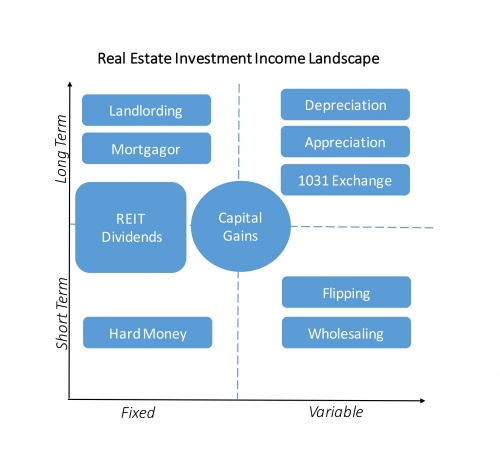

Real estate is a fundamental asset to preserve and accumulate wealth. When considering real estate investment income as a potential revenue stream or a component of a diversified portfolio, one should consider where the options fall within the real estate investment income landscape. Based on the investment strategy and position you chose to pursue; income is gained in a number of ways.

We all want more cash flow. The real estate investment income landscape chart illustrates our logic for thinking about real estate investment income and how income is produced. Real estate investments may be separated into short term and long term time frames; the income can be classified as either a fixed sum or variable.

Landlording

Whether you choose to be hands on or hire a property manager, landlording is a definite way to real estate investment income. Owning property allows you to lease its use to tenants and receive rental income in return for the service. Rent prices are typically fixed for the term of the lease. Therefore, the income received from this genre of asset may be considered a fixed income. Landlording is a strategy typically used in with a mindset towards long term investment.

Mortgagor

It pays to be the bank. The next level up from leasing use of buildings and property to tenants is to own the mortgage the owner has on the property. That’s right, you can own the debt instead of the property. As the mortgagor, you are in the position of lender in a real estate transaction.

Similar to rental income, the mortgagor receives monthly mortgage payments from the owner. In the United States, debt secured by real estate is typically given at a fixed interest rate for the life of the 15, 20 or 30 year loan. Because of this, the monthly payments to the lender are also fixed.

This strategy is good for persons that like the long term aspect of real estate investment income but do not want to interact with tenants or other property ownership headaches.

REIT Dividends

Dividend paying stock is the paper equivalent of rental property. Real estate investment trusts are publicly traded companies which own real estate as the core business and underlying assets. The IRS regulates that REITs are required to pay out 90% of income to shareholders.

This payout is in the form of dividends and is fixed with both short and long-term aspects to real estate investment income. REITs can offer both a secure return over time as well as the quarterly payments. Investing in REITs is a more passive approach to real estate investment income.

Hard Money

Being in the position of hard money lender is very similar to being a mortgagor. Once again you are the bank and loan your money out for a rate of return. A key difference is that hard money lending usually delivers a higher rate of return in exchange for the short-term use of capital.

Just like all loans, the interest rates fluctuate depending on the lender. It is common to see hard money rates in the 10-15% range while bank and credit union loans are in the 3-5% range. As real estate investment income is produced through hard money lending, you are able to gain a short term return on your money with a determined or higher fixed rate of return.

Capital Gains

It is important to acknowledge that any real estate investment strategy you take will have tax consequences (or advantages). You should feel excited to be in a position to contribute productively to society. Each real estate investing approach should be paired with guidance from a certified accountant or tax preparer.

Much like the taxes charged to stock market investments, when real estate increases in value and is sold at a higher price, the owner is required to pay tax on the difference between the sales price and the original purchase price in the form of capital gains. Capital gains are at the center of our real estate investment income landscape because it influences and effects all areas of the landscape.

At some point, someone will pay capital gains taxes, now or later, you or your heirs.

Recommended Real Estate Investing Posts:

Depreciation

Depreciation in real estate ownership is the process of distributing the tax deduction over the useful life of the property. The IRS has created a specific schedule for depreciation. The building, land, and fixtures such as hot water heaters, furnaces, etc. can be depreciated over this timespan.

The amount of depreciation is variable year over year and is a long term process. Depreciation takes into the reduction in value of the property due to aging and wear and tear on the property. Based on the depreciation mindset and schedule property is only viable for 27.5 years in residential real estate. Therefore, the building and attached fixtures are depreciated, the value is partially reduced annually, to account for the age.

Appreciation

Appreciation in real estate is the process of increasing property value. This value increase in a property gives the owner an increase in equity. Equity in real estate can lead to access to real estate investment income. Many factors affect appreciation which necessitates its position as a long term and variable income stream in the real estate investment income landscape.

1031 Exchanges

One strategy that is used to avoid and reduce the tax ramifications of capital gains is the 1031 exchange. This process allows you to transfer proceeds from one real estate transaction to another transaction, immediately sheltering the tax. To be a sophisticated real estate investor, you should consider your needs for short term and long term capital prior to deal execution.

Depending on your timeline for return on investment you can maximize the financial value by deferring access to short term capital. The 1031 exchange requires you as an investor to have a real estate team whom can assist in facilitating the transaction. One key stakeholder involved in this process is the escrow agent. More up front planning and coordination are required when executing a real estate investment transaction using the 1031 exchange.

Flipping

The process of buying, improving, and selling property for a profit is called flipping. Flipping a property is usually done in a short time frame to maximize profits. Before flipping a home, a comprehensive strategy should be created before approaching this process. You could create a real estate investing business plan based on a flipping strategy.

A large part of real estate investing success lies in the numbers. The financials behind each property allow you to create value and produce income. Flipping is a short-term income strategy which requires multiple deals to continue producing income. The strategy is short term because once the flipping stops, so does the income. The process of flipping also provides real estate investors with variable income due to changing financial goals.

Wholesaling

Wholesaling is a strategy where the investor does not retain ownership of the property; instead they assign or sell their interest in the property to another buyer. The difference between the contract price and what the buyer is willing to pay is called the spread. The value of the spread can vary based on transaction size and property market.

A wholesaler is essentially a middle man. The wholesaler finds a severely undervalued asset, increases the price to a level that is still attractive to an investor, and profits from the difference.

Short term lump sum gains are possible but vary based on the number of wholesale deals completed. The income produced using this real estate strategy fluctuates. A real estate investor pursing this strategy should beware of the legal boundaries and limitations of wholesaling.

Law in some states requires wholesalers to be licensed real estate salespersons just like Realtors. Some marketing strategies and word choice in wholesaling could put you at risk; be mindful and do your own due diligence before proceeding with this strategy.

Making Sense of Real Estate Investment Income

The landscape for real estate investment income options is dependent on the investment time frame, short term versus long term. The value of the return also changes in consistency based on a fixed rate and a variable return.

After identifying the region of the landscape most in line with your goals, the applicable strategy for moving forward should be a critical component of the investment path you chose. This is just as important as the financials or numbers.

These two components, strategy, and financials are partners in maximizing the return on investment. Understanding the real estate investment income landscape allows you to have more insight for decision making.

Use the real estate investment income landscape as a tool to overcome analysis paralysis and empower your real estate investing. To advance from being a beginning investor, one must take action and have a long-term mindset.

Gaining experience through strategy implementation trails and error will evolve to case studies and scenario models. Sophisticated investors, advance to an expert by focusing on winning strategy before taking action. Leverage planning and strategy.

Nice overview. Thank you. One thing to add about hard money loans is that they are generally very safe investments for the lender when the loan to value ratio is kept at a conservative level (max of 70-75%).

Hi Jeff, Thank you for the comment! I agree, hard money loans are safer for the lender when LTV ratios are kept at conservative levels. I believe hard money loans are a risker product as a borrower with larger short term ballon payments.