An evil genius once said, “You can print money, manufacture diamonds, and people are a dime a dozen, but they’ll always need land. It’s the one thing they’re not making any more of.” This was from Lex Luther in Superman I as he was about to reduce the supply of real estate by blasting everything west of the San Andreas Fault into the Pacific Ocean. Although this quote is from a fictional and highly psychotic character hell-bent on global domination, that detail does not make its underlying premise any less true. As populations and standards of living grow, the supply of land remains forever fixed and the owners of this land can receive a growing stream of cash flow to enrich their families for generations. This has made real estate is an attractive asset to own and since the dawn of civilization land has been one of the world’s most important symbols and sources of wealth.

In the modern era, real estate appeals to many investors because it is perceived as being safe in a world fraught with uncertainty. Conceptually, it is an easy investment to understand…a physical asset that produces tangible cash flow without the complexity and opacity of the stock market. Fortunately, today there are a wide range of alternatives for investors looking to park capital in real estate and collect the rent. For those not interested in the workload of direct property ownership (clean-ups, repairs, and even derelict tenants) a long established investment vehicle called a Real Estate Investment Trust can provide a much more passive stream of income.

U.S. Investors BUY Canadian REITs on Sale

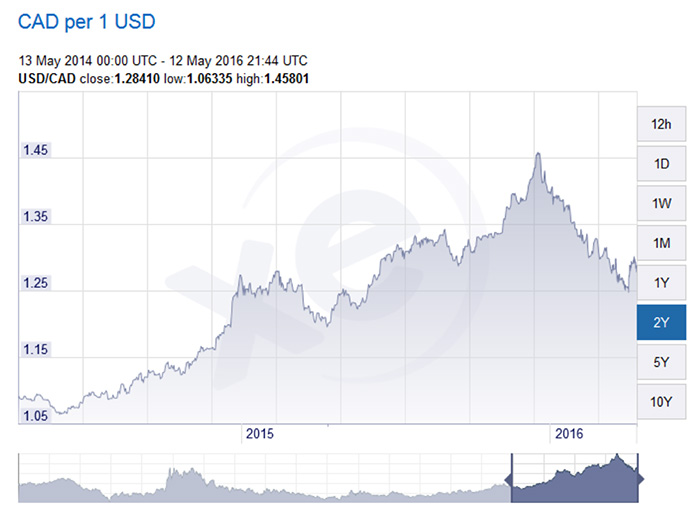

Buying income property abroad, particularly with the strength of the Greenback again world currencies in recent years, can be a great way to diversify your portfolio. In strong real estate markets such as the West Coast of Canada (some of the richest valuations in the world) U.S. dollars can stretch farther (see the chart below). Alas, with international property add the travel expenses to the workload of direct property ownership noted above and the proposition suddenly becomes far less attractive.

There is a great alternative.

A Real Estate Investment Trust, or REIT, is a company that owns income-producing real estate and redistributes a high percentage of net cash flow back to its investors. REITs can be publicly-traded on a stock exchange and be bought and sold by anyone like a regular stock. Currently, the Canadian market is home to about 52 publicly-traded REITs which invest in all types of income-generating property like apartment buildings, office towers, industrial and warehousing facilities, shopping malls and retail stores, and the list goes on. In today’s market, these REITs offer their investors income yields ranging from 3% to over 10%.

Now, yields upwards of 10% may look pretty attractive to a less-than-discerning income investor…but buyers beware! Things are not always as they appear in the stock market and REITs are no exception. There is a wide range in the quality of the companies occupying this space, with some REITs boasting multi-billion dollar diversified portfolios of high-quality properties in major centers across the continent, while others may have only a single property valued at a few million. It’s important to know what you’re buying, and there are a few key factors to think about to be a better informed investor.

Payout Ratio: This is the percentage of a company’s net cash flow paid back to investors. REIT distributions are not guaranteed and can be reduced at any time. Payout ratios near or above 100% put the distribution at risk. Most of the more established REITs tend to maintain payout ratios in the 80% to 90% range or even lower.

Debt Leverage: Debt is an essential tool for maximizing returns in real estate, but too much debt can be disastrous. The right balance between debt and equity is critical. One important metric for measuring this leverage is the debt-to-gross book value ratio. Higher-quality REITs generally maintain a ratio in the 45% to 55% range or lower.

Asset Quality: Assets are the life blood of any business. Low quality assets can result in deferred maintenance costs and stagnant rents down the road. High quality assets allow the REIT to attract the best tenants and charge premium rents. Location, age and class of buildings, occupancy levels, and rent and same-property net operating income (NOI) growth all fall into this category.

Most of these metrics are readily available to investors in a company’s financial documentation. However, if sifting through dozens of financial statements while calculating and comparing ratios doesn’t sound like an exciting adventure to you, then congratulations, you are like 99.9% of the population (and surely much more fun at parties than I am). Researching individual REITs is time-consuming and technical. Investors looking for a less active investment strategy might want to consider an exchange traded fund (ETF) that is indexed to the REIT sector. Indexed ETFs trade like stocks and can pay an income yield, but their objective is to hold a basket of companies that replicate the performance of a particular index (in this case the S&P TSX REIT Index). The draw of this vehicle is its easy management and low fee structure. The trade-off is that there is no potential to outperform the respective index. In Canada, there are several established ETFs available to investors. One example is the iShares S&P TSX Capped REIT Index ETF (XRE: TSX) which currently yields around 5.5%.

For investors trying to outperform the average, individual REIT selection is likely the best option. In this endeavor you can either go it alone or you can utilize the services of a qualified, independent advisor who specializes in picking individual stocks. Later this month, KeyStone Financial will be releasing its 2016 REIT SECTOR REPORT which will provide commentary, analysis and actionable advice to investors about the 52 REIT stocks currently occupying this sector.

REITs covered will include H&R Real Estate Investment Trust (HR.UN) with a current yield of 6.18% and WPT Industrial Real Estate Investment (TSX:WIR.U) with a current yield of 7.2% among many others.

This author has no positions in any stock mentioned and does not plan to open any positions in any stocks mentioned for at least 72 hours after publication of this article.

Author Bio: KeyStocks is a financial advisor with a 17 year track record of generating outstanding results for our clients. We take a GARP (growth at a reasonable price) approach to identifying and recommending fundamentally strong, low priced small-cap and dividend growth stocks. Specifically, we provide clients with unique BUY/SELL/HOLD stock recommendations and strategies to help them build their own 10-12 growth stock and dividend stock portfolios – independent research you will find nowhere else.