Saving money and investing are the keys to growing your net worth. However, it can be tricky to know how much you should save—and by what age. And in case it isn’t obvious, we can only give broad recommendations here since everyone’s finances are a little bit different.

Nevertheless, household net worth was the highest for those age 65-74 age group in 2019, according to the Survey of Consumer Finances, published by the Federal Reserve. That report showed that the median net worth was of $266,400 for those individuals those aged 65-74.

So, is that enough? Once again, it’s impossible to give a simple “yes” or “no.” Thus, this post will explore both the average savings for different ages as well as what might be a good number to target.

Net Worth by Age: A Closer Look

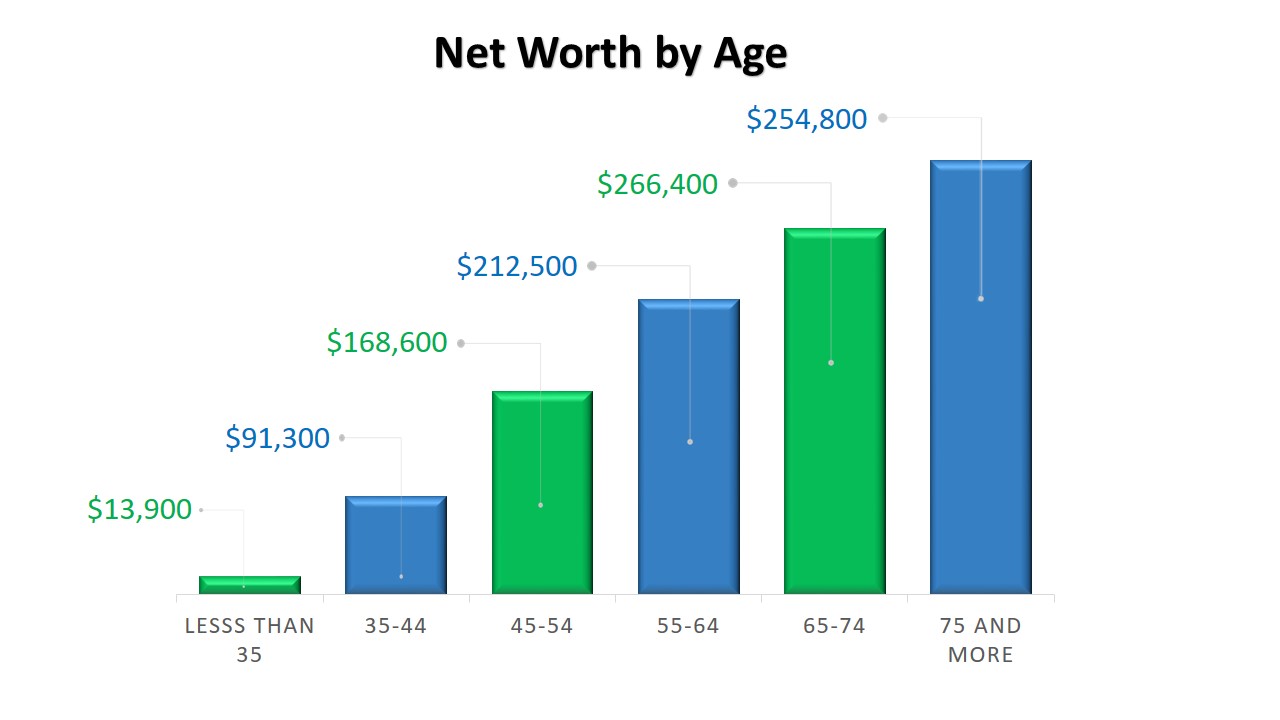

Now, let’s go ahead and break down the net worth numbers by age. These numbers will come from the same source as referenced above, the Survey of Consumer Finances.

This report was published by the Federal Reserve on September 16th, 2020. In the report, we see changes in consumer finances from 2016 to 2019. We will reference 2019 numbers here, since those are the most recent, and therefore the most relevant to today.

| Age | Median Net Worth | Mean Net Worth |

| Under 35 | $13,900 | $76,300 |

| 35-44 | $91,300 | $436,00 |

| 45-54 | $168,600 | $833,200 |

| 55-64 | $212,500 | $1,175,900 |

| 65-74 | $266,400 | $1,217,700 |

| 75 and Over | $254,800 | $977,600 |

What is Net Worth?

Simply put, net worth is the total value of your assets less any liabilities:

Net Worth = Total Assets – Total Liabilities

AssetsTypically, assets include one or more of the following:

- Cash

- Savings accounts

- Retirement accounts

- Brokerage accounts

- Any other savings/investment vehicles

Liabilities

On the other hand, liabilities include things like:

- Mortgages

- Auto loans

- Student loans

- Personal loans

- Credit card debt

- Medical debt

- Back taxes

You may notice the lack of items such as home equity and the value of your car(s). If you browse personal finance groups on Facebook and Reddit, you will probably find people asking regularly whether to include these in their net worth calculation.

While you can include them if you want, there is a simple reason not to include them. The reason is this: your net worth should generally reflect the amount of money you have to fund your retirement. Unless you plan to sell your house and car when you retire, the value tied up in those assets isn’t going to be useful.

Whichever assets you decide to include, their total value minus any money you owe is your net worth.

What Should My Net Worth Be By 30?

A common recommendation is to save half of your income by age 30. Another rule of thumb is to subtract your age from 100 to get the percentage of your portfolio allocated to stocks.

