly mistakes. And yet, many Americans are not what would be considered financially literate.

Here are some key financial literacy statistics:

- As part of a FINRA study, participants were asked five questions on topics such as inflation, compound interest, and interest rates. 66% of participants answered three or fewer of the five questions correctly.

- This is also worse than 2009, when 58% of participants answered three or fewer questions correctly.

- Despite the above, half of U.S. adults (55%) give themselves a grade of A or B on their knowledge of personal finance.

Retirement Savings

If you want to retire securely, retirement savings are an absolute must. While most Americans are in support of Social Security, there are looming questions over the program’s sustainability. Thus, saving money on your own is important, too.

Here are some of the retirement statistics for Americans:

- 45% of US households don’t have any retirement account assets. (National Institute on Retirement Security)

- Median retirement savings for those in their 20s is $16,000. This figure increases to $45,000 for those in their 30s, and $172,000 Americans in their 60s. (Synchrony Bank)

- Most retirement advisors recommend having at least 80% of your pre-retirement income in retirement. In 2019, the median income was $57,456. Thus, if a man retires at 67 and lives 10 more years, he would need about $459,000 saved to maintain 80% of his pre-retirement income.

- Among all adults in the US, median retirement savings is $60,000. (SmartAsset)

Tip: Try managing your 401k with Blooom, a robo-advisor that specializes in retirement accounts.

Emergency Funds

Keeping emergency savings on hand is essential for all American households, yet few have sufficient emergency savings. And with one in three Americans living paycheck to paycheck, having an emergency fund is even more important.

Here are the key statistics about emergency funds:

- Nearly half of Americans have less than $1,000 saved to cover emergency expenses. (Chicago Tribune)

- 61% of Americans said their emergency savings wouldn’t last until the end of 2020. (CNBC)

- One survey found that the median emergency fund was $2,000, while the mean was $39,900. (The Motley Fool)

Why Do Personal Finance Statistics Matter?

Personal finance statistics are important because they help you understand the big picture. They help you gauge where you are in comparison to the larger population.

For example, do you have what feels like an impossibly large mountain of student debt? This article may have revealed that the average borrower owes more than you. And depending on your personality, that could be humbling.

That said, these statistics alone won’t solve your financial woes. Of course, attacking any debt you may have is also helpful, as is opening an IRA.

Whatever you do, take this as a way to see how you stand. Having that perspective will give you some clarity and make it easier to take the appropriate action.