Children are capable of more than we give them credit for. Adults often think of investing as a difficult topic, because it was difficult for them to learn at age 30 or 40, but children are so much more moldable and teachable.

As parents, we’ve got to use that. Sometimes it means raising your expectations, and that’s not a bad thing. Children will rise to your level of expectation, assuming you’re not totally unrealistic.

The stock market is a great place to invest, especially if your start early. It’s also a great place to teach kids about investing. Let’s dive in…

Start With the Basics

Start with some basic finance terms your kids can understand, and then progress from there. For kids, investing is best explained by starting with the big picture, and then zooming in, like this:

- Step 1: Return on Investment (ROI) – At the foundation of investing, your kids need to understand the concept of putting money into something, and getting money back (or losing money).

- Step 2: Risk Vs. Reward – Now you’re ready to explain how much they can expect to get back, based on how much risk they want to take.

- Step 3: How Stocks Work – Once they understand investing in general, it’s time to understand how stocks are pieces that make up a company, and that many people own those pieces, all over the world.

- Step 4: Different Ways to Invest in Stocks – Individual stocks are only one way to own stocks. Now you can explain stock funds. You can explain things like DRIPs and stock options if you want, but for kids, I would stick with mutual funds.

- Step 5: Passive Vs. Active Funds – Many adults don’t even know the difference here, but your kids must. It would be a good time to explain how passive funds outperform active funds 80% of the time.

If your child learns these five steps before they leave the house, they will be successful investors. Even if they only put money in index funds for their entire life, their early start will practically guarantee their success.

Teach Saving Before Investing

Saving money is easy for kids to understand. If you don’t spend your money today, you will still have it tomorrow. Start there. You can use the pre-teen years to instill the idea of saving some of everything they earn, and then in the teen years, you can start to teach investing.

If your kids will need the money in the next five years, they may want to keep it out of the stock market. Once they grasp the concept of saving, explain the types of things they would save for. Follow it up by explaining what they would use investing for, and then you can begin to cultivate a love for investing in them… or so we all hope.

Teach “Pay Yourself First” and the Rest Will Follow

The most important thing you can teach your kids about investing is simply to just do it. If you teach your children to invest before doing anything else with their money, they will already have a head start.

Imagine where you would be right now if you knew this concept when you were 12. We all know the power of compound interest, and this is merely a way to make sure it starts working for your kids immediately. Getting an early start will give your kids an unbeatable advantage. This leads to my next point…

Recommended Stock Investing Posts:

- Why Blue Chip Stocks Should Be Your First Investment

- Top 10 Ways to Quickly Improve Your Trading Skills

- Top 3 Bollinger Bands Trading Strategies

- Using The Power Of The 80-20 Rule For Larger Returns

- Advantages of Trading Small Cap Stocks

- 3 Reasons Day Traders Need To Use Volume Weighted Average Price

- PE Ratio: The Best Market Timing Tool of All?

- Critical Reasons To Invest In Small Cap Stocks

Show Your Kids This Chart

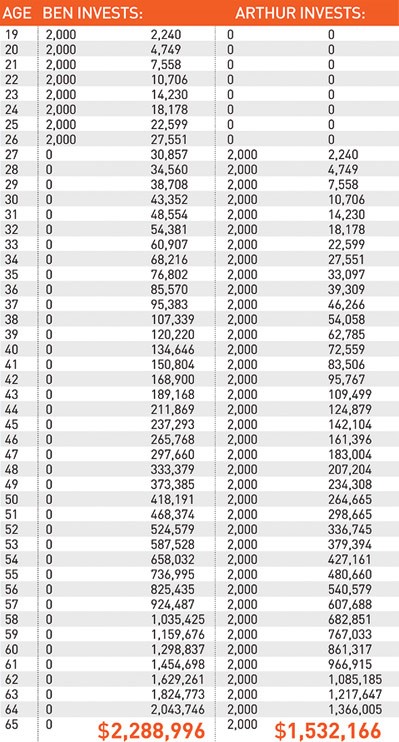

Whenever I teach any young person, no matter their age, I show them the chart that Dave Ramsey uses to explain the power of compound interest. It assumes a 12% gain, which may be unrealistic, but the point is still made: starting early will give you an advantage that can never be had again.

Here is the chart:

This data is typically enough to get any kid’s attention. Interest is the vast majority of your asset once your money has been growing for many years. If your child can’t understand that when you explain it to them, this chart should do the trick.

Try Conservative Products at a Young Age

This final point may go against your gut, because as investors, we don’t really care for financial products that… well, suck. But think differently here. We’re not talking about performance, we’re talking about teaching your child about investing.

It’s a common suggestion to let your child buy a stock in some company that they’re interested in. Disney is often a first obvious choice, and many books suggest doing this. While I see the idea behind it, I’m not sure it’s the best way to start. Why? Because it can have some adverse effects. If the stock does really well, it could give your kid a sense of false hope, and lead him to thinking that stocks always do really well. If it tanks, it could scare him away from investing ever again. So what do you do?

When your kid is young (pre-teen and early teens), it’s a good idea to keep the investment more conservative, as to show the value and basic concept of investing. For example, a Certificate of Deposit (CD) may not be a great investment, but it’s a great teaching tool to show delayed gratification. It shows how you start with an amount, say $100, and then you get 1% ROI (or close to it) on that amount, which gives you $101 after a set number of years. It shows your child that she earned the interest due to her patience and delayed gratification. It may be a bad investment, but it’s a great lesson.

Final Words

Let’s recap. You start with the basics of teaching terms and concepts. Then you move to the lessons. This is where you teach the idea of saving before investing, and the pay-yourself-first mentality. Use tools like the chart above to make this stuff visual. Graphics are a huge help for kids. Finally, start your kids off with some conservative investing products that can teach them the concept, before they dive into investments with a higher risk/reward ratio.

About the Author:

Kalen Bruce is the founder of Freedom Sprout where he simplifies financial concepts to help you teach your children about money. He believes if we teach financial literacy to our kids now, we won’t be showing them how to dig their way out of debt later. Follow the Facebook page for updates in the world of children’s finances.