The retail industry is going through a time of convulsions as large retailers react to retail oversupply and the growth of online shopping. Likewise, the retail real estate market is reinventing itself and flexing through the changes. This confluence of instability and great change is a nexus of opportunity. If you position yourself right, you have a chance to reap great rewards in retail real estate investing.

Pros and Cons of Investing in Retail Real Estate

Investing in retail real estate is not for everyone. There are some significant pros and cons that are associated with the retail industry in general and investing in commercial real estate in particular. The retail industry is broad and includes storefronts, malls, strip malls, restaurants, and entertainment locations.

The potential for high investment returns leads the pack when it comes to the benefits. In growth areas, it’s not unusual for retail space to become available through the natural cycle of businesses. The right investor can snap up those retail properties at a discount and either sell them for a profit or lease them out for residual income. Rental income is the second pro for real estate investing. It’s income that comes in each month. It pays for expenses and provides a profit in addition to real estate appreciation.

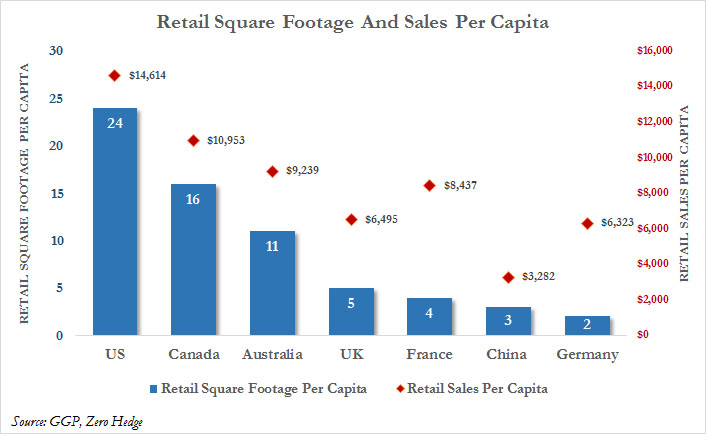

There is one major downside if you get involved in a retail real estate investment property. The biggest problem is that the US has too much retail space. On a per-capita basis, the US has almost 50% more retail space as the second-place country Canada. The retail space supply is not evenly spread across the US. Areas, where retail space has increased significantly faster than buying power, are particularly at risk of falling retail real estate values.

Recommended Real Estate Investing Posts:

Where to Invest in Retail Real Estate

The best places to invest in retail real estate are in those areas where the buying power is increasing faster than the square footage of retail space. The greater the difference, the greater future opportunities there will be. It’s not a hard and fast rule though. There might be significant opportunities even in areas with decreasing buying power. Even in areas of general declining growth, there are areas where growth is still occurring.

One thing to keep in mind is that in some areas retail property is being retrofitted for different purposes. Malls are being converted into office buildings or entertainment complexes. Strips malls are becoming office space. Redevelopment means even more retail demand and more opportunities for investing in commercial real estate.

How to Find Where to Invest in Retail Real Estate

It’s easiest to start investing in your hometown since you know the market and know the opportunities. Investing in a different city or even state, you will probably want to find a partner who has better knowledge of the market. It’s important to practice due diligence when researching different deals. You need to make sure that you have as much information as possible.

It takes work and access to pertinent statistics to come up with the right information to make a decision. For example, between 2000 and 2017, Seattle saw a 50% increase in buying power, but an increase of only about 20% in retail square footage. On the other hand, Cleveland saw a 20% decrease in buying power and a 20% increase in retail square footage over the same time frame. While stats are good, sometimes you need the expertise to see through the statistics.

Best Ways to Invest in Retail Real Estate

Investing in commercial real estate can be done using several vehicles. Direct buying is quick and easy when investing locally. You can take possession and manage it yourself. It’s not always the easiest but it is certainly possible. A better option is to invest in a Retail Real Estate Investment Trust. A retail REIT is an investment vehicle that purchases and manages retail properties. You are paid out from your share of the REIT earnings.

Related Investing Product Reviews: