There are many choices when it comes to investing the money you’ve worked so hard to earn. Individual stocks such as Motley Fool stock picks, mutual funds, real estate investing and commodities investing all have their benefits depending on how you wish to grow your money and what you’re most comfortable investing in.

Personally, I’m a fan of investing in index funds. There are many great ways to invest your money, but In this post I’ll talk about why I think index fund investing is a great way to build your wealth.

Index Funds vs. Mutual Funds

A mutual fund is a collection of stocks, bonds and other assets. Mutual funds are put together by the fund manager, who picks which investments are in the fund based on his or her educated guess that those investments will outperform the market. Mutual funds are “actively managed”, which means the fund manager is regularly tracking the success of the investments within the fund, making changes when they feel it’s necessary for the good of the fund’s performance.

Index funds however, are different. Index funds are put together in a way that mimics an already-existing fund such as the S&P 500. Because the goal is to imitate an existing market, index funds need much less management than mutual funds. The lack of work needed by fund managers with index funds translates into a lower cost product for the investor. Here’s how.

Index Funds and Expense Ratios

According to Investopedia, “The expense ratio is a measure of what it costs an investment company to operate a mutual fund. An expense ratio is determined through an annual calculation, where a fund’s operating expenses are divided by the average dollar value of its assets under management. Operating expenses are taken out of a fund’s assets and lower the return to a fund’s investors.”

The typical expense ratio for a mutual fund runs around 1.5% or more. However, index funds, which need very little management, generally have an expense ratio of well under 1.0%. In fact, the typical expense ratio for an index fund is 0.25%.

This could mean a savings of hundreds or even thousands of dollars a year for an investor.

Recommended Stock Investing Posts:

- Traditional IRA vs. Roth IRA vs. 401k

- How to Supplement Your Income with Stocks

- How to Teach Your Children to Invest in the Stock Market

- A Review of The Truth About Money by Ric Edelman

- A Review of The Intelligent Investor by Benjamin Graham

- Top 3 Bollinger Bands Trading Strategies

- Top 3 Trading Books Every Trader Should Read

- Using The Power Of The 80-20 Rule For Larger Returns

Index Funds and Load Fees

Many mutual funds charge clients a sales fee – either on the front end when you purchase the fund or on the back end when you redeem the fund – called a load fee. Load fees on mutual funds typically run between 4% and 8% of the amount invested.

Most index funds do not have load fees, and when they do have load fees they are often less than the typical load fee of a mutual fund. However, many investment experts recommend avoiding index funds with load fees.

Between load fees and annual management fees, mutual fund costs far outweigh index fund costs and can cost you thousands of dollars a year depending on how much you’re investing.

Recommended Index Funds Posts:

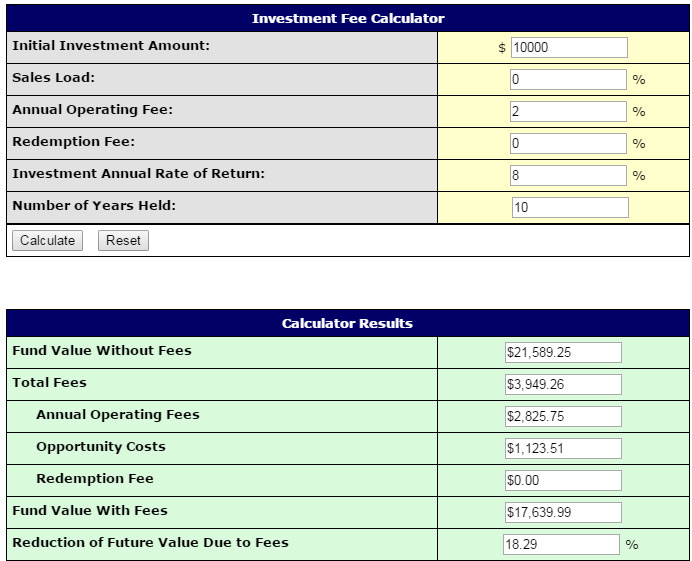

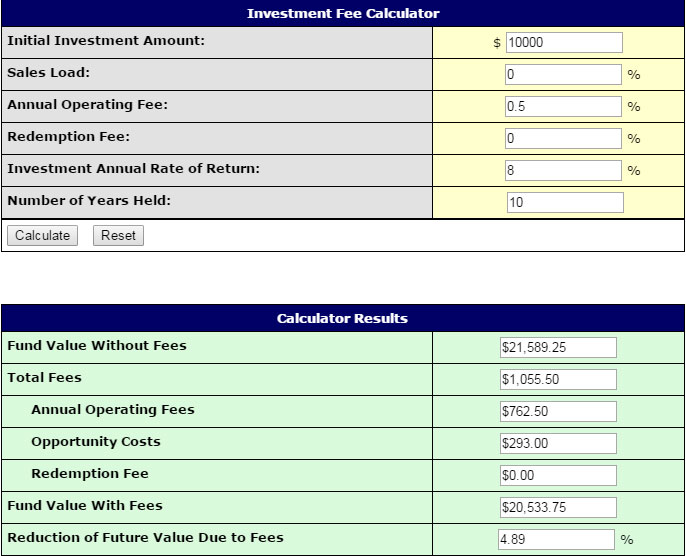

What’s so bad about fees? Fees can make a massive impact on your net worth over time. Let’s do a little comparison to get a clear picture on how mutual fund fees can impact your net worth. The chart below compares a small $10,000 investment and how even a small difference in fees can impact the investment’s net worth over time.

Mutual Fund Investment with a fee of 2%:

Index Fund Investment with a Fee of 0.5%:

Source: https://www.buyupside.com/calculators/feesdec07.htm

As you can see, the larger mutual fund fee made a big impact on a small investment; nearly 15% of the profit was lost due to fees. This is one more reason to consider an index fund as opposed to a mutual fund when deciding on ways to invest your money.

Monitor the Track Record

When considering investing in an index fund, it’s important to lock at the fund’s ten year track record so you can get an idea of the history of its returns. As with all investments, it’s good to keep in mind that previous results don’t guarantee future returns.

No matter what your investment preferences, a diverse portfolio is always a smart idea and adding index funds to that portfolio can help for a more rounded investment plan.

Author Bio: Deacon Hayes is a financial expert, speaker and podcaster who shares his expertise on getting out of debt and building wealth at his blog, Well Kept Wallet.