Based in New York City, Betterment is a fairly new company that seems to cater to new investors. Their tools are not only designed for ease of use, but they can also help newbies to get a leg up in the market.

Betterment offers a variety of investments – such as stocks, bonds, diversified ETFs, and even a Betterment IRA. Most importantly, it makes the process simple for anyone who has never invested in the stock market before.

I want to look at some of the top 5 reasons why I think you should consider using Betterment for your investment needs.

Click for Betterment Pricing and Details.

#1: Ease of Use

I said before that Betterment’s investment tools are easy to use. They have a very intuitive platform that makes it simple for investors who aren’t quite as experienced. It’s clear they had this in mind when they were developing this platform.

#2: No Minimum Balance

For someone who doesn’t have a lot to put in the market, this will be a huge advantage. Many online brokers require a large minimum balance (somewhere in the thousands) before a person can start trading. So, the fact that you don’t have to put a certain amount in your account will make things much easier for the little guy.

#3: Low Fees

While this may not be an issue for some people, it can mean a world of difference for others. Someone who is trying to break into the market will find this refreshing since they are more concerned about cost.

Related: Betterment vs. Acorns: How Best to Invest

Betterment charges a percentage of every trade (it is not a flat-fee service), but they are fractions of a percent. Their fees run from 0.25% to 0.40%, depending on the asset you are trading.

#4: Great Automation Tools

One of the great features of Betterment is that there are many processes that operate on the back end. These processes include:

- Asset allocation

- Tax-loss harvesting

- Portfolio rebalancing

While it might be frustrating for hands-on investors, casual traders and people with less experience will find these tools extremely useful. It can help them to get the most out of their portfolio without much effort.

Recommended Stock Investing Posts:

- Roth IRA Conversion Ladder for Early Retirees: Decoded

- Critical Reasons To Invest In Small Cap Stocks

- Traditional IRA vs. Roth IRA vs. 401k

- PE Ratio: The Best Market Timing Tool of All?

- Using The Power Of The 80-20 Rule For Larger Returns

- 2 Easy Ways to Use Arbitrage to Make Money in the Stock Market

- 6 of the Most Popular Instruments for Financial Traders

- The Neatest Little Guide to Stock Market Investing Book Review

#5: Great Selection of IRAs

I already mentioned that Betterment offers a variety of different assets, but they have some great tools for planning your retirement – including a fantastic selection of both traditional and Roth IRAs. They have a list of great providers, and you don’t need much to get started.

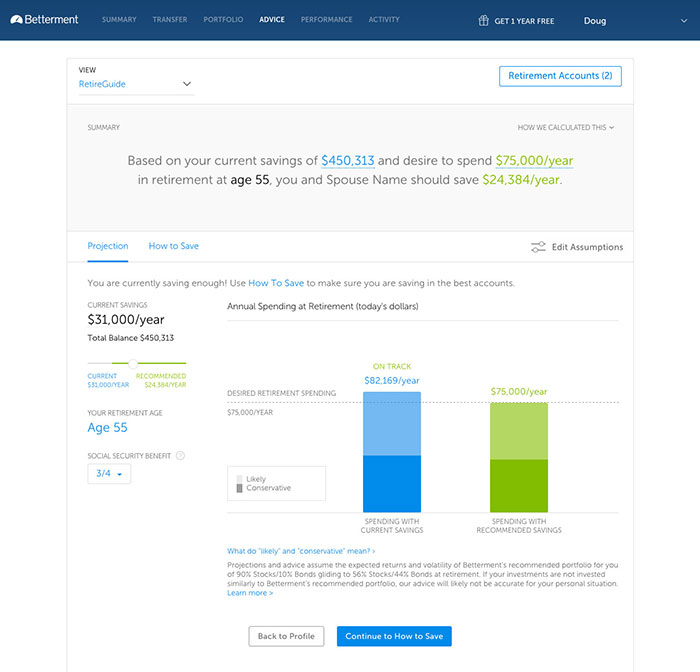

Betterment also has a lot of great tools to help you come up with a long-term savings plan. They have a special retirement calculator (that they call RetireGuide) that looks at your past income and expenses to come up with a solid savings plan that won’t put you in the hole. Not only does it look at your cash flow, but it also takes into account the possibility of receiving large sums of money that could turn into lump-sum savings.

Final Thoughts

When you look at the big picture, it’s obvious that Betterment is built for the new investor in mind. And the lower fees make what they have to offer that much more valuable – especially when that person doesn’t have a whole lot to invest. Also, the fact that they automate many of the regular processes on the back end will help investors get as much as they can out of their portfolio.

And of course, I can’t forget about their great retirement planning tools, which anyone can find useful – regardless of where they are in their lives. So, if you want to get a head-start in building your net worth, you should definitely consider using this platform.

Click for Betterment Pricing and Details.

Betterment Comparisons:

- Betterment vs Wealthfront

- Betterment vs Acorns

- Betterment vs Vanguard

- Betterment vs Fidelity

- Betterment vs Robinhood

- M1 Finance vs Betterment

- Betterment vs Sofi

- Betterment vs Stash

- Betterment vs Charles Schwab

- Betterment vs Personal Capital

- Betterment vs Ellevest

- Betterment vs ETrade

- Betterment vs Wealthsimple

Related Investing Product Reviews: