As one of the oldest robo-advisors around, Betterment has redefined investing. Those who couldn’t fathom investing before are now doing so without thinking twice. As a result, Betterment’s assets under management is in the tens of billions.

While Betterment makes things easy, that doesn’t mean there can’t be missteps. Betterment has several different account types, investment goals, and custom portfolios. Thus, these tips will help set you on the right path to help you optimize your Betterment strategy.

1. Choose the Right Account Type

First and foremost is choosing the right account type. Betterment has several different account types these days, and its setup wizard can be a bit confusing. There is oftentimes overlap between the choices you see when creating an account.

Here is a quick breakdown of the types of accounts you can create in Betterment:

- Individual taxable account. This is the most basic type of investment account in which you invest after-tax dollars. These accounts offer minimal tax advantages but let you build a totally custom investment portfolio. Joint taxable accounts are also available.

- Individual retirement accounts. Betterment offers the full gamut of IRAs, including traditional IRA, Roth IRA, and even inherited IRA. As the name implies, these are retirement accounts that offer tax advantages including no tax on earnings and gains. However, IRAs have contribution limits.

- Cash reserve accounts. Betterment’s Cash Reserve account is essentially a high-yield savings account. Money in this account earns an interest rate higher than traditional banks; the idea behind the “Cash Reserve” name is you can store extra money here you don’t want to invest yet. However, this account can be used independently, too.

- Checking accounts. Betterment offers a fully-functional, online checking account. It includes several nice perks, including no ATM fees or overdraft fees. Betterment partners with banks to offer this service.

- Trust accounts. Trust accounts allows you to set aside assets which will be bestowed upon the trustee you specify.

2. Choose the Right Goal

Now that we have our account type, the next step is to invest your money in a specific goal or goals. The purpose of goals is to give your money a purpose. In other words, goals don’t materially change how your account works. The idea is to create buckets so you know exactly what you are working toward.

Here are the goals Betterment offers:

- Manage your daily spending. Selecting this goal will create a Betterment checking account.

- Save cash and earn interest. With this goal, you can either create an individual or a joint Cash Reserve account. You can also create custom individual or joint goals to save for something else, such as an upcoming expense.

- Invest in a diversified portfolio. This goal will create a taxable account for you, but you can specify your objectives. Betterment suggests saving for education, creating a safety net, investing for a major purchase (like your dream home), or

- Plan for retirement. You can use this goal to create any type of IRA, a taxable account, or a trust.

