What is Risk Management?

Many investors have difficulty figuring out exactly what risk means to them. But this is an crucial topic to understand if you are to succeed in today’s markets. In the financial world, risk management is the process of identifying and handling uncertainties in one’s investment decisions. If you can manage your risks, then your investment’s should perform well over time.

As the most famous investor Benjamin Graham once said, “the essence of investment management is the management of risks, not the management of returns.”

How to Properly Analyze Investment Risk

Whether it is investing, playing sports, or driving down the street, you are constantly exposed to risk. Your demeanor and lifestyle choices largely determine how much risk you are comfortable with. When it comes to investment risk, your temperament play a major role in shaping your risk tolerance. Since risk is defined as the likelihood of a financial decision’s outcome being lower than the expected return of a particular investment.

To this end we have to examine a few factors that will determine your tolerance for risk.

- Asset Allocation. You have to balance risk versus reward by managing the percentage of each asset class in your portfolio according to your personal risk tolerance. The two primary types of investments are equities, which tend to have higher risk and returns, and fixed income, which has lower risk with matching lower returns for the most part. Proper asset allocation should create long term portfolio growth, while providing fixed income stability.

- Time Horizon. The longer you have to invest before taking money out the more risk you can take on with investments that tend to have higher volatility and returns over time. For example, growth companies such as FAANG stocks (Facebook, Amazon, Apple, Netflix and Google) and private equity may provide better long term returns as a whole. But in the near and medium time horizon they can be very volatile.

- Personal financial situation. Your income level, savings rate, job stability, investment knowledge, household budget, debt level, and borrowing rate can all have an impact on your risk tolerance. Some investors are comfortable and prefer picking individual securities, while others may choose to use index funds or low cost robo-advisor services.

Everyone will have a different level of risk they are comfortably able to take on. If most of your investment is in the stock market and you have difficulty falling asleep at night, then you might be taking on too much risk. Consider re-balancing your portfolio to hold more bonds or REITs to diversify and lower your risk. Your risk profile will probably change throughout different parts of your life.

At times, life events such as a new career, a new house, or a new baby will require an adjustment in your risk tolerance. Re-evaluating these changes to your life is essential to managing your investment risk. We cannot fully remove risk from the equation, but we can manage it by reducing the uncertainty around a potential investment. Tren Griffin explains the difference in his Tweet below.

Uncertainty, by contrast, is when we don’t know what the outcome is, but we actually don’t know what the underlying distribution looks like.

— Tren Griffin (@trengriffin) March 12, 2016

Once you understand your own risk profile it’s time to look at the different risks connected to various investments. Below are some common types of risks that can threaten your investment returns in the financial markets.

- Market Risk – The possibility that you will lose money in an individual investment because the overall market is moving against you. This is also known as “systematic risk.”

- Volatility – The tendency for an investment to change rapidly and unpredictably. A higher volatility suggests that a security’s value will fluctuate more over a period of time and is associated with high risk.

- Earnings Risk – The constant change of input costs such as commodity prices and factors that affect sales numbers can all affect a company’s net earnings, which is used to ultimately value a company.

- Interest Rate Risk. – An increase in interest rates will usually lower the value of existing bonds.

- Management Risk – Refers to the risk of the management team making poor financial decisions that are either ineffective or destructive to the company.

- Credit or Default Risk – The probability that an entity will not be able to service its debt obligations. This is primarily a risk for bond holders of companies. In most cases government bonds have the least amount of default risk but also produce the lowest returns. Corporate bonds tend to have higher amount of default risk but also higher coupons or interest rates.

- Geography and Political Risk – Refers to the risk of an investment being too focused in one geographical area. A lack of location diversification can harm the performance of an asset if something were to negatively affect that part of the world such as a natural disaster or government intervention.

- Liquidity Risk – Refers to when an investment doesn’t have enough marketability so it cannot be traded quickly enough. This means the transaction of the security will have a meaningful impact on its market price which can exacerbate a loss.

