Webull Review 2022: Should You Finally Ditch Robinhood?

| By: Bob Haegele | April 23, 2021 |

In a nutshell: Webull is a free trading app with an excellent user experience across the board. Both its mobile app and desktop application make it easy for anyone to start trading.

While beginners may be overwhelmed by the experience, and not all types of assets can be traded, Webull offers a solid trading experience overall.

| Fees | Account Minimum | Promotion |

|---|---|---|

| $0 | $0 | Get 2 free stocks |

Webull’s user-friendly interface makes it easy for most traders who need more advanced trading tools than those offered by simpler trading apps.

Pros & Cons

PROS

- Margin trading without a subscription

- No account minimums

- No cost to trade options

- Get 2 free stocks

CONS

- No mutual funds or bonds

- No fractional shares

Compare to Other Trading Platforms

| |

| Fees$0 |

| Minimum Investment$0 |

| PromoGet 2 free stocks |

| |

| Fees$0 - $125/year |

| Minimum Investment$0 |

| PromoInvest for free |

| |

| Fees$0 |

| Minimum Investment$0 |

| PromoInvest for free |

Full Webull Review

Webull is an investing app and trading platform with commission-free trading on a variety of asset types. With many younger investors preferring a mobile-first trading experience, and this app looks to meet the needs of the upcoming generation.

Webull is best for:

- Experienced traders

- Active traders

- Cost-conscious options traders

Webull at a Glance

| Account Minimum |

|

| Management Fees |

|

| Options Trade Fee |

|

| Account Fees |

|

| Investment Types |

|

| Customer Support |

|

| Trading Platform |

|

| Mobile App |

|

| Research & Analsyis |

|

Trading stocks has always been popular, but recent trends and events have changed the face of the industry. As many younger investors accumulate enough wealth to start investing heavily, they’re looking for an investing platform that is both visually appealing and mobile-friendly. Does this platform deliver? Found out in this Webull review.

While apps like Robinhood have similar goals, it may not meet the needs of all investors. On the other hand, Webull offers a nice alternative to those who want a little more out of their investing app.

What is Webull?

Webull is an investing app and trading platform with commission-free trading on a variety of asset types. With many younger investors preferring a mobile-first trading experience, and this app looks to meet the needs of the upcoming generation.

Although the app is quite nicely designed and looks visually appealing, it’s not all about looks. In fact, it has plenty of technical indicators and advanced charting tools to meet the needs of more seasoned traders. Our Webull review will take a look at its stock trading features and what you can buy and sell.

Plus, the app supports advanced order types and comes with Level 2 Nasdaq data. In this way, it goes well beyond the likes of anything Robinhood has accomplished thus far.

Another nice thing about Webull is how cohesive the experience it is. The desktop platform and web application look exactly the same, and all the features are present on the mobile app.

Webull Features

Webull has no shortage of features that will allow you to do some advanced trading if you so choose. It also has a generous amount of charting and analysis available to help you monitor the market.

Trading Platform

Webull has a fully-functional trading platform. Anyone who has used TD Ameritrade’s thinkorswim will notice the look and feel is somewhat similar. (Note: The desktop application has a light theme by default. I have enabled the dark theme in settings.)

If you click the Markets tab, you will see an overview of the markets, including:

- Top Gainers

- Top Losers

- Most Active

- Marginable Stocks

- Shortable Stocks

- Best-Performing Industries

There’s plenty more you can see, too. For instance, you can view charts for different indexes, plus there is a tab that gives you stock news. There is also a separate tab for the Hong Kong market.

Also on the markets tab, there is a global market section that gives you a quick glance at markets around the world. In addition, it gives a list of Forex rates which update in real time, which is fun to watch.

In several of the tabs, you have the ability to rearrange or even remove widgets on the right sidebar. To rearrange, hover over the title bar until you see the cursor change to a move window indicator.

And if you want to remove something, click the menu icon (sometimes called a “hamburger”) in the upper right of a widget.

Research and Charting

Webull gives you access to plenty of advanced charting types, such as candlesticks, bar charts, line charts, and Heiken Ashi. For comparison, Robinhood only has candlesticks and line charts.

There are also several technical indicators viewable on the platform. A few of them are:

- Bollinger bands

- Simple moving average

- Volume-weighted average

- Volume

- Ichimoku clouds

- KDJ

These are just a few examples of the indicators you can find on Webull. Jump into the desktop or web application to see everything it includes.

Level 2 Advance

As mentioned earlier, Webull does give you access to Level 2 Nasdaq market data. That is made available using Nasdaq TotalView. You do have to pay for that access, but the cost is only $1.99 per month. For that rate, you gain access to Auction Crossing NOII, which includes information such as:

- Opening Cross

- Closing Cross

- Halt Crosses

If you aren’t familiar with all of these technical details, they are a bit more advanced than what your average investor typically uses. However, it can help you find new trading opportunities. Thus, Level 2 Advance is more useful for the active trader.

Fundamentals Analysis

Webull also has tools to view a company’s fundamentals. For example, you can view its income statement, balance sheet, and cash flow.

There is plenty more here, too, such as news and press releases. You can also view options and an overall analysis, which is nice to have.

It’s nice to have a quick reference here, including whether the stock is a buy, and how many analysts rated it each way.

Overall, the fundamentals analysis isn’t as in-depth as it is on platforms such as TD Ameritrade, but it does give you some nice breakdowns.

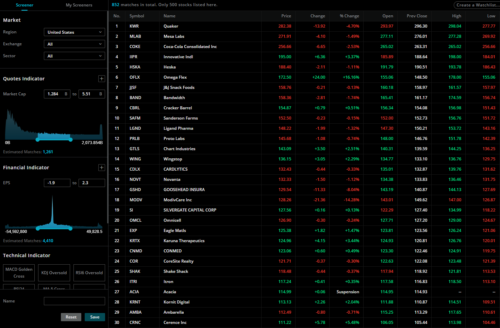

Stock Screener

Webull gives you access to a stock screener that is more advanced than what you might see on other platforms.

As you can see, the Webull stock screener has a large number of filters to help you find exactly the stock you want. You can filter by region, market cap, earnings per share, and plenty more.

There are also analyst ratings such as strong buy, sell, and hold. Plus, you are able to search for “marginable” stocks.

Lastly, you can add stocks to your watchlist directly from the screener and make notes of them.

Indeed, there is plenty you can do with the Webull stock screener.

Off-Hours Trading

One nice feature about Webull that is somewhat unique is extended-hours trading. In other words, you aren’t confined to trading only while the markets are open. Instead, you can place trades as early as 4 a.m. and until 8 p.m. (Eastern time).

Margin Trading

When you sign up for Webull, you will have to create either a margin account or a cash account. If you select a margin account, you will automatically have access to margin trading if your account is approved.

The only other requirement is you need at least $2,000 to trade on margin. Webull compares favorably to Robinhood here, as Robinhood requires a Robinhood Gold subscription ($5/month) to trade on margin.

Webull allows up to 4x margin trading and up to 2x overnight margin. Interest rates for margin trading are:

| Portfolio Balance | Interest Rate |

| Up to $25,000 | 6.99% |

| $25k – $100k | 6.49% |

| $100k – $250k | 5.99% |

| $250k – $500k | 5.49% |

| $500k – $1M | 4.99% |

| $1M – $3M | 4.49% |

| Over $3M | $3.99 |

Paper Trading

Webull also supports paper trading, which is always a nice feature to have. Paper trading allows you to place real trades on the open market using fake money. Thus, you can neither make nor lose money, but it allows both new traders to get a feel for how trading works.

Paper trading can be helpful for experienced traders, too, as it allows you to experiment with different trading strategies.

My Watchlist

Webull allows you to create your own custom watch lists, and you can add stocks to them from the Stocks tab. There is a separate watch lists tab, but you can also see your watch lists in the left bar on the Stocks tab.

In reality, the functionality on the My Watchlist tab is fairly basic, but it does allow you to see some useful things. For example, the prices update in real time. The red highlights you see in the snippet above indicate that those prices just dropped.

You can also switch to a grid view using the icon with the four squares in the upper right.

Webull Commission & Fees

| Traded Asset | Fee | Charged By | Rule |

| Stocks/ETFs | $0.0000051 * Trade Total (Min $0.01) | SEC | Sells Only |

| Stocks/ETFs | $0.000119 * Total Trade Volume (Max $5.95) | FINRA | Sells Only |

| Options | $0.0000051 * Trade Total (Min $0.01) | SEC | Sells Only |

| Options | $0.002 * Number of Contracts (Min $0.01) | FINRA | Sells Only |

| Options | $0.0388 * Number of Contracts | Options Exchanges | Buys/Sells |

| Options | $0.045 * No. of Contracts(Max $55 per Trade) | OCC | Buys/Sells |

Webull charges no commissions for any of its trades, including options. That said, it is still subject to fees charged by regulatory agencies.

Though these look somewhat complicated, when you look at the actual amounts, they are really inconsequential. And options incur more fees than stocks and ETFs.

Ease of Use

Webull gets high marks here. The desktop and web applications are uniform, and it’s very easy to open an account. The stock market can be confusing, but Webull is easier to use than many other trading platforms.

Plus, you get commission-free stock trading and SIPC protection. Granted, Webull is slightly more complicated than apps such as Robinhood, but it should only take you a few days to get the hang of it.

Webull Customer Service

Webull offers customer support via telephone during regular market hours. The number to call is (888) 828-0618. If you have questions outside of market hours, you can email customer support at customerservices@webull.us.

Webull vs. The Competition

| Trading Service | Fees | Min. Investment | Features |

| Webull | $0 | $0 | Crypto, Stocks, ETFs, and options trading |

| TD Ameritrade | $0 | $0 | Stocks, options, bonds, ETFs |

| E*TRADE | $0-$1.50 ($0 for stocks, bonds & ETFs | $0 | Stocks, options, bonds, ETFs |

| Robinhood | $0 | $0 | Stocks, ETFs, options, crypto (requires Robinhood Crypto) |

Webull vs. TD Ameritrade

Both Webull and TD Ameritrade will allow you to trade stocks and options for free. Plus, both require no minimum deposit to begin trading. But while the two appear very

Webull has a very clean look across all platforms, and arguably has a nicer-looking mobile app. However, the interface isn’t the only advantage Webull has over TDA.

