Wouldn’t it be great to replace some of your income with stock investing profits?

Whether you’re currently working and want some additional incoming cash or you’re retired and looking to replace your old working income, the right stocks can add a lot to your bank account.

The best way to earn steady income from investing is to focus on dividend stocks. Building a portfolio of high-quality dividend stocks can allow you to collect regular dividend payments that are fairly predictable (similar to a regular paycheck).

On the other hand, buying non-dividend stocks can also provide great returns, but profits tend to be somewhat lumpy and unpredictable. The market might go through a bull run where you lock in a whole bunch of winning stocks or it might go through a bear run where all your stocks decline.

While the market almost always makes money over a 10-15 year stretch of time, in the short term investing returns can be much less predictable. That’s why we think dividend stocks are the best place to focus if you want steady, reliable, predictable supplemental income.

How Much Income Can You Earn from Dividend Stocks?

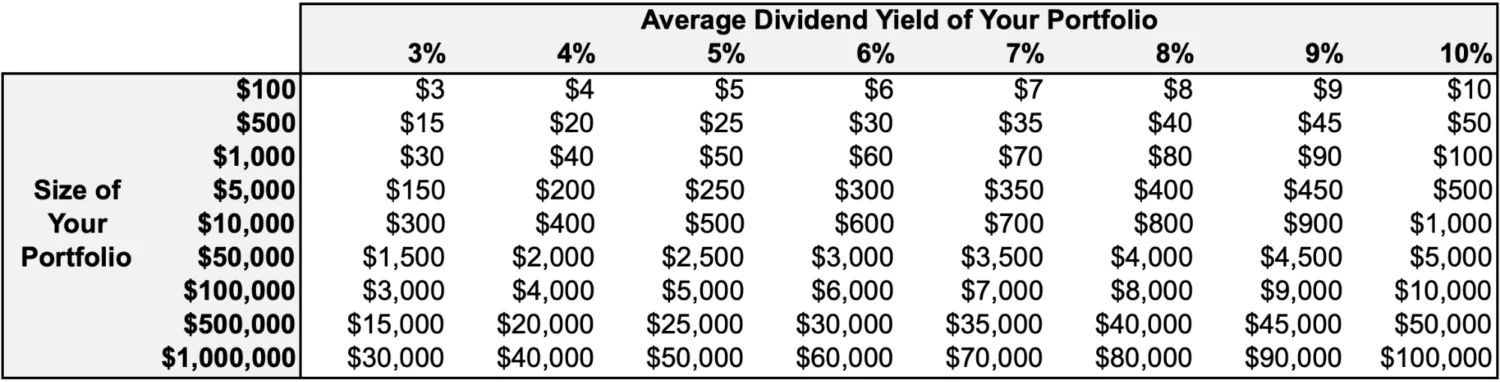

Before looking at how to find the best dividend stocks, let’s calculate how much supplemental income you can earn.

It really comes down to two simple questions:

- How much money will you invest?

- How high is your portfolio’s dividend yield?

The more you can invest and the higher the average yield of your portfolio, the more you’ll collect in dividend income.

Here’s a simple table calculating various portfolio sizes and how much annual dividend income each would earn at various average portfolio yields:

The bottom line is that if you have a lot of money to invest, you can quite easily earn dividend payments to replace your regular income. If you don’t have much money to invest, you’ll have to seek higher dividend yields and can supplement just a portion of your income.

Keep in mind, this table only shows dividend income per year, it doesn’t include any gains or losses from the dividend-paying stocks. Good dividend stocks will also gain in value over time, which means more profit and a larger portfolio for you.

And, if you choose to reinvest your dividend income, that will steadily grow the size of your overall portfolio.

There are over 4,000 stocks that pay dividends on the U.S. market today – so how do you know which are the best to buy?

While there are many good dividend strategies – such as buying monthly dividend stocks, ultra high-yield stocks, REITs, dividend capture, and more – today let’s focus on building a portfolio of solid, high-performing, fairly valued companies that also pay healthy, reliable dividends.

Now, let’s look at how to find the best dividend stocks for your income-replacement portfolio.

How to Find the Best Dividend Stocks to Supplement Income

When it comes to earning side income from dividend stocks, there are three important characteristics to look for:

- High income (collect as much in dividends as you can)

- Steady income (predictable, reliable payments; no sudden dividend cuts)

- Good company (underlying stock is solid and will likely gain over time)

The third point is an important one that is often overlooked by dividend-hungry investors.

In an attempt to find the highest yielding stocks possible, sometimes investors end up buying mediocre companies that see their stock prices decline. While high dividends are great, if your invested capital declines it will undermine all the dividend income you’re collecting.

Put simply, if you earn $1,000 in dividends but the stock declines by $1,000, was it worth it?

