Crowdfunding has revolutionized the traditional fundraising system. Through crowdfunding, the funds are raised from a large number of investors in small proportions to finance a particular project, venture or an idea.

Crowdfunding is emerging rapidly at a global level. A World Bank report estimates a $93 billion market size for this alternative approach as compared to $34 billion in 2015.

What Is Real Estate Crowdfunding Investing?

In the past, real estate investing was an engine for massive wealth creation, but it was out of reach for small investors.

Real Estate Investment Trusts (REITs), an investing structure that allows individuals to invest in income generating large-scale real estate are an option, but then you have a fund manager deciding on the real estate deals. Also, because their aim is steady returns, it is not ideally suited for aggressive wealth building.

Because of the large ticket size in private real estate, High Net Worth Individuals (HNIs) and institutional investors had cornered returns from realty. With real estate crowdfunding emerging as an alternative, real estate investing is now possible for the common investor.

Real estate crowdfunding is another way to fund real estate projects. It empowers people to invest however much they have in real estate by pooling funds from thousands of similar small investors.

Benefits of Crowdfunding Over Traditional Investing

Crowdfunding has many advantages over other traditional investing methods, including the following:

- Mitigation of risk: Investing in a single project can be risky putting all your money into a single project. By using crowdfunding real estate investing, it cuts out the risks by helping you diversify your money into multiple real estate projects.

- Real estate investing know how: It is difficult for a non-professional investor to conduct due diligence of real estate deals. The legal and regulatory knowledge required is extensive, and it can get quite expensive to get the lawyers to vet a small deal. Crowdfunding real estate investing gives the investor confidence since the platform usually conducts the primary due diligence, and only brings curated offers for their investor base.

- Transparency: With a REIT, an investor has no choice but to follow the recommendations of the fund manager. Also, the investor usually learns about any new investments only after the deal is done and through a quarterly statement. Crowdfunding in comparison is extremely transparent, and you get to invest in only what you believe is right for your portfolio.

- Low Dollar Amount: With a small minimum required, crowdfunding allows you to invest in the biggest of real estate projects. You can start investing with as little as a $1,000 and diversify your portfolio to one of the most important asset classes for wealth generation – real estate.

Types of Crowdfunding Investments

There are two main types of crowdfunding investments. The first is through real estate debt investment or real estate equity investment. The investor gets the opportunity to invest through two different types of crowdfunding investment.

Under real estate debt investment, investor acts as a lender to the buyer/owner of the property. Here, the investment is secured by the property, and in return, the investor gets a fixed return, which is the interest on the loan which (it all depends upon the amount of loan lent by the investors).

Quite often, this type is usually a short investment (6-24 months), and the investors get preference over equity investors when it comes to repayment.

On the other hand, real estate equity investor act as a shareholder as she or he holds the stake in the property which is proportionate to the amount invested by her or him. The shareholder gets a return from the rental income generated by the property.

They also earn a profit when a property is sold (if the price of the asset has appreciated). These investments are generally for a longer period as compared to debt investment and can last up to 10 years. The investors also get the tax benefit such as depreciation deductions.

The second type of crowdfunding is parties to crowdfunding real estate investments. Both accredited (high net worth individuals) and non-accredited investors can invest in such projects.

Crowdfunding real estate investments provide a significant benefit to non-accredited investors by delivering a low-base entry point into real estate investing.

How Does Crowdfunding Real Estate Investments Work?

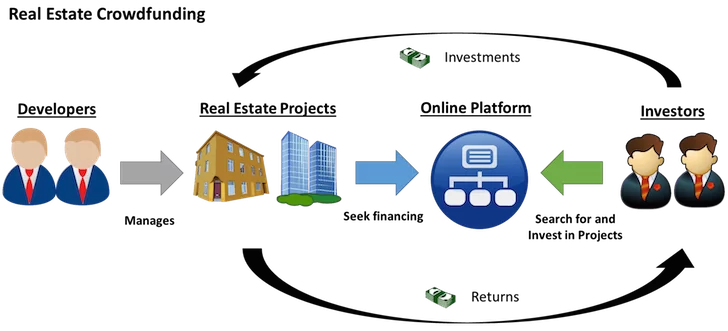

Real estate crowdfunding is usually done through online platforms that invite accredited and non-accredited investors to invest in the real estate project. The real estate developer then submits his or her project report to the platform and negotiates the price, return, and other aspects related to the investment with the developer.

Once agreed, the platform executes the marketing of the project and tries to capture potential investors, who are interested in the project.

The platforms pool the funds from a large number of investors which is invested in the real estate project. Every platform has a different range of minimum and maximum investments with a different fee charged by each platform (generally, a small fee is charged by the platform which is approximately 1%-2%). With the return of the investment, the investor gets monthly or quarterly interest or dividends.

Crowdfunding works great for the investors as they get to sit back and relax as they watch their investment grows since it is a group of professionals manage the properties.

Recommended Stock Investing Posts:

- Traditional IRA vs. Roth IRA vs. 401k

- Using The Graham Formula to Find Underpriced Stocks

- Why Leveraged ETFs are Better Than Futures and Options

- How to Teach Your Children to Invest in the Stock Market

- Critical Reasons To Invest In Small Cap Stocks

- Using The Power Of The 80-20 Rule For Larger Returns

- Investment Diversification: 5 Risky Mistakes to Avoid

- How We Make Money Swing Trading Stocks

Legality of Crowdfunding Real Estate Investments

Yes, real estate crowdfunding is legal. Though real estate syndication is decades

old, the Jobs Act has created a simple template for all crowdfunding instruments. Depending upon the exact structure, crowdfunders are leveraging Reg A+, Reg CF and Reg D for raising millions of dollars from a wide range of investors.

Platforms for Crowdfunding Real Estate Investing

There are over a 100 real estate crowdfunding online platforms. Some specialize in a particular niche or a particular geography, and some are mainstream real estate investment platforms for both accredited and non-accredited investors. It is critical for an investor to choose the right platform.

Among the best platforms for online real estate investing are Fundrise and Realty Mogul. Both companies are considered to be the early movers of the field. Fundrise has raised over $55 million in equity funding from a clutch of marquee investors like RenRen and Guggenheim Partners.

Similarly, Realty Mogul has raised over $45 million from players like Canaan Partners and Sorenson Capital.

Fundrise

Fundrise investments include projects like commercial renovation, apartment renovation, home construction, new commercial development, and many other projects.

The primary products offered by Fundrise are eREITs (an online version of REITs), and eFUND (an investment arm that buys and develops land). The initial investments for these products are as low as $500 for eFUNDS and $1000 for eREITS.

Recommended Real Estate Investing Posts:

RealtyMogul

RealtyMogul invests in projects like residential buildings, shopping centres, high rise multi-tenant structures, and mobile home parks.

Fundrise vs. RealtyMogul

Dividends: Fundrise pays dividends quarterly, while some RealtyMogul investments pay monthly dividends.

Initial Investment: The minimum fees for Fundrise is $500, whereas for Realtymogul investment it is $1000.

Fees: Fundrise charges an annual management fee of around .85% plus .15% advisory fees. RealtyMogul fees are between .30% & .50%.

Both companies are a good option since they both lower the barriers to real estate investing and open up the investing for all kind of investors. However, it is important to look at the individual deals and instruments being offered by both the platforms, and assess accordingly to which suits your risk profile and return expectation. You should add in your own analysis as no platform completely understands your unique financial position.

See a more detailed comparison.

Takeaway

It would be best if you diversified your portfolio for optimum risk management. Bonds and stocks alone are not enough. Real estate investing is a critical missing piece for many small investors.

With crowdfunding real estate investing, it allows you to spread your real estate portfolio across all of the real estate ventures. It allows you to focus on either debt or equity investments.

Choosing the right platform is essential to get the benefit of scale and curated offerings. Fundrise and RealtyMogul are two of the biggest, well-funded players in the market.