For example, it has lower margin rates across the board and its wire transfer fee is 50% lower than TDA’s. Also, Webull supports cryptocurrency, which TDA currently does not offer.

TD Ameritrade, for its part, does have several advantages over Webull. Buy-and-hold investors may notice bonds are missing from Webull’s platform, but TD does offer them. The same can be said for mutual funds.

TD also has certain advanced order types that Webull lacks, such as trailing stops and contingents. TD also has a lot more technical indicators and more charting features in general.

Lastly, TD Ameritrade is a great platform for day trading, while Webull is best for swing trading and semi-active trading. This gets a bit technical, but the reasons include the fact that TDA has direct market access and other features day traders need.

Webull vs. E*TRADE

E*TRADE is another trading platform that has been around for quite some time, so it makes sense to see how it compares to Webull.

E*TRADE offers commission-free trading for stocks and ETFs, as most brokers do these days. Like TD Ameritrade, it has plenty of advanced order types and charting tools, beating out Webull for technical analysis.

E*Trade also has a plethora of stock research options, including screeners for ETFs, mutual funds, and bonds. Webull only has a stock screener, for comparison. Plus, E*TRADE is a decent option for day traders.

The advantages Webull has over E*TRADE are essentially the same as those it has over TD Ameritrade, so we won’t rehash them here.

Webull vs. Robinhood

Lastly, we will compare Webull to Robinhood. Webull sits somewhere between Robinhood and the other platforms mentioned here, so let’s look a little closer.

Webull has a lot more technical indicators and charting tools than Robinhood. It has dozens of technical indicators, drawing tools, and comes with plenty of stock research tools. It also offers crypto trading at no extra fee.

Robinhood is a relatively simple app as we’ve noted, though it does have some advantages over Webull. One big one is fractional shares, which is something many robo-advisors include these days. Its margin rates are even lower than Webull, but note that you need a Robinhood Gold account to trade on margin, which costs $5 per month.

Of course, both Robinhood and Webull offer commission-free trading. Despite the recent trade of people day trading on Robinhood though, neither Webull or Robinhood at the best for it. Consider one of the two alternatives mentioned above for day trading.

Webull FAQ

As always, there are plenty of common questions asked about Webull. Let’s address a few of them here.

Is Webull Legitimate?

Yes, Webull is legitimate. Webull Financial, LLC is based in New York, New York and was founded in 2017. It is a registered broker-dealer and a member of Securities Investor Protection Corporation (SIPC), New York Stock Exchange (NYSE), and Nasdaq. It is also a member of the SEC and FINRA.

Webull members are covered up to $500,000 (up to $250,000 cash). Its clearinghouse, Apex Clearing, has an additional insurance policy that provides protection for up to $37.5 million in securities for individuals, and up to $900,000 in cash.

Is Webull Really Free?

Yes, Webull is really free. It charges no commissions for stock, ETF, and options trades. Some fees still apply, such as those charged by regulatory agencies.

Can You Make Money on Webull?

Certainly, you can make money on Webull. It is no different than any other trading platform in that sense. Of course, that is never guaranteed. For most investors, the easiest way is to buy and hold ETFs. You can also test the waters with paper trading before fully jumping in.

What Are People Saying About Webull?

You might be wondering what people are saying about Webull in different places online. Don’t worry—we’ve got you covered:

- On the Apple App Store, Webull has a 4.7/5 with over 179,000 ratings.

- On Google Play, Webull has a 4.5/5 with over 109,000 ratings.

What do people like about Webull? Here are what a couple of real reviews on Google Play have to say:

No problem getting signed up. I like the charting and many of the features at first glance. The desktop version is really nice. Still on Robinhood, but that will most likely change as I play around with Webull and get used to the lay of the land. Like the news feeds in Webull also.”

No problem getting signed up. I like the charting and many of the features at first glance. The desktop version is really nice. Still on Robinhood, but that will most likely change as I play around with Webull and get used to the lay of the land. Like the news feeds in Webull also.” |

“I’ve used a lot of trading app, and I got to say this is definitely my favorite. It seems complex at first, but thats just because there’s so many tools and once your over the learning curve it gets pretty easy. If you’re a serious trader, i would highly recommend them . 👌” |

Read to get started? Create your account and start trading with Webull.

Is Webull Right For You?

So what are our final thoughts? Well, Webull is a solid trading platform that looks great across a variety of devices. It has many more research and charting tools than apps like Robinhood, and offers a customizable workspace. Opening an account is easy and only takes a few minutes.

If you are a day trader or someone who needs the most advanced platform, you may want to look to TD Ameritrade or E*TRADE. For everyone else, a Webull account may be more than enough.

That being said, swing traders and those who just want to dive a little deeper may find it meets their needs. It still offers a lot of features when compared to apps like Robinhood. Overall, Webull is an excellent platform and worth a look.