I love recession proof stocks.

They help me sleep better at night. And when I sleep better at night, I make better investing decisions 🙂

In this article, I’d like to show you how recession proof stocks work.

And, more importantly, how you can fill your portfolio with these beauties!

Low Volatility = More Chill

You see, we all want to make investing gains, to have our stocks grow with the smallest level of volatility.

Volatility is what makes stocks go up and down more violently.

While it does create excellent buying opportunities, it’s not great for mental health!

So one of the keys is to pick stocks that have low volatility but which can also provide great returns.

One of the easiest ways to accomplish this is to choose stocks belonging to the dividend aristocrats.

These are stocks that have been increasing their dividends each and every year for 25 years or more.

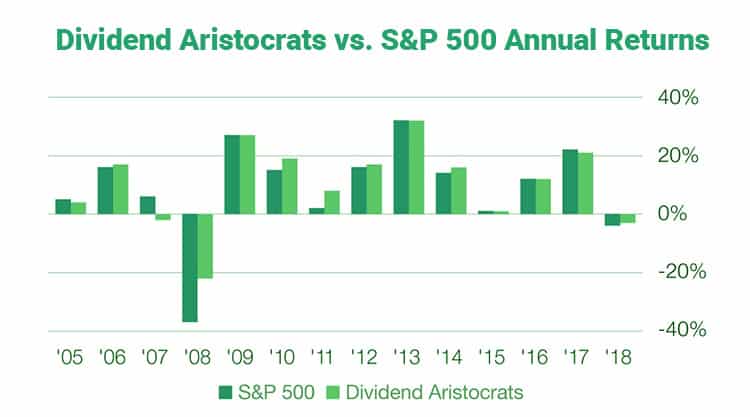

Dividend Aristocrats have actually been proven to out-perform the S&P 500… with smaller volatility. See the graph below:

Talk about the best of both worlds!

Now, you could simply go out there and invest in a dividend aristocrats ETF.

That would get you most of the way.

But in the rest of this article, I want to discuss 3 recession proof stocks that have a long track record of withstanding recessions.

3 Recession Proof Dividend Stocks

So we’ve established that choosing dividend aristocrats is a good idea if we want great returns as well as low volatility.

The next question is:

Which stocks should I actually pick?!

Well, there’s no point in choosing stocks that will not withstand a recession…

That goes without saying! 😁

So in this article, I’ll show you 3 stocks with a history of withstanding recessions – and also increasing their dividends, which is a great way to earn passive income while you wait for your investments to grow!

NOTE: I’ve chosen one stock from each of 3 sectors which are less cyclical than other sectors.

Plus, I’ll also talk about these stocks in terms of their beta levels, which is a measure of volatility.

This is key if you want to remain calm and let your stocks grow over the long term without being tempted to sell them.

Ok, let me now show you the stocks…

#1 Hormel Foods (HRL)

Sector: Consumer Defensive

Hormel Foods is a Fortune 500 company that makes packaged foods.

It’s my favorite kind of company: boring!

Honestly, if you want to avoid higher volatility, you need to start looking for these types of stocks.

Although they are an American company and have many brands that are not well known outside of the USA, they do serve 80 different countries.

The real highlight here is their very long streak of dividend raises.

It currently sits at 53 years!

And their dividend growth rate over the last few years has been an impressive 16%.

This means that your income from Hormel Foods would double every 4.5 years! 😍

Having said that, this isn’t a stock that normally offers a high yield. Far from it, it currently sits at around 2%.

However, it does have a low payout ratio of 52%, which is exactly what you need to look for when searching for recession proof dividend stocks!

Finally, what I love about this company is that their products and their sales don’t tend to be affected by recessions, as people always need food – particularly handy packaged food.

Now, its beta value has averaged -0.06…

A negative beta actually means that the stock tends to behave in the opposite way as the market. When the market is up, this stock tends to go down (by only a little), and vice versa.

#2 American States Water (AWR)

Sector: Utilities

This is a utility company that delivers water and electricity to a large part of America.

It’s also the company with the longest dividend growth streak in the world.

That’s so difficult for a company to do, that it simply screams “recession resilience”!

While its dividend yield is pretty low, at around 1.5%, the dividend growth rate has been quite impressive at 8.7%.

That’s its average dividend growth rate over the past 10 years, which is very good, even considering its low starting yield!

At the risk of sounding obvious, people will always need water and electricity. It’s such an essential part of our lives, that the companies that supply it should be able to stay where they are for a long time.

Its beta has been -0.08 over the last few years, which means it’s extremely nonvolatile (sounds like I’m talking about explosives here!)

This is definitely one of the best recession proof stocks out there

#3 Air Products & Chemicals (APD)

Sector: Raw Materials

APD produces chemicals and gasses which it sells to industrial companies.

Yet another boring company…are you noticing a trend here? 😉

While a recession can impact the industrials sector, which is why I’ve not included it here, APD tends to do well during recessions.

It has a relatively high dividend yield (stress the word “relative”) of 2.4% and a dividend growth rate of 10.3%.

It’s also been increasing its dividend for 38 consecutive years, spanning many recessions and bear markets.

Another key element is that this company carries low debt, at only 0.3 debt:equity.

Its beta sits at 0.85, which means it is less volatile than the overall market (the market has a beta of 1).

Dividend Growth Stocks

These 3 stocks were all examples of dividend growth stocks, which are stocks that tend to increase their dividends each and every year.

They have consistently overperformed the market, and I personally absolutely love them!