Here are some lessons about building wealth I've learned from Jeff Bezos, the CEO of Amazon.com, during my short time working with his company.

- Drive down costs. For companies this means don't overpay for input costs. If there are capable workers who are happy to do the job for $15/hr, don't offer anything higher for this position. If nobody is willing to do it for less, consider investing in automation. For me this means I should cut my spending wherever I can, like on snacks. Find ways to save time such as combining my errands. Minimize redundancies like reducing the number of investment accounts I have. The more resource I save the faster my net worth will grow.

- Foster innovation. Instead of thinking about what's working right now, Jeff recommends thinking about what is likely to work in the future. I should consider how the economy might change. Ask myself which way is the job market moving? Which skills do I need to develop to stay relevant in tomorrow's art industry? By getting good at adapting to change I will be able to stay ahead of the curve. Being laid off in February made me realize I did not adequately prepare for the future. I did not innovate and improve my skill sets. But I have learned from this mistake. Thanks to Jeff Bezos I now understand the importance of thinking ahead. Next time I will see the changes coming, adapt, and be ahead of the curve.

- Choose long-term value over short-term results. Similar to a grandmaster chess player Jeff believes thinking 5 or 6 moves ahead is the best way to win in business. This is true for personal finance too. Some people didn't understand why I invested money into Motley Fool stock in 2009 instead of paying down my mortgage. I admit reducing my debt is a good feeling. But that's only in the short term. Nearly 10 years later I'm very happy I chose to invest because the returns have outpaced the cost of borrowing money over this time period. In the short term, buying blue-chip dividend stocks today may not give me the high returns as a more exciting stock such as Spotify, which recently had its IPO. But 10 years from now my dividend stock will probably give me an overall higher return. Creating a Facebook post and waiting for people to like it will give me some level of satisfaction today, but will not help me in the long run. To build more wealth I only have to ask myself, "what can I do today that would make me the most money 10 years from now?"

Recommended Stock Investing Posts:

- How We Make Money Swing Trading Stocks

- Top 3 Bollinger Bands Trading Strategies

- Using The Power Of The 80-20 Rule For Larger Returns

- Top 10 Ways to Quickly Improve Your Trading Skills

- Top 3 Trading Books Every Trader Should Read

- Advantages of Trading Small Cap Stocks

- A Review of The Truth About Money by Ric Edelman

- How to Supplement Your Income with Stocks

From a personal finance perspective, doing all three things above should grow our net worth. Driving down costs means spending less money. Fostering innovation is about finding more efficient ways to do the same thing - for example, utilize online banking services instead of commuting to the physical location. And investing for the long term means making wise decisions that will withstand the test of time and not chase after hot story stocks.

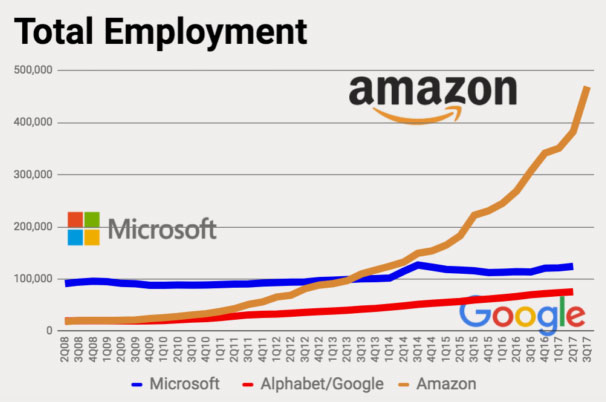

Amazon has really ramped up its hiring over these last few years. 5 years ago it had about the same number of employees as Microsoft. Today it's grown to about 5 times Microsoft's workforce. With over 560,000 total Amazon employees around the world there's no telling how much further it will expand.

It is astonishing how Jeff Bezos is able to balance the interests of everyone who's involved with the company. Amazon's customers are overwhelmingly satisfied with its services. Prices are cheap, shipping is fast. What's not to like? Putting customers first really pays off.

The Amazonians are generally satisfied with their working environment too. I've talked to many coworkers and everyone seems to like it there. Amazon treats and pays everyone fairly, which is why the majority of its employees are opposed to unionization.

And finally, Amazon shareholders have been handsomely rewarded. About 5 years ago I saw a lot of potential in Jeff Bezos and purchased 10 shares of AMZN for $290/share. Today they are worth $1,580/share. Not only did Jeff make himself rich, but he's also made a ton of money for other people.