3. Select the Right Portfolio

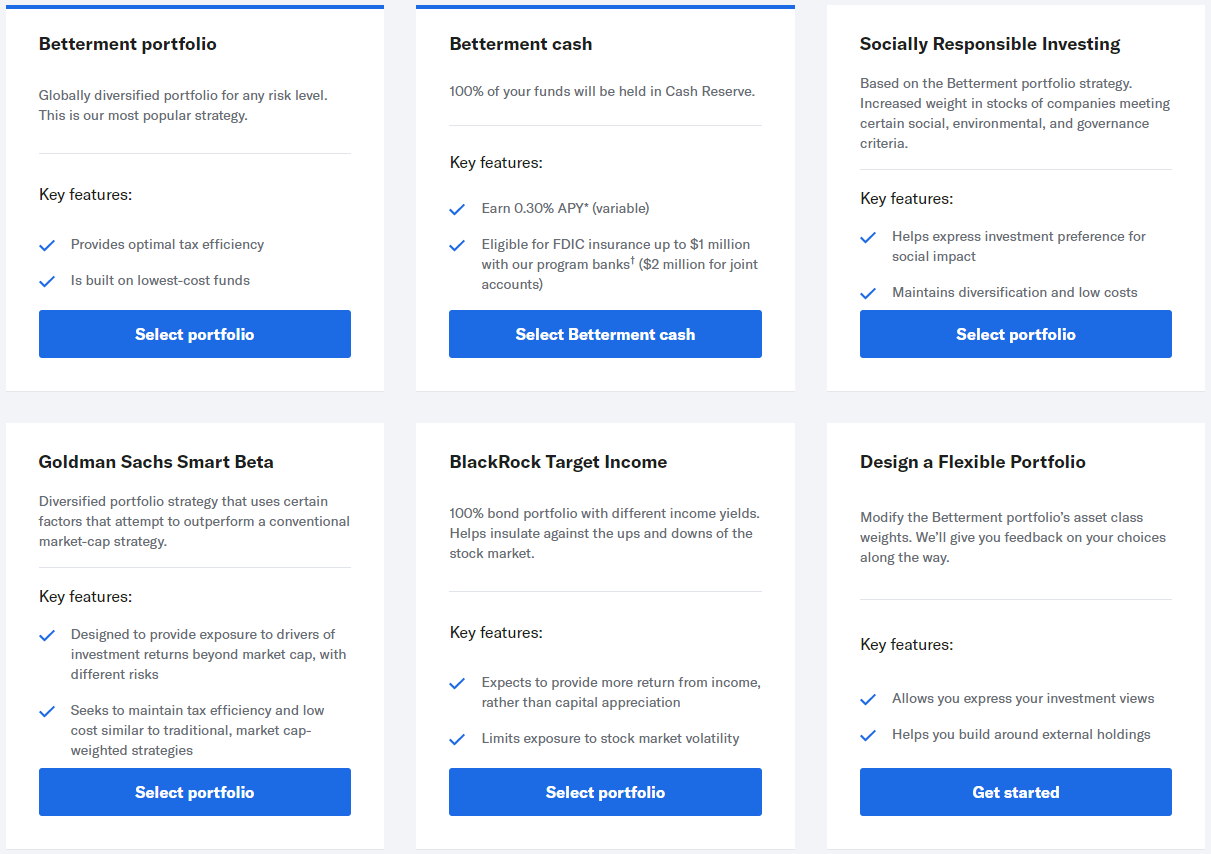

These days, Betterment has a large selection of custom portfolios. These portfolios are useful for those who want to be more intentional about how they invest. Fortunately, the description of each portfolio is fairly straightforward.

If you are a brand-new investor and have no idea what to do here, you can’t go wrong with the Betterment Core portfolio. It’s simply referred to as “Betterment portfolio” in the screenshot above.

The second portfolio listed is Cash Reserve, which you probably aren’t looking for if you are wanting to invest and build wealth. The same likely goes for Target Income.

The other main choices for building wealth, then, are the Goldman Sachs Smart Beta portfolio and the Socially Responsible Investing portfolios. Let’s briefly review each of them. Specifically, how are these portfolios “better” than the core portfolio?

Goldman Sachs Smart Beta

As you may have guessed, this portfolio is managed by Goldman Sachs. It is essentially a more actively-managed portfolio that looks to eek out better returns or reduce volatility. However, according to Senzu.io, its historical returns since 2013 are just 6%. As you can see from the graph on the page, its performance is hardly any different than that of the S&P 500.

Socially Responsible Investing

Betterment’s Socially Responsible Investing portfolios are different. The goal is less about increasing performance and more about investing in companies with strong environment, social, and governance (ESG) indicators.

That being said, an independent analysis by Morgan Stanley of 11,000 mutual funds from 2004 to 2018 couldn’t identify a meaningful drop in performance for ESG investing. The paper even goes so far as to say these funds have less downside risk than traditional funds.

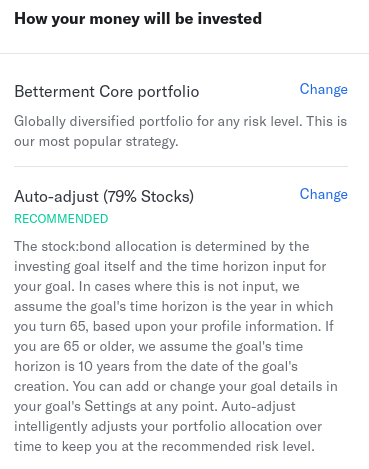

4. Properly Manage Your Allocation

Managing your allocation properly is an important part of optimizing your investment strategy. In the case of investing for retirement, this means adjusting your stock/bond allocation so you aren’t exposed to too much risk just before retirement.

When considering your asset allocation by age, there are some rules of thumb you can use. One is the 100 minus age rule, where your stock allocation is 100 minus your age. So if you are 30, you subtract your age from 100 to get 70% stocks. This is something you can adjust every few years.

However, why complicate things if you don’t have to? After all, automation is the name of the game with Betterment. And thankfully, Betterment has an option to adjust your allocation automatically.

You could always adjust your allocation on your own, but Betterment aims to do so as tax-efficiently as possible. For the average investor, this is a great feature and worth using to their advantage.

5. Invest Regularly and Stay the Course

This is the most important tip, especially when saving for long-term goals like retirement. You can rebalance regularly, invest in assets that perform well, and minimize taxes. All of these things are great, but none of them hold a candle to the power of compounding interest. For instance, investing $400 per month at a 7% rate of return over 30 years will leave you with $491,722.

But the kicker is that only $144,100 of that money is your contribution. The other portion, nearly $350,000 is pure interest.

Indeed, nothing tops compound interest. For the best results, choose an investing strategy and stay the course for the long haul.

If you’d like to get started building wealth, head over to Betterment and create your first portfolio.

Betterment Comparisons:

Related Investing Product Reviews:

- M1 Finance Review

- SoFi Invest Review

- Motley Fool Review

- Benzinga Pro Review

- Mindful Trader Review

- Betterment Review

By: Bob Haegele

By: Bob Haegele