Young Homeowners Are More Likely to Borrow From Parents

Home prices in the United States and across many other parts of the world have been growing at a reasonable pace for the past five years. One contributor to this trend comes from the demand of young adults. HSBC (NYSE:HSBC) bank commissioned polling firm Kantar TNS to survey roughly 9,000 people in 9 different countries: Canada, Australia, China, France, Malaysia, Mexico, the UAE, the U.K., and the U.S. The survey includes some interesting results about the housing market, particularly among individuals between ages 18 and 35, which is the range HSBC defines as a millennial. The poll was conducted in October and November of 2016. According to the survey, parents are playing an important role in getting their millennial adult children into the housing market. More than a third of millennials surveyed, or 37%, said they had financial aid from the bank of mom and dad to cover their housing costs. Furthermore, 21% of them received help from their parents when it came to paying for other costs after they had purchased homes.

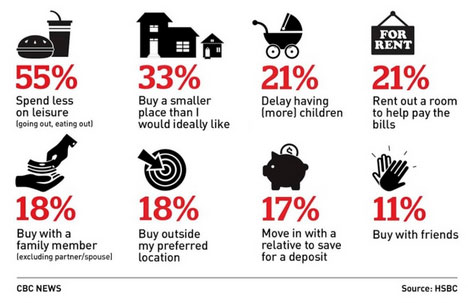

In at least one country surveyed, a little more than one-third of the millennial population already own their own homes. And out of the remaining ones who don’t, 82% say they intend to buy a home within the next five years. Young adults are willing to make concessions around other parts of their lives in order to become homeowners. Below are some sacrifices that a millennial would consider in order to buy a property.

Here are a few reasons why the millennial generation seems to be very interested in buying real estate.

- FOMO – Many people are susceptible to the herd mentality. They have a fear of missing out. When some of their friends are doing something that looks cool, they want to join in on the experience as well. There’s a perception that real estate almost always goes up in value over the long term so the longer you wait to get into the market the less likely you’ll be able to buy at a lower price.

- Recency Bias – People tend to most easily remember something that has happened recently, compared to remembering something that may have occurred a long time ago. According to the S&P/Case-Shiller 20 City Composite Home Price NSA Index, which tracks the prices of real estate across 20 major American cities, home values have been going up since 2012. According to this index, the five-year annualized return is 7.11%. It has been one of the best bull market stretch in recent memory. However, over the long term, historical data shows that real estate has only grown slightly above the rate of inflation (CPI) each year. But since many people have short-term memories of the market, they believe the 7.11% annual gain is normal.

- There is no better alternative – Other investments such as equities, and bonds are currently very expensive by historical standards. SNAP Inc shares, the company behind the popular app Snapchat, began trading publicly yesterday. (NYSE:SNAP) traders sent the stock soaring 40% during its first day of trading. Currently, the company isn’t even profitable yet but its market cap is $28 billion. Many people believe the stock market is in a bubble because some valuations don’t make sense. This gives investors an incentive to buy homes instead. When a millennial is thinking about where to put his savings, real estate is still one of the best options given its risk to toward ratio.

After taking into account all the variables in context, it’s easy to understand why real estate continues to increase in value. In order for there to be a housing correction, something has to change and we simply haven’t seen any major disruptive force in the market yet. That doesn’t mean prices will go up forever. But at least for now, real estate still seems to be a good long-term investment as long as it’s in the right location. The population in the United States is growing. But they are not making any more new land.