So, at 30, your portfolio would be 70% stocks and 30% bonds. Consider adjusting your allocation at least every 10 years to be sure your portfolio isn’t too volatile. Target date funds do this automatically.

| Median | Mean | |

| Net worth (under 35) | $13,900 | $76,300 |

| Income (under 35) | $48,600 | $65,100 |

In 2019, the median net worth for those under 35 was $13,900. Interestingly, the mean net worth for this age group was $76,300 in that year. This suggests that even for young people, the mean is already top-heavy.

The median before-tax household income for those under 35 was $48,600. Thus, the typical under-35-year-old is not saving half their income. The mean household income in 2019 was $65,100.

However, it’s also important to remember that net worth calculations requires subtracting student loans and other debt. Thus, those who have no student loans have a significant advantage at this stage.

Keep in mind that investing is one of the best ways to grow your net worth. And yet, only 45% of those age 18-34 have any investment accounts. That includes both taxable accounts and retirement accounts.

Growing Your Net Worth

If you are in that age group and looking to grow your net worth, your first step should be opening a retirement account. The first place to look for this is a retirement plan through your employer. However, not all employers offer them, especially if you are one of the growing numbers of workers at a job without benefits.

If you don’t have that option, you can always open an IRA for yourself, which will still have tax advantages. One option is to open a Betterment Roth IRA.

But that is just one way to start growing your net worth. Another option is to open an account with blooom, a robo-advisor specifically designed for retirement accounts.

Generally speaking, maxing out your retirement accounts should be your first priority due to their tax advantages. If you are able to contribute the maximum to your retirement accounts, you can always open a brokerage account.

You have plenty of options for brokerage accounts, but we have a strong preference for holding Motley Fool stock picks in an M1 Finance brokerage account.

What Should My Net Worth Be By 40?

At this point, a general recommendation is to have twice your income saved. You may also want to consider lowering your stock allocation to 60%.

| Median | Mean | |

| Net worth (35-44) | $91,300 | $436,200 |

| Income (35-44) | $74,300 | $110,000 |

The median net worth for those aged 35-44 was $91,300 in 2019. Meanwhile, the mean net worth was $436,200.

The median before-tax household income for those aged 35-44 in 2019 was $74,300, compared to a mean of $110,000. Thus, if you fall at the median for both income and net worth, you are still behind!

Truthfully, this isn’t a shocking revelation, but it shows how important it is to save. If you open an M1 Finance Roth IRA, it’s a lot easier to invest and grow your net worth.

What Should My Net Worth Be By 50?

The recommendation for age 50 is to have four times your income saved. Plus, you may want to make your portfolio 50/50 for stocks and bonds.

| Median | Mean | |

| Net worth (45-54) | $168,600 | $833,200 |

| Income (45-54) | $77,800 | $145,300 |

The median household net worth for those aged 45-54 was $168,600 in 2019. The mean was $833,200.

Meanwhile, median household income was $77,800, and the mean was $145,300. Yet again, the median person isn’t saving four times their income.

You may have noticed that it’s at this point that the mean net worth really starts to pull away from the median. A closer look at the Survey of Consumer Finances may help explain. For instance, the mean value of “pooled investment funds” was $854,300 in 2019. On the other hand, the median was just $110,000.

The report doesn’t break down investment fund value by age. In spite of this, we can see that the mean value of “transaction accounts” was $41,700—a small fraction of the investment fund mean.

Thus reiterates the importance of investing, as discussed above.

What Should My Net Worth Be By 60?

You should aim to have six times your salary by age 60. In addition, consider moving your portfolio to 40% stocks to reduce volatility as you prepare for retirement.

| Median | Mean | |

| Net worth (55-64) | $212,500 | $1,175,900 |

| Income (55-64) | $63,600 | $130,600 |

In 2019, the median household net worth for those aged 55-65 was $212,500. The mean was $1,175,900.

As for household income, the median stood at $63,600, and the mean was $130,600. As you may have guessed, the median household net worth is well below six times the median household income at this stage.

Nevertheless, you should still be preparing for retirement at this point. What will your expenses be, and will you work past the typical retirement age?

Ideally, you should be thinking about these questions long before retirement. But by the time you reach 60, you should already have a sense of how your retirement will look.

What Should My Net Worth Be at Retirement?

You should aim to have ten times your salary saved by retirement. Plus, you’ll want to have a conservative portfolio of at most 30% stocks. You may also be able to receive Social Security benefits at this point, which could be a big boost.

| Median | Mean | |

| Net worth (65-74) | $91,300 | $1,217,700 |

| Income (65-74) | $50,200 | $107,800 |

As you can see, both income and net worth continue to decline for the 65-74 age group—not terribly surprising.

As far as retirement goes, experts suggest you’ll need at least 80% of your pre-retirement income in retirement. Drawing down your investments does count as income, but you should aim for at least 80%. If you aren’t sure of your annual expenses, you can use an app like Personal Capital to track them.

Also, don’t forget about health care costs. It’s estimated that health care will cost about $295,000 per couple after age 65.

Net Worth by Age: Do You Have Enough?

There you have it—a framework for what you net worth should be at each age. Keep in mind that this is just general guidance, and your specific situation may vary significantly.

If you have thought about investing but haven’t started yet, try one of these best robo-advisors to get started. Remember, it’s never too late to start.

However, no matter where you are on your retirement journey, make sure you are planning appropriately. The sooner you start planning for retirement and growing your net worth, the sooner you’ll be ready.

By: Bob Haegele

By: Bob Haegele