Probably not.

So, it’s critical to find stocks that are both good dividend payers AND good companies.

Thankfully, there’s some good research on which types of dividend stocks tend to perform best over time.

The Three Characteristics of a Good Dividend Stock

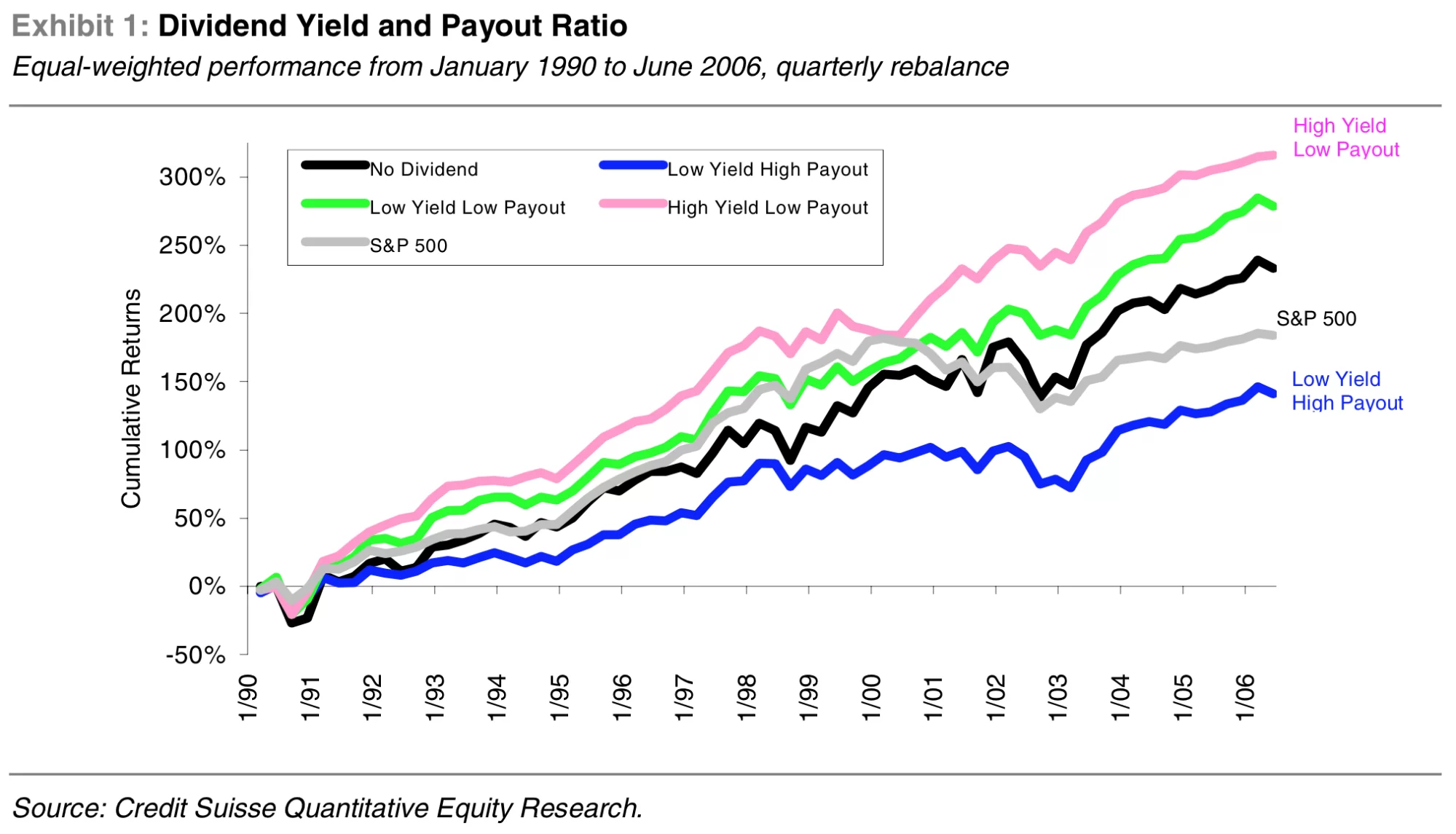

While many investors head right for the highest yielding stocks, research has found they don’t always perform best. Instead, it’s the combination of high yield PLUS low payout ratio that uncovers dividend gems.

As a reminder, payout ratio measures the amount a company pays out in dividends divided by its earnings. For example, if a company paid out $0.25 per share in dividends last year and earned $1.00 in earnings per share, they have a payout ratio of 25%.

Payout ratio is a measure of dividend sustainability. Companies that are paying out a large portion of their earnings in dividends are at risk of cutting their dividend or needing to raise money to keep paying it. Both are bad news for shareholders.