- Foreign Exchange Risk. – This applies to any investment you buy that is not in your native currency.

Recommended Stock Investing Posts:

- PE Ratio: The Best Market Timing Tool of All?

- How to Use Behavioral Finance to Your Investing Advantage

- How to Supplement Your Income with Stocks

- A Review of The Truth About Money by Ric Edelman

- Critical Reasons To Invest In Small Cap Stocks

- Pros and Cons To Investing In The Stock Market Today

- How to Teach Your Children to Invest in the Stock Market

- Advantages of Trading Small Cap Stocks

More Important Now Than Ever

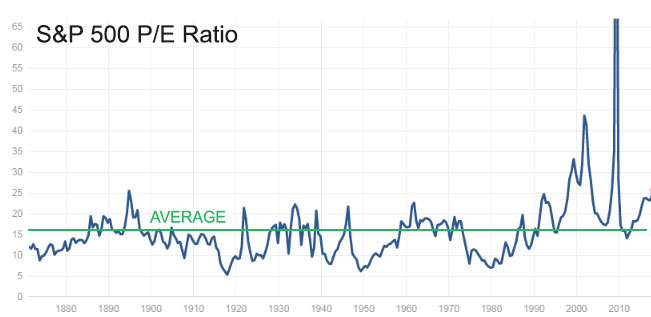

The financial markets in the United States have been increasing for nearly a decade. Due to this huge run-up in asset prices it is becoming harder to find attractively valued investments. The S&P 500 stock market index in the United States currently has a P/E ratio of 25. This suggests that the market is about 56% more overvalued than the historical average P/E ratio of around 16 times.

This means the markets are at a higher risk of producing lower returns in the foreseeable future. Eventually the market will go through a correction but there are too many variables to accurately predict when and how that will happen. Fortunately the one variable you can manage is your risk.

This is why risk management is more important now than in the past. This doesn’t mean you have to be overly conservative with your investment choices because caution is not a good investment strategy by itself. But in an environment with potentially low rates of return you really need to protect your downside and carefully consider the various risks that are associated with every investment you make.

“Risk comes from not knowing what you are doing.” Warren Buffett

A Risk Management Skill Every Investor Should Know

A common metric to measure risk is by using the standard deviation in a normal distribution. This is a statistical measure of dispersion around a general tendency or trend. For example, in the 20 years between 1996 to 2016 the average total return of the S&P 500 stock market index was 10%.

The average standard deviation during this time for the index was 18% according to moneychimp.com. In statistics about 67% of the outcomes should fall within one standard deviation of the average. And 95% of all outcomes should be within 2 standard deviations or 95% of the time.

By looking at the premise we can conclude that during any individual year between 1995 and 2015, we can expect the S&P 500 index to return (-8%) to +28% about two-thirds of the time, and (-26) to +46% about 95% of the time. This doesn’t tell us any measurable return we should target over the next 12 months.

It’s nearly impossible to manage your portfolio to hit actual return numbers. Instead, the goal should be to manage your risk and expected returns by looking at historical data. Managing risk is more important than trying to hit a specific return. If you understand the importance of planning for a wide range of possibilities then you can use the law of large numbers to help you increase the odds of success.

Smart investors understand to manage their risks, not their returns. And in time, the favorable returns will eventually manifest.

You need risk management for everything in the world of investing. You use it to figure out if you should add to your portfolio more low-risk bonds, or high-risk stocks. You also use it to research a company before investing in them. More advanced investors use derivative instruments such as options and futures to manage their risk.

In the end risk management is about turning your personal values into investment decisions to create a financial plan that is optimally personalized for you.

Exclusive Bonus: Three effective ways to reduce your investment risk to minimize losses. Photo Source

Excellent list here Kevin. As always due diligence is a must for every investor whether one intends to invest for the long term or not. One thing that I always do before investing in a company stock is actually checking their competitors in the exact same industry. This will help me understand more about what the company really does.

Comparing companies within a sector is a good way to measure relative risk. There are businesses out there that provide this type of research as well.