NASDAQ CHART:

Source: https://www.marketwatch.com/investing/index/comp/charts

Source: https://www.marketwatch.com/investing/index/djia

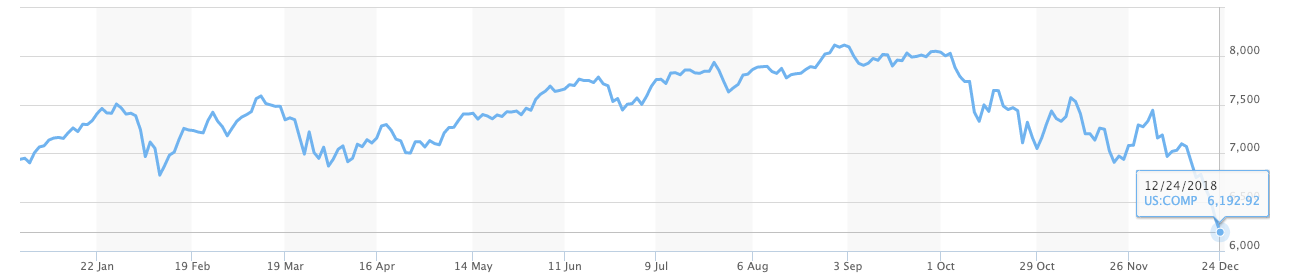

NASDAQ was trading in a range above 7000 in January 2018. Once August rolled around, it was trading over 8000. Then comes October, and it has since been in a declining trend since.

We’ve witnessed the market’s relentless economic and stock market growth for almost a decade now, and every stock market pundit was aware that the “bear” is just around the corner. However, no one (obviously) anticipated that the bull would suffer in one of the worst Decembers since the 1930s.

The index dropped 20% from its all-time high and is by definition, in a bear market. It currently trades at 6193 (approximate on 24 December), down 2.2% from its previous close. If you look at the NYSE, it’s not fairing any better with DJIA down by 2.91% on Christmas Eve trading and closing at 21,792. You could also consider the S&P 500 is in bear market territory with its latest drop of 20%.

It’s no wonder the US stocks have bottomed out this summer with everything that’s gone on. You have a partial federal government shutdown, the Trump’s dispute with the Federal Reserve’s chairman, Jerome Powell, the US-China trade disputes and interest rate hikes. The S&P 500 has suffered its most substantial monthly loss so far since the financial crisis a decade ago and is on pace for the biggest decline in any December since the Great Depression.

If you’re a stock market player, this news likely scares the life out of you. However, handling the tough times in the market decides who gets to keep the wealth generated during the bull run. Patience is the best friend of an investor, and this is especially true during market turbulence.

Recession Preparation – What To Do In a Bear Market:

1. Stop Panicking – Hang Tight

For long-term investors, the best thing to do is, well, nothing. Any activity might not be borne out of the right set of emotions, and anything done in haste will likely only lead to more panic. At this moment, your best bet is to stay rational and avoid taking any unnecessary actions.

A fluctuation in the market is not a new phenomenon and isn’t a rare one either. The ticker cannot keep moving in one direction. It must inevitably fall the other way. We hesitate between emotions of greed (bull market) and fear (bear market). Warren Buffet has held onto his investments for decades, doing absolutely nothing during bear and bull markets alike. If the company fundamentals are strong, do nothing.

2. Buy Stocks

Before the pullback, the stocks were more expensive (obviously) than in the current scenario. You’re more inclined to purchase items during the Thanksgiving sales. Why? Because the prices of the TV or shoes you’ve eyed up the last few months are slashed in half.

Similarly, with the underlying economy strong, this might be an excellent opportunity to stock up on some of your favorite companies. Make a list of stocks that you wish you could buy. As we enter a pullback, that is the time when you could buy quality businesses at throwaway prices. For some great choices, check out Motley Fool stock picks.

Recommended Stock Investing Posts:

- Using The Power Of The 80-20 Rule For Larger Returns

- Investment Diversification: 5 Risky Mistakes to Avoid

- How to Use Behavioral Finance to Your Investing Advantage

- Using The Graham Formula to Find Underpriced Stocks

- A Review of The Intelligent Investor by Benjamin Graham

- The Neatest Little Guide to Stock Market Investing Book Review

- Why Blue Chip Stocks Should Be Your First Investment

- Traditional IRA vs. Roth IRA vs. 401k

3. Resist the Urge to Sell

It is essential to control the urge to sell. Smart investing is when you buy at low prices and sell at higher prices. Selling after a crash is the exact opposite.

Warren Buffet’s famous quote, “Stock Markets are voting machines in the short run and weighing machines in the long run,” comes to mind when you see investors sell during a market crash. The underlying business has not changed. People are still buying, and Christmas sales have been strong this year. Your ability to stomach the notional loss is critical for your success as an investor.

4. Rebuild Your Portfolio

Putting all your eggs in the same basket is a huge risk; it is vital to have a diversified portfolio. After a pullback, it’s the perfect time to determine the value of your portfolio and check the asset allocation. You may need to realign yourself according to the new economic or market scenario, and a crash is a good opportunity to re-evaluate your existing strategy and see what you should change. Leverage and (or) unnecessarily high exposure in one “hot” sector (like tech currently) needs to be trimmed.

5. Dividend Investing

Investing in companies that have been paying dividends for decades gives a dual benefit of regular cash flows and an opportunity for stock appreciation when the market conditions improve. The dividend yield is enhanced due to the market beat down. Consider investing in Dividend Aristocrats, stocks that have increased dividends for 25 continuous years. Exchange-traded funds (ETFs) are also recommended for new exposure (and dollar-cost averaging) as they are not expensive and are tax-efficient.

6. Consider Investing in Defensive, Consumer-Staple–Oriented Companies

Consumer staple businesses are those where the customer cannot consider cost-cutting regardless of their financial situations. These are considered non-cyclical and are in demand throughout the year regardless of how the economy is functioning. Thus, these companies are a safe investment while diversifying your portfolio. These may include companies like pharmaceuticals, groceries, gasoline, snacks, soft drinks, fast food, and cosmetics.

Conclusion

A bear market, no matter how much it may suck, is a part of the market cycle and is unavoidable. The phenomenon does not mean a looming financial collapse and does not make any stock a bad investment. You need to re-evaluate your portfolio and stocks both individually and cohesively to ensure that each asset is a good investment on its own. They also need to serve the overall objective of your investing.

So, instead of panicking with recession preparation, consider a bear market as a golden opportunity to do some house cleaning and welcome some new stocks that had been evading your portfolio due to high prices.