On the other hand, companies with a low payout ratio earn plenty of money to fund their dividend.

Companies with a high yield AND low payout ratio are paying a lot in dividends AND they can afford to do so. These stocks have historically performed better than other types of dividend stocks.

Source: Credit Suisse

From 1990 – 2006, high yield with low payout ratio stocks generated an average yearly return of 19.2% versus 11.2% for the S&P 500 – beating their benchmark by 8% per year.

While dividend yield and payout ratio are powerful predictors of the best dividend stocks, there’s one more element to consider when hunting for good dividend-paying companies.

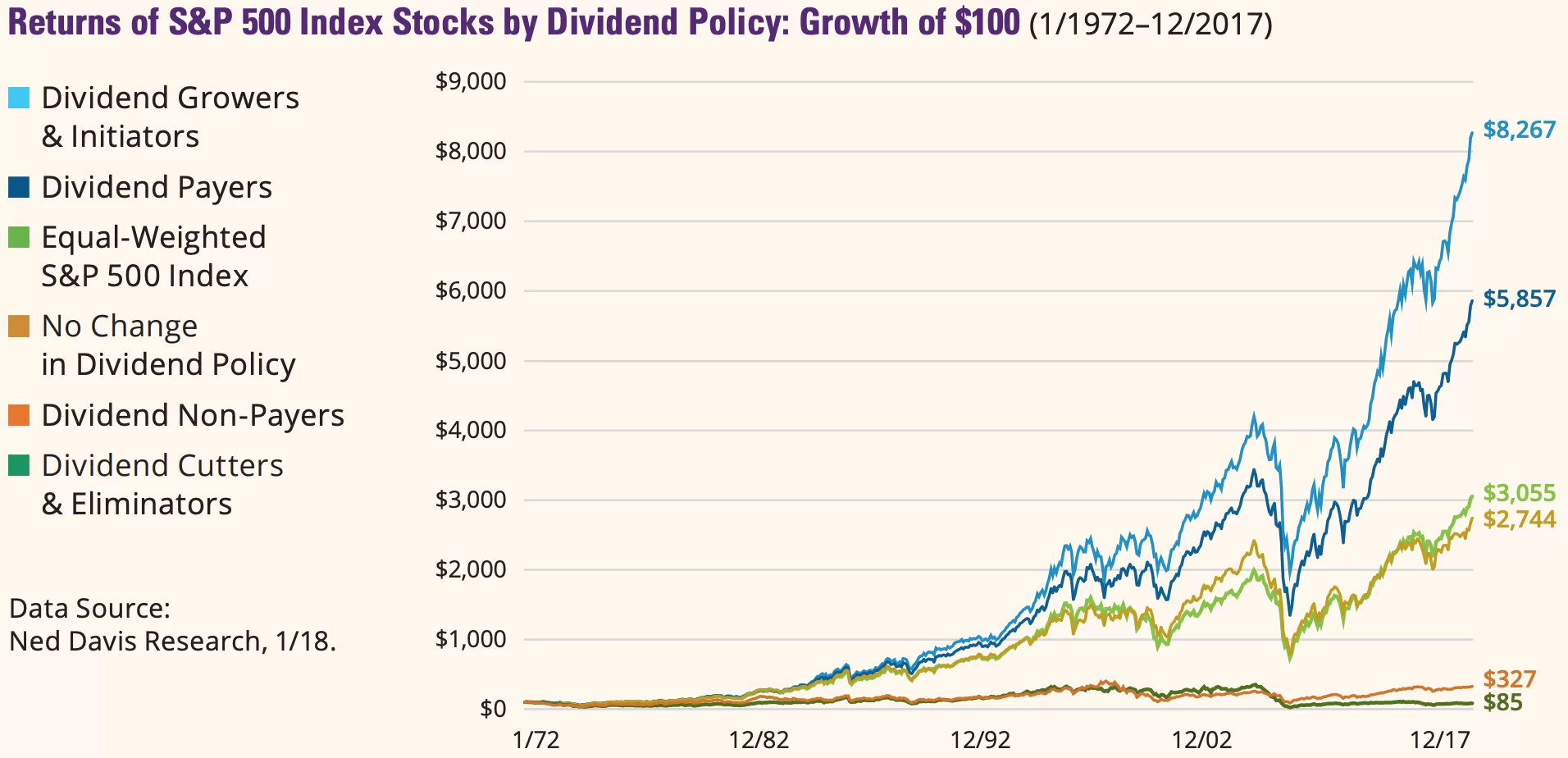

Research shows that companies that are steadily growing (or initiating for the first time) their dividend tend to perform well over time.

These are companies that are both performing well financially (because they can afford to pay more in dividends) and committed to returning value to their shareholders. That’s a powerful combination.

Source: Hartford Funds

Companies that are growing their dividends have performed the best, whereas dividend non-payers and cutters have performed the worst.

So, in addition to dividend yield and payout ratio, it’s critical to analyze whether a company has a history of growing its dividend.

Now we have a clear sense of what we’re looking for in a dividend stock portfolio:

- High dividend yield

- Low payout ratio

- Steady dividend growth

- Good, healthy company

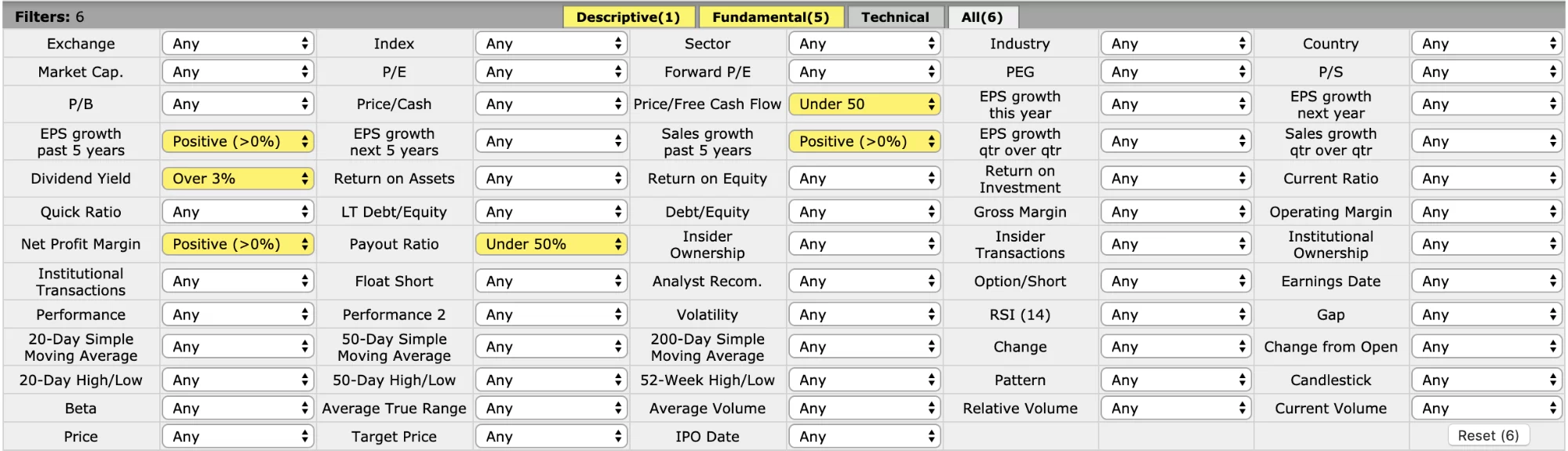

We can take that vision and translate it into screening metrics. There are many stock screeners available online, but let’s use the free and simple screener from FinViz:

You can click here to see the screener and full results in FinViz.

Notice that we have selected:

- Positive sales and earnings growth over the last 5 years

- Positive net profit margins

- Dividend yields over 3% (to find strong dividend income)

- Payout ratios under 50% (to find sustainable dividends)

- Price / free cash flow under 50 (to avoid overvalued companies)

While FinViz doesn’t have dividend growth metrics, you can check dividend history on a company’s website or (even better) other financial data sites.

At the time of publishing this article, this screen found 79 high yield, low payout ratio, growing, profitable, fairly valued stocks that could easily help supplement your income.

If you want yields higher than 3%, you can simply dial up the minimum dividend yield requirement. Just keep in mind you may have to loosen some of the other criteria a bit.

Recommended Stock Investing Posts:

Final Thoughts on How to Supplement Income with Stocks

When it comes to supplementing or even completely replacing your income with stocks, there are a few key takeaways to keep in mind:

- Dividend stocks can provide steady, predictable income.

- The more you can invest and the higher your portfolio yield, the more dividend income you’ll earn.

- Reinvesting your dividends and locking in profits from stock price gains will help grow your portfolio size over time (which means even more dividend income).

- Research has shown high yield, low payout ratio stocks tend to perform best.

- Companies growing (or initiating) their dividend tend to perform far better than dividend cutters or stagnant dividend payers.

- A strong income-replacement portfolio is made up of high yield, low payout ratio, growing, profitable, fairly valued stocks.

Not many investors can afford to simply walk away from their jobs and rely on dividend income to pay the bills. Unless you have a large nest egg to invest, it will take time to grow the size of your investment portfolio.

But if you buy high quality dividend stocks and consistently reinvest your income and profits, over time you’ll need to rely less and less on your monthly paycheck.